Written by Sales Tax Partner Doug Deihm, CPA

Starting October 1, 2019, if you manufacture and sell craft beer in the same location, you are required to pay 6% sales tax on 25% of the retail sales. In other words, you will charge the customers 1.5% sales tax instead of 6%, which was the original sales tax percentage in the tax bulletin that was sent out by the PA Department of Revenue in July of 2018.

BACKGROUND

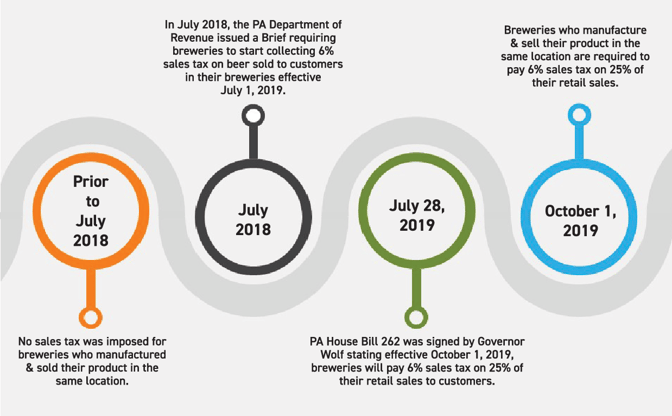

Prior to 2018, these businesses were not required to pay any sales tax when they sold their product in the same location it was manufactured. However, in July 2018, the Pennsylvania craft beer industry was outraged to learn that effective July 2019, they would be required to pay 6% sales tax which was significantly higher than the sales tax restaurants, convenience, and grocery stores were required to pay.

On June 28, 2019, Pennsylvania Governor Wolf signed the PA House Bill 262 which leveled the playing field. The Bill stated that effective October 1, 2019, breweries are only required to pay 6% sales tax on 25% of their retail sales to customers.

| Helpful Trick Since 25% of 6% is 1.5%, you can use this similar formula to calculate sales tax. [Retail Cost] x 1.5% = [Sales Tax] |

EXAMPLE

XYZ Brewery

XYZ BreweryXYZ Brewery sells a growler of craft beer for $10.00 at their brewery. Starting October 1, 2019, the brewery is required to charge 6% sales tax on 25% of the sale which for this particular example is $0.15

The Math:

25% of retail = $2.50 x 6% sales tax = $0.15 Sales Tax

or

$10.00 x 1.5% = $0.15 Sales Tax