Accounting, audit and other compliance reporting considerations

In response to the pandemic, Congress has passed several pieces of legislation that created various relief funds to help organizations navigate the impact of COVID-19. The Provider Relief Fund (PRF) comes with a unique set of compliance, auditing and reporting requirements that must be met by recipient organizations.

On January 15th, 2021, the U.S. Department of Health & Human Services (HHS) released updated guidance on the Provider Relief Fund reporting requirements. This amended guidance is in response to the Coronavirus Response and Relief Supplemental Appropriations Act (Act). The Act was passed in December 2020 and added an additional $3 billion to the PRF along with new language regarding reporting requirements.

In the wake of this new guidance, healthcare providers should undertake the following steps:

- Register on the HHS Provider Relief Fund Reporting Portal and establish an account as soon as possible.

- Revisit lost revenue calculations to determine if your current methodology is appropriate or if an updated methodology would be more appropriate under the new guidance.

- Understand the ability to transfer General and Targeted distributions and the impact on reporting of these funds.

- Develop reporting procedures for lost revenue and increased expense for reporting in the HHS portal.

- Review audit and compliance requirements that pertain to your organization.

Quick Links

Click on a specific topic below to jump to that section of this blog post.

- Capital Expenditures

- Distributions

- Incremental Expenses

- Lost Revenue

- Reporting Requirements

- Single Audit Extensions: 2020 At A Glance

- Single Audit Requirements: Timing & Deadlines

- Single Audit Requirements: Meeting $750,000 Threshold Considerations

- Single Audit Requirements: Allowable Costs

- Single Audit Requirements: Pending Items Awaiting Additional Guidance

- Additional Resources

Capital Expenditures

Is it your interpretation of the capital and inventory guidance that you can report the full cost but still account for it on the balance sheet as per normal accounting processes? The word “expenses” in the HHS FAQs is giving me pause that HHS is expecting providers to expense inventory and capital and claim it for PRF.

Please see the FAQs below which address your question. Accounting treatment and PRF treatment in this case may be different.

Will the Provider Relief Fund limit qualifying expenses for capital equipment purchases to 1.5 years of depreciation, or can providers fully expense capital equipment purchases? (Added 11/18/2020)

Expenses for capital equipment and inventory may be fully expensed only in cases where the purchase was directly related to prevent, prepare for and respond to the coronavirus. Examples of these types of equipment and inventory expenses include:

- Ventilators, computerized tomography scanners, and other intensive care unit- (ICU) related equipment put into immediate use or held in inventory

- Masks, face shields, gloves, gowns

- Biohazard suits

- General personal protective equipment

- Disinfectant supplies

Can providers include the entire cost of capital facilities projects as eligible expenses, or will eligible expenses be limited to the depreciation expense for the period? (Added 11/18/2020)

Expenses for capital facilities may be fully expensed only in cases where the purchase was directly related to preventing, preparing for and responding to the coronavirus. Examples of these types of facilities projects include:

- Upgrading a heating, ventilation, and air conditioning (HVAC) system to support negative pressure units

- Retrofitting a coronavirus unit

- Enhancing or reconfiguring ICU capabilities

- Leasing or purchasing a temporary structure to screen and/or treat patients

- Leasing a permanent facility to increase hospital or nursing home capacity

Consolidated vs. Individual Reporting

If a company or organization has multiple Taxpayer Identification Numbers (TINs), does the year-over-year actual lost revenue need to be compared by TIN or can a consolidated comparison be used when the PRF funds were assigned by TIN?

Generally, the use of consolidated reporting vs. individual reporting depends upon the type of distribution. With general distributions, either consolidated TIN reporting or individual TIN reporting may be used if the individual TINs are subsidiaries that are consolidated through normal accounting treatment. Less clear are cases where affiliates are simply combined as a result of a management services agreement - HHS has not issued a clarification on those situations. In the case of targeted distributions, the TINs receiving the targeted distributions must individually report. However, you do need to ensure that you have proper documentation and support.

Distributions

If providers received amounts that do not seem to be 88% of reported losses for Phase 3, should these providers follow up regarding the amount received?

A follow up is recommended; however, please keep in mind that there may be a reason that the full 88% (or 2% of revenue) is not received. Per HHS, certain applicants may not receive these full amounts because HHS determined the revenues and operating expenses from patient care reported on their applications included:

- Figures that were not exclusively from patient care (as defined in the instructions);

- Reported figures were not reflected in submitted financial documentation;

- Or reported figures were extreme outliers in comparison to other applicants of the same provider type. instead, HHS capped the amount paid to these provider types based on industry estimates of revenue and operating expenses from patient care.

We applied for funding in October 2020 and have not received funding. HHS has communicated that our application is still processing. Should we be concerned?

There have been delays in Phase 2 and Phase 3 funds. Organizations should ensure that they have resubmitted their data to HHS if they were asked to do so. Additionally, organizations who have not set up an ACH account with HHS should do so immediately, as that could be a reason for the delay.

Does this reporting apply to the first distribution where there was no application, but an amount appeared in our bank accounts?

Yes, recipients who received one or more payments exceeding $10,000 in the aggregate will have to report how funds were utilized.

Incremental Expenses

Are incremental expenses based on per patient day costs (PPD)? In many cases, our census was down so much that our total expenses decreased although we had an abundance of COVID-related expenses.

When looking at incremental expenses you would not look at total expenses. A healthcare provider would look at increases in expenses for supplies, PPE, equipment, IT, facilities, employees, and other healthcare related costs/expenses for calendar years 2019 and 2020, calculate the change in year-over-year expenses and identify the portion that is attributable to coronavirus.

Can corporate overhead expenses (including accounting and HR) be allocated to entities and be included in COVID expenses at the facility level (e.g. development of policies, tracking expenses, etc.)?

These G&A expenses can be included if they are healthcare related (development of COVID policies, tracking of COVID expenses) and are incremental. Incremental would not include time spent by salaried professionals in developing policies or tracking of expenses. The expenses are only includable if they represent expenditures over and above normal operational expenses (Hero bonuses, overtime pay) and are healthcare related.

Is allocation of exempt personnel salaries allowable?

Allocation of exempt personnel salaries is allowable only to the extent the exempt personnel are paid in excess of their actual salaries (Hero bonuses). Salaries by themselves are typically not allowable as incremental expenses unless a salaried person has been hired to specifically deal with coronavirus issues.

How are incremental expenses determined, such as certain supplies (antibacterial wipes, for instance) if overall costs are down due to a decrease in volume as a result of shutdowns but certain categories of expenses have increased due to coronavirus?

Providers would calculate incremental expenses attributable to coronavirus and then estimate the portion of those expenses that were not covered through operational revenues, other direct assistance, donations or other sources. Providers calculate expenses for supplies, PPE, equipment, IT, facilities, employees, and other healthcare related costs/expenses for calendar years 2019 and 2020, calculate the change in year-over-year expenses and identify the portion that is attributable to coronavirus.

Please elaborate on the definition of allowable supply cost. While PPE and sanitizers are obvious, we have been struggling with reporting the cost for various drugs, oxygen, etc. used to treat patients. Do we reduce those costs by reimbursement from what was billed to a patient’s insurance?

The actual healthcare-related expenses attributable to coronavirus that were incurred over and above what has been reimbursed by other sources is what is includable. Any reimbursement that you receive for costs incurred should reduce those costs. Any expenses that were incurred over and above what has actually been reimbursed (even at a reduced level) remain includable if they are related to COVID.

Lost Revenue

Early on, it was clearly stated that 340B pharmacy revenue can be included in the lost revenue calculation; is this still the case?

Yes, 340B pharmacy revenue can be included in the lost revenue calculation. Patient care revenues do include savings through enrollment in the 340B pharmacy program.

Should Medicaid DSH / Upper Payment Limit payments, classified by GASB, be treated as other operating revenue or as Net Patient Service Revenue (NPSR) for the lost revenue calculation?

Medicaid DSH is to be treated as an “other source of revenue” and not included in the Lost Revenue calculation

What if your budget fiscal year is not the same as your calendar year? Can you use fiscal year vs. calendar?

If using the actual to budget methodology, the budget must be on the calendar basis. Given that you are on a non‑12/31/2020 fiscal year, the use of the budget does not appear to be feasible. Rather, you may want to consider the use of the “other reasonable methodology” option. Under that approach, you could use your fiscal year 2020 budget for the first 6 months of 2020, and then the first six months of your 2021 budget which would represent the final 6 months of 2020 on a combined basis. Further documentation as to the use of the same approval policies and procedures for the 2021 budget that were used for the 2020 budget would demonstrate that the budgeting process is consistent, and the use of this methodology is reasonable.

Does Lost Revenue include only patient care revenue or all revenue?

The lost revenue calculation only includes patient care revenue or revenue intended to support patient care (such as fundraising, if it directly relates to patient care).

Definition of revenues from patient care per HHS:

- Gross charges for patient services minus

- Contractual adjustments from third party payors

- Charity care adjustments

- Bad debt

- Other discounts or adjustments

“Patient care” means health care, services and supports, as provided in a medical setting, at home, or in the community. It should not include: 1) insurance, retail, or real estate values (except for SNFs, where that is allowable as a patient care cost), or 2) grants or tuition unrelated to patient care.

- Exclude medical supplies – only patient care provided in a medical setting, at home, or in the community

- Includes entrance fee amortization if normally included as revenue associated with patient services

- May include fundraising revenues, grants or donations if such activities contribute directly to funding patient care

If lost revenue more than exceeds PRF funds received, are we still required to tabulate and report coronavirus expenses first?

Yes, healthcare-related expenses attributable to coronavirus that another source has not reimbursed and is not obligated to reimburse must be identified and covered first. PRF payment amounts not fully expended on healthcare related expenses attributable to coronavirus are then applied to patient care lost revenues.

Do you think the 2021 lost revenue calculation can be 2020 budget versus 2021 actual?

2021 lost revenues can be calculated using either the difference between: 1) 2019 Quarter 1 to Quarter 2 and 2021 Quarter 1 to Quarter 2 actual revenue, or 2) 2020 Quarter 1 to Quarter 2 budgeted revenue and 2021 Quarter 1 to Quarter 2 actual revenue.

Reporting Requirements

Can organizations that have not expended all their PRF funds apply them after December 31, 2020?

Yes, healthcare organizations that have not expended all their PRF funds at December 31, 2020 can apply them to expenses and lost revenue from January 1, 2021-June 30, 2021.

Do we need to report targeted distributions by Taxpayer Identification Numbers (TINs) even if we are going to show use on a consolidated basis?

Reporting Entities that received a Targeted Distribution and are a subsidiary of a parent organization must report on the use of each Targeted Distribution received. However, the subsidiary’s parent organization may transfer the subsidiary’s Targeted Distribution to another subsidiary of the parent organization, to be used by that other subsidiary. The subsidiary that is the Reporting Entity must indicate the amount of any of the Targeted Distributions it received that were transferred to the parent entity. Transferred Targeted Distributions face an increased likelihood of an audit by HRSA.

Do we need to apply any other sources of funds listed before we can apply the PRF to expenses?

Yes, as it relates to expenses, providers identify their healthcare-related expenses, and then apply any amounts received through other sources (e.g., direct patient billing, commercial insurance, Medicare/Medicaid/CHIP, reimbursement from the Provider Relief Fund Coronavirus Claims Reimbursement to Health Care Providers and Facilities for Testing, Treatment, and Vaccine Administration for the Uninsured, or funds received from FEMA or SBA/Department of Treasury’s Paycheck Protection Program) that offset the health care-related expenses. Provider Relief Fund payments may be applied to the remaining expenses or cost, after netting the other funds received or obligated to be received which offset those expenses.

If we are planning to use the budget-to-actual approach, do we need to break out revenue by payer mix? If we did not have it in the budget, can we base it on actual percentages?

Actual revenue will need to be reported by payer and by quarter, but the budget would be reported in total and supported by the 2020 approved budget. This budget must have been approved before March 26, 2020.

Do you foresee any issue with a provider using all the funds on lost patient revenue?

Healthcare-related expenses attributable to coronavirus that another source has not reimbursed and is not obligated to reimburse must be identified and covered first. PRF payment amounts not fully expended on healthcare-related expenses attributable to coronavirus are then applied to patient care lost revenues.

How do you define a parent organization?

To determine whether an entity is the parent organization, the entity must follow the methodology used to determine a subsidiary in their financial statements. If none, the entity with a majority ownership (greater than 50 percent) will be considered the parent organization.

What is the link to the HHS Provider Relief Fund Reporting portal?

https://prfreporting.hrsa.gov/s/

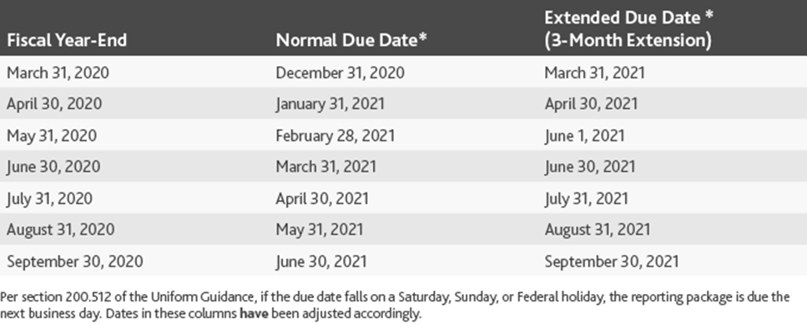

Single Audit Extensions: 2020 At A Glance

Snapshot of Impact of OMB Addendum 3-Month Audit Extension on Various Fiscal Year-Ends for Entities Receiving Coronavirus Funding

Single Audit Requirements: Timing & Deadlines

What is the deadline for each of the audit options (Single Audit, Program-Specific Audit and Financial Audit under Generally Accepted Government Auditing Standards (GAGAS)?)

The Uniform Guidance requires the Single Audit and the program specific audit, if regulations allow, to be completed within 9 months of the entity’s year-end. However, due to coronavirus, there have been extensions granted. The compliance supplement addendum issued by OMB confirmed that for entities with coronavirus funding, the original filing dates from October 1, 2020 through June 30, 2021 all have a three-month extension. The entity does not have to apply for this extension and will not be considered to have submitted their audits late. The entity should maintain documentation however as to why the filing was delayed. The key point here is that this is only available if coronavirus funding was received and expended. No extension has been granted for the 12/31/20 year-ends.

As for the financial audit under GAGAS option, the deadline is not yet clear on this audit and is a pending item awaiting guidance from HHS.

Also please note in relation to timing of when PRF funds are reported on the schedule of expenditures of federal awards (SEFA) - as discussed in Part 4 of the compliance supplement addendum, for fiscal years ending in 2020 on or before December 30, 2020, the entity reports no PRF expenditures (including no lost revenue) on the SEFA. Therefore, this program’s expenditures will first be reported in the SEFA and audited under the Uniform Guidance in a fiscal year-ending on or after December 31, 2020.

How is the timing of reporting different between the HHS portal and the Single Audit?

These two reports are connected in the sense that the SEFA which is your main schedule in your Single Audit report must mirror and agreed to reflect the amount of expenditures and lost revenue you report in the HHS portal submission. Therefore, you can’t have the Single Audit fully completed until the HHS reporting in the portal has been completed – which at this time is not possible, since it has been delayed and not yet available, other than for registration purposes. The HHS portal submission was originally due 2/15/21 for all entities. However, this has been delayed and no set new deadline has been established. The first Single Audit deadline is 9/30/21 for PRF which is for 12/31/20 calendar year-ends. So once the expenses and lost revenue are submitted to HHS, they should then be reflected on the SEFA for the Single Audit.

If an organization’s only COVID funding is Provider Relief Funds, are they allowed to utilize the Single Audit extension if they are a 6/30/20 or 9/30/20 year-end, even though PRF is not included in the Single Audit for those fiscal years?

Yes, Appendix VII of the Addendum states that the extension of three months may be granted to recipients and subrecipients that received and expended coronavirus funding with original due dates from October 1, 2020 through June 30, 2021. Even though Provider Relief Funds are not included on the SEFA or in the Single Audit for those corresponding fiscal years, an extension is allowed.

Single Audit Requirements: Meeting $750,000 Threshold Considerations

Would an entity include expenditures or receipts on a SEFA to see if the $750,000 audit threshold is met?

The threshold for requiring a Single Audit and Program specific audit is if $750,000 or more is expended by the organization within the fiscal year, not received.

The amounts that trigger a Single Audit, meaning those amounts that are reported on the SEFA, are the amounts of funds expended. Another unique consideration when it comes to the term expenditures as it relates to the PRF specifically, is that lost revenue will also be included on the SEFA along with expenditures and those amounts together will have to be considered to determine if you reach the $750,000 threshold.

There is still uncertainty around the financial audit under GAGAS option available to for-profits. The Governmental Audit Quality Center (GAQC) is awaiting guidance from HHS on whether this report would be based on expenditures or receipts, since HHS’s FAQ uses the word ‘received’ rather than ‘expended.’

If an entity expended less than $750,000 in both 12/31/20 and 12/31/21 fiscal years, does it need a Single Audit for each of those years?

No, if an organization expended less than $750,000 in a given fiscal year, they would not require a Single Audit for those years. However, an entity must ensure their SEFA reconciles to their accounting records and reflects what is reported in the HHS portal submission.

If our organization received Paycheck Protection Program (PPP) loans and its forgiveness in 2020, do we add this to HHS PRF funding amount to see if we exceed $750,000?

SBA has confirmed that PPP loans are not subject to Single Audit. For example, many have asked that even though PPP is not subject to Single Audit, does it need to be included on the SEFA because it has an Assistance Listing or CFDA number? The answer to this question is no. Only federal awards that are subject to Single Audit belong on the SEFA. PPP may have a separate CFDA number but should not be included on the SEFA. Taking it another step further, PPP funds and their corresponding forgiveness are not included in the calculation to determine if you have met the $750,000 threshold to have a Single Audit. Since it is not subject to Single Audit and not reported on the SEFA, the PPP amounts also should not be considered at all when determining if you have $750,000 of federal awards.

Does the Single Audit extension apply to entities if their only COVID funding is the PPP loans?

Since PPP is not subject to Single Audit, even if you receive forgiveness for these amounts, if the entity does not receive any other COVID funding that is subject to Single Audit, but rather their other programs on SEFA are all non-COVID funds, the extension will not be available to your organization. Only if you received COVID funding that is subject to Single Audit would the extension relate to you.

Which of the HHS distributions are included within CFDA 93.498?

The PRF includes the following components which are listed in the Compliance Supplement Addendum for 93.498 in Part 4:

General Distribution – This includes the first round of Phase 1 funds which was distributed to providers on April 10, 2020 and April 17, 2020. The second round of Phase 1 funds would also be included in this CFDA which was distributed to providers beginning on April 24, 2020. Part 2 General distribution funds would also be included which were made available in June 2020.

Targeted Distributions would also be included in 93.498 which were the distributions in the areas of:

- High Impact Area Distribution

- Skilled Nursing Facility Distribution

- Skilled Nursing Facility Infection Control Distribution

- Safety Net Hospital Distribution

- Indian Health Service Distribution and

- Rural Distribution

The CFDA numbers were not provided at time of payments or included in initial terms and conditions. Most payments were sent out to providers without application, with requirement for recipients to accept the terms and conditions through an online portal or return funds. Recipients were required to either accept the terms and conditions or return the funds.

Single Audit Requirements: Allowable Costs

Can coronavirus funding be used to pay the external auditor fee for the Single Audit?

In general, the Uniform Guidance states in Subpart E, Section 200.425 that a reasonably proportionate share of the costs of audits required by, and performed in accordance with, the Single Audit are allowable. That being said, there are specific terms and conditions under the Provider Relief fund that must be considered which are that the funds were utilized to prevent, prepare for, and respond to coronavirus for necessary healthcare-related expenses or lost revenues that are attributable to coronavirus.

Although the allowable activities listed in the compliance supplement were very specific to coronavirus and healthcare type expenses, if we look towards the FAQs, HHS answers a question about more administrative type expenses such as: “ When reporting my organization’s general and administrative expenses attributable to coronavirus, how do I calculate the expenses attributable to coronavirus not reimbursed by other sources?”

HHS’s response is that providers should calculate incremental general and administrative expenses incurred that were attributable to coronavirus and then estimate the portion of those expenses that were not covered through operational revenues, other direct assistance, donations and other sources. They also give some examples and state that items attributable to coronavirus that were not normally incurred would be included. Therefore, if not covered by other federal funding first, and these funds are the only reason you need the audit, then based on the fact that they are administrative expenses attributable to coronavirus, we believe they would be allowable to be reimbursed with PRF funds.

Are capital expenditures allowable under the Provider Relief Fund?

Yes, capital expenditures are allowable under the Provider Relief fund, if they are related to coronavirus. As the compliance supplement states for 93.498, activities allowed are those that contribute in preventing, preparing for, and responding to coronavirus, including healthcare-related expenses or lost revenue attributable to coronavirus. What is considered unallowable are those expenses that have been reimbursed from other sources or that other sources are obligated to reimburse.

Per the HHS FAQs, expenses for capital equipment and inventory and capital facilities may be fully expensed only in cases where the purchase was directly related to prevent, prepare for and respond to the coronavirus.

What if we incurred some expenses prior to fiscal year 12/31/20 and some after fiscal year 12/31/20?

The PRF funds can be used to cover the expenditures in the year in which they incurred. Therefore, if only a portion of the expenses incurred prior to the end of the fiscal year, those would be the expenditures to include in the first HHS portal submission. The remaining expenditures, if incurred after 12/31/20 year-end, can be reported in the final HHS portal submission due 7/31/21 which includes remaining expenditures between 1/1/21-6/30/21. That is because recipients who have not used all the funds by December 31, 2020, have six more months from January 1 – June 30, 2021 to use remaining funds. Healthcare organizations will have to submit a second report before July 31, 2021 on how funds were utilized for that six-month period.

Single Audit Requirements: Pending Items Awaiting Additional Guidance

What pending items related to Provider Relief Fund are still awaiting further guidance from HHS?

The first item pending additional guidance is related to the delay of the HHS portal opening. HHS had previously communicated the HHS portal for recipient reporting to HHS would be launched 1/15/21. However, while HHS did open the PRF Reporting Portal for registration, the portal is not accepting submissions and there is no estimated date for its opening. This delay means that Single Audits including PRF funding will not be able to be completed yet due to the following: (1) the SEFA reporting is linked to the HHS reporting requirements; and (2) the PRF section of the Supplement requires the auditor to test the HHS reporting.

Another uncertainty is related to the for-profit guidance. For-profit entities receiving $750,000 or more of these funds during the entity’s fiscal year are subject to audit. Two options for audit are discussed under HHS guidance: (1) A financial related audit of a particular award or multiple HHS programs in accordance with Government Auditing Standards; or (2) A full Single Audit (or program-specific audit). However, the delays in the HHS portal opening and the need for additional guidance on the details of this audit option, has prevented for-profits from beginning these audits.

Additional guidance is pending in the following areas:

Is HHS requesting the $750,000 threshold that would trigger an audit be based on receipts or expenditures during the period?

If it follows the guidance like the Single Audits explained earlier, it would be expenditures of $750,000 or more. However, the exact language in the FAQs states annual total awards received are $750,000 or more.”

What will be the appropriate Financial reporting framework?

Cash, modified cash, accrual? We know that if the Single Audit option is selected, then expenditures will mirror the reporting required to be submitted to HHS in the portal, but we are not certain on this Financial Audit under GAGAS.

Are the disclosure requirements the same for a Single Audit and a Financial Audit in accordance with GAGAS?

At this time, it is unclear if the same disclosures required for a Single Audit would be required for a Financial Audit in accordance with GAGAS.

What is the exact timing of expenditures and lost revenues?

There is still uncertainty if the Provider Relief Funds for year-ends June 30, 2020 and September 30, 2020 would have the same treatment as those entities having a Single Audit. Are those PRF expenditures/receipts in year ended June 30, 2020 to be pushed onto the June 30, 2021 audit?

Lastly, the audit deadline is not yet clear on this audit.

Additional Resources

- CARES Act Provider Relief Fund

- CARES Act Provider Relief Fund General Information

- CARES Act Provider Relief Fund: For Providers which includes copies of terms and conditions

- CARES Act Provider Relief Fund FAQs

- Provider Relief Fund Phase 3 Stakeholder Toolkit

- GAQC 2020 OMB Compliance Supplement Web page

- HHS Provider Relief Fund Reporting portal

- General and Targeted Distribution Post Payment Notice of Reporting

- OMB Compliance Supplement Addendum released on December 22, 2020 available as one file at the OMB’s Office of Federal Financial Management Web site

- FAQ provides additional information relating to the CARES Act and M-20‑21 (Appendix A: List of Coronavirus Federal Assistance Programs)