Written by Sandra Nonnenmocher, CPA, MST & Robin Bodine, CPA

As a business owner or administrator for a tax-exempt organization, you are well aware of the costs of providing parking for employees e.g. lot maintenance, snow removal, insurance, security, and other lot expenses.

What you may not be aware of is under the Tax Cuts and Jobs Act, parking expenses are no longer deductible for businesses, and are considered unrelated business taxable income (UBTI) for tax-exempt organizations. For tax-exempt organizations, this creates scenarios where they will now pay tax.

In December 2018, the IRS started providing guidance on this issue, retroactive to expenses paid or incurred after December 31, 2017, in IRS Notice 2018-99.

According to IRS Notice 2018-99, the following inclusive but not exhaustive list of expenses are considered “parking expenses”:

- Repairs

- Maintenance

- Utilities

- Insurance

- Property Taxes

- Interest

- Snow and Ice Removal

- Leaf Removal

- Trash Removal

- Cleaning

- Landscaping

- Parking Lot Attendant

- Security

- Rent or Lease Payments

Included in “parking expenses” is a portion of a lease or loan where the lease or loan payment is for both the office space and parking lot. However, IRS Notice 2018-99 does not include a method to allocate a portion of the lease or loan to the parking lot. Currently, the IRS is advising to “use any reasonable method.”

Below are three examples of the potential cost to business owners as a result of the changes proposed in IRS Notice 2018-99. These examples are general in nature and do not include some of the nuances of IRS Notice 2018-99, such as reserved parking or the complexities of mixed retail and employee parking.

Example 1 - For Profit Business Leases the Parking Lot

Business X leases a parking lot specifically for employee use. During 2018, Business X paid $24,000 to lease the parking lot, $2,000 for snow removal, and $1,000 for 24-hour security monitoring. For 2018, Business X paid $27,000 in parking expenses which are no longer deductible, increasing Business X’s tax burden by approximately $8,000.

Example 2 - Non-profit Organization (Tax-Exempt)

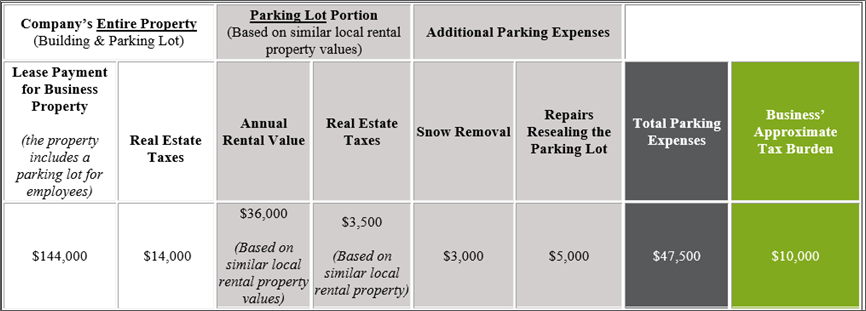

Tax-Exempt Organization Y leases office space, which includes a parking lot specifically for employee use. During 2018, Tax-Exempt Organization Y paid $144,000 a year in rent for the office and parking lot, and $14,000 in real estate taxes to the landlord. Based on similar local rental property values, $36,000 is approximated as the annual rental value of the parking lot, and $3,500 is approximated as the real estate taxes related to the parking lot. During 2018, Tax-Exempt Organization Y paid an additional $5,000 to reseal the parking lot and $3,000 for snow removal. For 2018, Tax-Exempt Organization Y paid $47,500 of parking expenses which are now considered unrelated business taxable income, causing Tax-Exempt Organization Y to pay tax of approximately $10,000.

Method used for allocating a portion of the lease or loan to the parking lot: based on similar local rental parking property values.

Example 3 – For Profit Business Owns Property with a Parking Lot

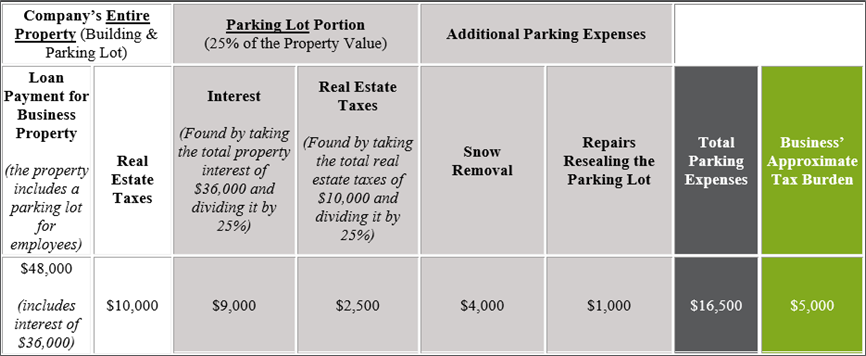

Business Z owns the property it operates out of, which includes a parking lot specifically for employee use. During 2018, Business Z paid a loan on the property of $48,000 a year, which includes the interest of $36,000. In addition to the loan, Business Z paid $10,000 in real estate taxes. Based on similar local property values, the parking lot is approximated at 25% of the value of the property, resulting in $9,000 of interest and $2,500 of real estate taxes being allocated to the parking lot. Business Z paid an additional $1,000 to repair a portion of the parking lot and $4,000 for snow removal. For 2018, Business Z paid $16,500 in parking expenses which are no longer deductible, increasing Business Z ‘s tax burden by approximately $5,000.

Method used for allocating a portion of the lease or loan to the parking lot: taking the percentage of the value of the property based on similar local property values.

We realize this news is very upsetting to read. We believe IRS Notice 2018-99 is far reaching and beyond the intent of the law. In fact, some would say it is ridiculous.

There is still time to act and to let the government know your position as IRS Notice 2018-99 is open for commentary through February 22, 2019. If you submit comments through this link, we would advise not including any personal or contact information.

In addition to submitting your commentary direct to the IRS, you can also contact your Congressmen to make them aware of your concerns with no longer allowing parking expenses to be deductible.

If you have questions regarding the deductibility of parking lot expenses, complete the form below.