Written by Karen R. Shenk, CPA, CVA, CCIFP, CEPA, CFE

Valuing a trucking or logistics business is a complex task that can yield varying results depending on the context of the underlying transaction, highlighting the importance of defining the purpose of the valuation. Whether you are selling your trucking company, seeking outside investment, transitioning to the next generation, or planning internal growth, each goal requires a tailored approach to estimate the business's worth accurately.

The Purpose of Business Valuations

Business valuations are not one-size-fits-all exercises. The purpose behind seeking a valuation greatly influences the methodology and outcome.

- A valuation intended for selling the business might emphasize market conditions and comparable sales in addition to potential synergies with the purchaser. This includes analyzing contract longevity, lane coverage, route length, materials handled, fleet condition, and the presence of dedicated routes.

- A valuation for investment purposes might focus on future growth potential and risk assessment. Investors may examine route density, freight demand trends, rate trends, fleet utilization, driver turnover, and equipment financing terms.

- A valuation intended for use in a buy-sell agreement among shareholders might seek to arrive at a value that is fair to all parties involved and ensures the continuation of the business by not making the price overly burdensome to the remaining owners. A valuation for this purpose emphasizes the company’s ability to generate sustainable earnings, reflecting the risks and benefits attributable to each owner, which also gives attention to depreciable assets like trucks and trailers, which carry significant value on the balance sheet.

- A valuation for the purpose of estate planning involves maximizing discounts resulting from ownership restrictions in order to preserve the total exclusion available (which may involve other tools such as recapitalization of the shares to allocate value to non-voting shares).

Understanding the specific goal behind the valuation helps in selecting the most appropriate method and ensures that the resulting figure is relevant and useful.

Discounted Cash Flows (DCF) Method

The Discounted Cash Flows (DCF) method is commonly used as a starting point for many business valuations. It evaluates a business's value by estimating the present value of expected future cash flows. These projections are discounted back to their present value using a rate that reflects the risk and time value of money.

In the trucking industry, cash flow forecasts must account for variables such as diesel fuel costs, labor availability, maintenance cycles, and regulatory compliance (e.g., Department of Transportation, Federal Motor Carrier Safety Administration). High capital expenditures for equipment replacement or fleet expansion also significantly influence the discount rate and free cash flow modeling.

While effective, the DCF method is very complex. An alternative approach that may be useful in a business valuation is the capitalization of cash flows method, which uses a weighting of years based on the representativeness of future performance and applying a multiple or capitalization rate to the result. The key to this method is finding a historical period that is representative of the future given significant volatility in the industry over the past few years.

Simplified Example

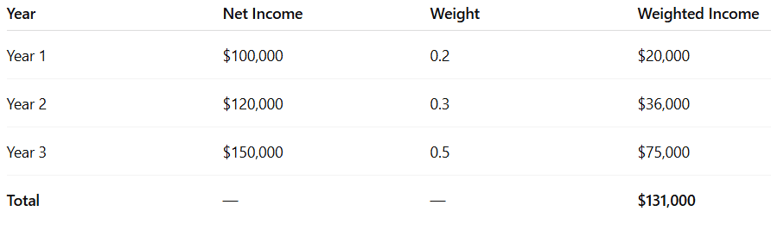

Consider the following net income generated for the prior three years:

-

Year 1: $100,000

-

Year 2: $120,000

-

Year 3: $150,000

If we assume Year 3 is the most representative of future income, we might weigh it more heavily, for example:

Summing these weighted amounts gives us $131,000. Applying a multiple, such as 4, results in a valuation of $524,000.

The above is an overly simplistic way of looking at valuing a company. An owner may want to adjust the net income for expenses such as depreciation, amortization, interest, and taxes, thereby starting with EBITDA (Earnings before interest, taxes, depreciation, and amortization).

The example also fails to consider unusual or extraordinary income, or expense items that could directly affect the results of the company and are not likely to repeat in future years (e.g., one-time fuel rebates, insurance proceeds from cargo loss, severance payments, Paycheck Protection Program (PPP) loan forgiveness income, or adjusted owner/operator salaries). The goal is to get to what is sometimes referred to as “normalized” net income or “normalized” EBITDA before weighting and applying a multiple.

The other oversimplification in the above example is the use of the multiple. The multiple will differ based on the industry and over time as a business becomes more or less relevant or desirable based on market conditions. In the trucking industry, for instance, multiples may be affected by regulatory changes, significant changes in economic conditions, fuel price volatility, labor shortages, or advances in fleet technology. A qualified business valuation expert can filter out the noise in reported market multiples from recent transactions, identifying which data points are relevant and applicable to your company’s specific characteristics and the valuation’s purpose.

This is why using a professional is invaluable if the valuation is to be used by the organization for any reason other than internally or anecdotally.

Understanding Value Drivers and Setting Goals

Regardless of the purpose behind the valuation, understanding the drivers of value is crucial for setting strategic goals that can enhance the company's worth. Key drivers might include:

- Revenue growth: Expanding the customer base, winning new freight contracts, improving rates with current customers, entering new markets, and increasing sales.

- Profit margins: Improving operational efficiency, reducing costs, and optimizing pricing strategies.

- Risk management: Diversifying revenue streams, strengthening financial health, and maintaining robust governance practices. This includes reducing the reliance on the owner. If the business is overly reliant on one or two people, the value lies with the valuable individual, not with the company.

- Competitive advantage: Innovating, branding, and leveraging unique selling propositions. In trucking, this may involve technology integration such as ELD systems, route optimization software, fuel management programs, or a well-maintained and modern fleet.

When an owner understands these value drivers, they can set specific, measurable goals to improve their business's performance and thereby increase its overall value. By focusing on areas such as revenue enhancement, cost control, risk mitigation, and competitive positioning, business owners can make informed decisions that align with their long-term valuation objectives.

Business valuations are highly subjective and dependent on the context of the underlying transaction, driving the importance of defining the purpose of the valuation. Even when the purpose is the same, different valuation firms may arrive at slightly different conclusions due to variations in assumptions, methodologies, or inputs – but credible valuations should fall within a reasonable range. It’s important to have someone on your team who can analyze the financial information along with what drives value in your organization.

Ready to Understand Your Business’s True Value?

Whether you're planning for growth, preparing for a sale, or securing your financial future, knowing what your trucking business is worth is essential. Let us help you make informed decisions with a clear and accurate valuation. Contact Trout CPA today to start a conversation with one of our certified valuation professionals.

About the Author

Karen R. Shenk, CPA, CVA, CCIFP, CEPA, CFE, leads Trout CPA’s trucking and logistics industry group and specializes in business valuation, assurance, and advisory services. As a Certified Valuation Analyst (CVA), she helps business owners understand what drives value and how to prepare for transitions such as sales, succession, or strategic planning. With additional credentials in construction finance and exit planning, Karen brings a well-rounded perspective on business performance and long-term value creation. She is passionate about providing clients with practical, informed guidance to support confident decision-making.