Written by Rebecca Shirk, CPA, Outsourced Controller

#1 Automate

Do you spend significant time each month, quarter, etc. manually manipulating data to produce relevant reports? You should consider if there are ways that these reports could be automated. This can be as simple as importing a budget into QuickBooks to run budget-to-actual reports at any point in time, or this could mean spending some time creating a custom report in your accounting software to provide you with the relevant information you need. A few hours up-front can lead to substantial time savings down the road and help eliminate errors that occur with manually manipulated data. The time previously spent compiling the data can be used to analyze that data to make more educated business decisions.

#2 Look Forward

Much of a Controller’s tasks involves handling day-to-day accounting transactions. While it’s important to look back when reporting and analyzing data, it’s also equally as important to look forward. Cash flow projections are a powerful tool that should be used when making business decisions. Cash flow should dictate how often and how in-depth your cash flow projection is. If cash flow is a challenge for your company, you should also be analyzing disaggregated data to help identify which products/projects are your most significant cash burn and evaluate how small changes over time could create a substantial impact on your cash flow.

#3 Focus on Internal Controls

Internal controls are imperative for any organization to mitigate the risk of fraud. While we would like to hope that theft or fraudulent activity wouldn’t happen in our company, the lack of proper controls could lead to opportunities for fraud to occur. A good set of internal controls can help to identify any abnormal transactions or even just simple errors. Chances are your organization already has controls documented. Are these controls in place and operating effectively? These procedures should be reviewed at least annually and revised to fit your accounting staff. Even in small organizations with limited staff, there are simple procedures that can be implemented to strengthen your company’s internal controls. Are you concerned with the effectiveness of your company’s internal controls or unsure how to implement segregation of duties? Consider having an internal control study done. Trout CPA can review your documented procedures, determine the effectiveness of the controls, and provide you with recommendations for new controls and procedures to be implemented.

#4 Invest in Your Staff

Many of us have hectic schedules and many day-to-day responsibilities. As the Controller, we often feel that we need to be doing everything and want to have “control” over all aspects of the accounting department. Consider what tasks you do daily, weekly, monthly, etc., that could be delegated to your team. Let your staff take ownership of these tasks and give them the proper support they need to complete the task successfully. A little time spent up-front training and guiding is almost always worth it down the road and will give you more capacity to focus on strategic planning and other tasks previously overlooked.

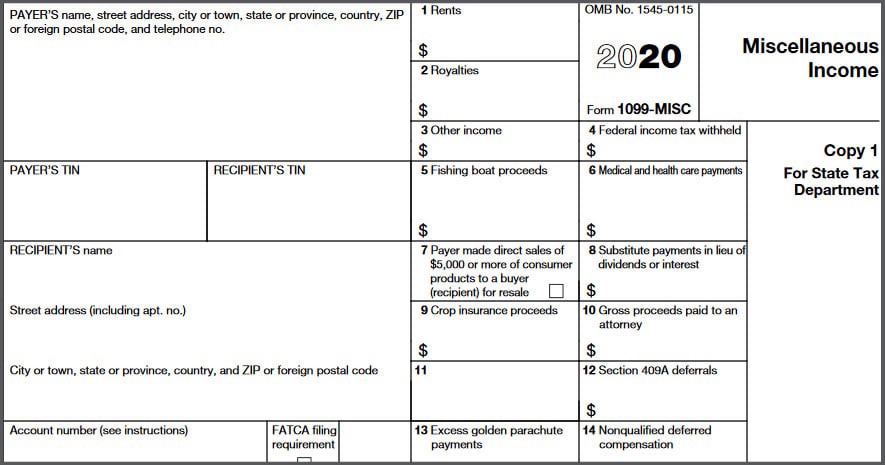

#5 Know when to Outsource

Do you feel weighed down by certain tasks on your plate that are keeping you from focusing on other important responsibilities? Or maybe you know some functions that would benefit your organization, but you don’t have the time, experience, or interest to complete those tasks effectively. You have delegated all that you can to your limited staff, and hiring another full-time employee does not seem like the most effective or feasible solution. You may want to consider engaging an outsourced contractor. This approach can help you customize the exact skills you need for your organization while being more cost-effective than hiring a full-time employee. Think of the ways that you could shift your focus if you had a couple of hours of bookkeeping assistance each week. Or perhaps an outsourced human resources consultant could bring some needed expertise and capacity to your organization’s HR function. Maybe an outsourced CFO would provide some fresh insight and experience to your organization. Whether as a temporary or permanent solution, an outside expert can help fill in the gaps and contribute to your organization's success.