- Industries

- Manufacturing & Distribution

Manufacturing & Distribution

Strategic insight and proactive advice

With increased global competition, regulatory compliance, advanced technology, and an insufficient workforce, manufacturers are dealing with unique challenges. Our accounting professionals understand these obstacles and provide a wide range of financial reporting, tax compliance, and business advisory services to help you succeed.

Our professionals obtain industry-specific training, which gives us the skill set to provide you with strategic insight and proactive advice from initial formation through succession.

Tax Services for Manufacturers & Distributors

- State & Local Tax (SALT)

- Sales & Use Tax

- Tax planning and preparation

- Tax resolution

- Payroll and Employment Tax

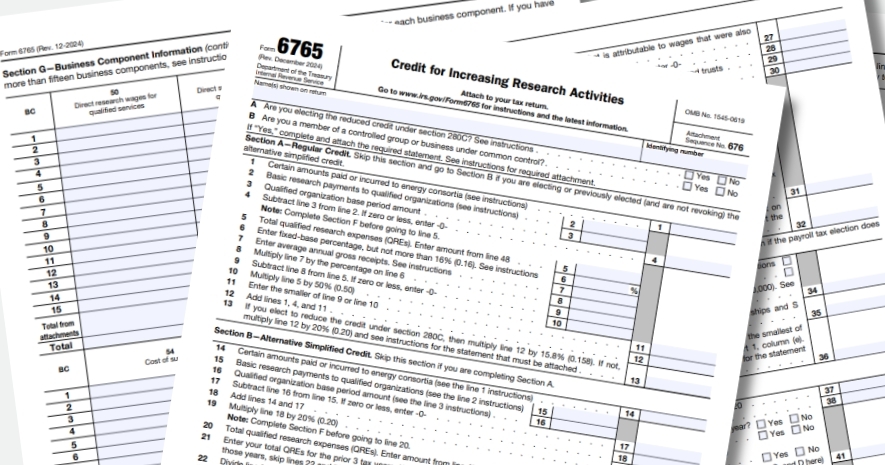

- R&D Tax Credit

- Industry specific tax deductions and credits

- Tax-deferred exchanges

- Tax minimization strategies

- Depreciation strategies

- Cost Segregation Studies

- Estate and Gift Tax planning

- IRS audit assistance

Assurance Services for Manufacturers & Distributors

- Employee Benefit Plan Audits

- Fraud investigation & forensic accounting

- Financial Statement preparation

- Examinations

- Forecasts and projections

Advisory Services for Manufacturers & Distributors

- Technology advisory

- Cash flow analysis

- Benchmarking

- Employee Benefit Plan Advisory

- Ownership buy-in / buy-out

- Sales & Use Tax consulting

- Financial due diligence

- Lease vs. purchase analysis

- Income Tax Nexus Studies

- Entity formation and selection

- Entity structure analysis

- Internal Control Studies

- Financing assistance

Outsourced Accounting for Manufacturers & Distributors

- Payroll assessment and administration

- Selection, implementation, and operation of accounting software