Written by Dan Chodan, CPA

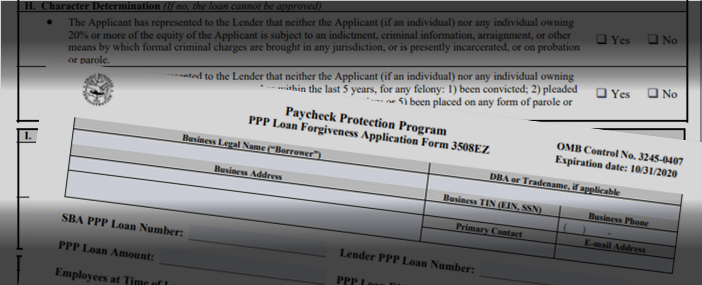

On Monday, August 24, 2020, the SBA & Treasury Department announced an interim final rule which provided additional guidance concerning the ownership percentage that triggers the applicability of the five owner compensation rule for forgiveness purposes and limitations on the eligibility of certain non-payroll costs for forgiveness.

Below are the key takeaways from the new rule. You can read the PPP IFR Treatment Owners Forgiveness Certain Nonpayroll Costs guidance here.

-

A threshold of 5% has been added for C/S Corporation owner-employees. Owner-employees who have less than a 5% ownership stake in a C- or S-Corporation are not subject to the owner-employee compensation limits.

-

Related party interest payments are not allowed for PPP forgiveness even if the debt is secured by hard assets.

-

The new rule limits PPP forgiveness for self-rent to the amount of mortgage interest owed on the property during the covered period (by the real estate entity). Any amount of common ownership creates a related party self-rent for this purpose.

Example 1: The borrower pays $2,000 per month to the related rental entity. The rental entity no longer has a mortgage on the property. Because there is no mortgage interest in the related rental entity during the covered period, none of the $2,000 rent payment is eligible for PPP forgiveness.

Example 2: The borrower pays $2,000 per month to the related rental entity. The rental entity makes a mortgage payment of $1,800 per month ($1,200 principal, $600 interest). The borrower can only claim $600 interest amount for PPP forgiveness out of the entire $2,000 rent.

For questions or assistance, please complete the form below or call 717-569-2900.