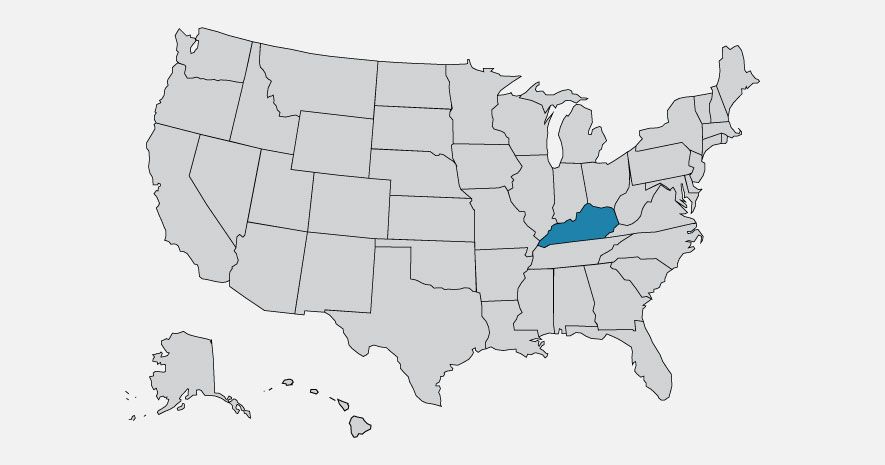

The Kentucky General Assembly enacted H.B. 8 on April 13, 2022, overriding the governor’s veto on the bill. Effective January 1, 2023, the legislature enacts a one-time, 60-day long tax amnesty program and imposes sales and use taxes on numerous services. In addition, the legislation updates Kentucky’s Internal Revenue Code (IRC) conformity date and reduces the individual income tax rate beginning in 2023 based on satisfying state revenue levels.

Kentucky Tax Amnesty Program

The tax amnesty program is expected to run from October 1, 2022, through November 29, 2022, and would apply to qualified tax liabilities or transactions applicable between October 1, 2011, and before December 1, 2021. Program participants will qualify for a penalty waiver and 50% abatement on interest. Eligible taxpayers who do not participate in the program will be subject to post-amnesty penalties of 25% of the underreported tax and 50% for failure to file a tax return. Additionally, any unpaid amnesty-eligible tax liability will be subject to a 2% increase on the statutory interest rate.

The Department of Revenue is required to procure the services necessary to implement the tax amnesty program. If a successful bid from a service provider is not timely secured for the October/November 2022 amnesty period, the program will instead be conducted during a similar 60-day period in 2023.

Sales and Use Taxes Imposed on More Services

H.B. 8 expands Kentucky’s sales and use tax base to numerous services, effective January 1, 2023. Among the new services that will be subject to tax, some of note include:

- Prewritten computer software access services (SaaS)

- Web site design and development services

- Web site hosting services

- Photography and photo finishing services

- Marketing services

- Telemarketing services

- Public opinion and research polling services

- Lobbying services

- Executive employee recruitment services

- Testing services, except for medical, educational, or veterinary reasons

The above are just a fraction of the services that will be subject to sales and use taxes under H.B. 8. The legislation also imposes Kentucky sales and use taxes on over 30 other types of personal and business services.

Gross receipts from the sale of services in fulfillment of a lump-sum, fixed-fee contract, or a fixed-price contract executed on or before February 22, 2022, will be excluded from sales tax. In addition, a lease or rental agreement entered into on or before February 25, 2022, will not be subject to sales tax.

Income Tax Amendments

Individual income tax rate reduction

The legislation provides for a rate reduction of 0.5% for the tax year beginning January 1, 2023, if certain revenue conditions are met. The rate reduction will take effect if, pending review, Kentucky’s reserve trust fund exceeds its general operations fund by 10%, and the balance in the general operations fund is equal to or greater than fiscal year appropriations plus the reduction in revenue from a 1% decrease in the income tax rate. The review will take place in September 2022. Further 0.5% rate reductions may apply in subsequent years depending on revenue conditions but will require future legislative action.

IRC conformity date updated

Kentucky is a fixed-date conformity state. The legislation changes the IRC conformity date for Kentucky corporate and individual income tax from the IRC in effect on December 31, 2018, to the IRC in effect on December 31, 2021, for tax years beginning on or after January 1, 2022. The legislation does not adopt the federal exclusion for restaurant revitalization grants.

Insights

- Our professionals are available to discuss Kentucky’s tax amnesty program in greater detail while awaiting further guidance to be issued, such as where and how to apply for the program. This one-time program runs for a short window of time, so businesses would do well to prepare in advance.

- B. 8 significantly expands sales and use tax, and businesses should review the full list of services contained within the legislation to verify whether they will owe sales and use tax starting in 2023 on services that previously were not taxed. Retailers of these new taxable services will need to update their systems to account for these new taxability codes and charge tax on those services. Likewise, purchasers of these services will need to review their transactions to determine whether they must self-assess applicable use tax.