Written by Dan Chodan, CPA

On August 4, 2020, the Small Business Administration and Department of the Treasury released guidance to address borrower and lender questions concerning forgiveness of Paycheck Protection Program (PPP) loans, as provided for under section 1106 of the Coronavirus Aid, Relief, and Economic Security Act (CARES Act).

The document includes new details on how the PPP Loan Forgiveness Applications will be calculated. For instance, questions around prepaying health insurance and retirement contributions are discussed along with answers to other loan forgiveness questions.

Below are our key takeaways from the PPP Loan FAQ Document.

- Prepaying health premiums and prepaying employer retirement contributions are not allowed as qualified costs:

- “Forgiveness is not provided for expenses for group health benefits accelerated from periods outside the covered period.”

- “Forgiveness is not provided for employer contributions for retirement benefits accelerated from periods outside the covered period.”

- For partners, they must receive compensation payments during the period to be eligible for forgiveness. “Compensation is only eligible for loan forgiveness if the payments to partners are made during the covered period.” While Schedule C & Schedule F owners get “owner’s compensation replacement,” the same mechanical calculation is not given for partners or shareholders; instead, the amounts must be actually paid.

- The utility expense “transportation” means the “transportation of utilities” like electric distribution charges. This seems to eliminate hope for mileage reimbursement or other normal travel type transportation costs qualifying. However, fuel used in business vehicles and equipment is still a “gas” utility cost based on other guidance.

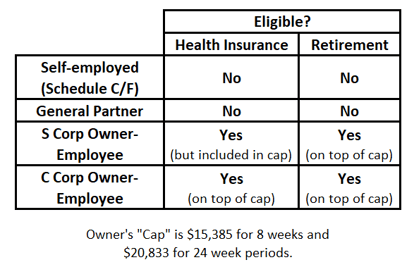

- The differences between cash compensation, benefits, and the “cap” for owners is confirmed:

- Leases renewed or mortgages refinanced do qualify even if this change occurred after the 2/15/20 cutoff date (as long as the previous lease/mortgage existed prior).

- Only salaries and wages are taken into account when determining if a reduction in excess of 25% of the rate of pay has occurred. Tips, bonuses, commissions, or other incentive-based compensation would not be considered.

- The borrower is responsible for paying accrued interest on loan amounts not forgiven. So I expect to commonly see 1% interest of all of the EIDL $10,000 advance portions of not forgiven PPP loans as a result.

For questions or assistance, please contact us at 717-569-2900 or click the link below.