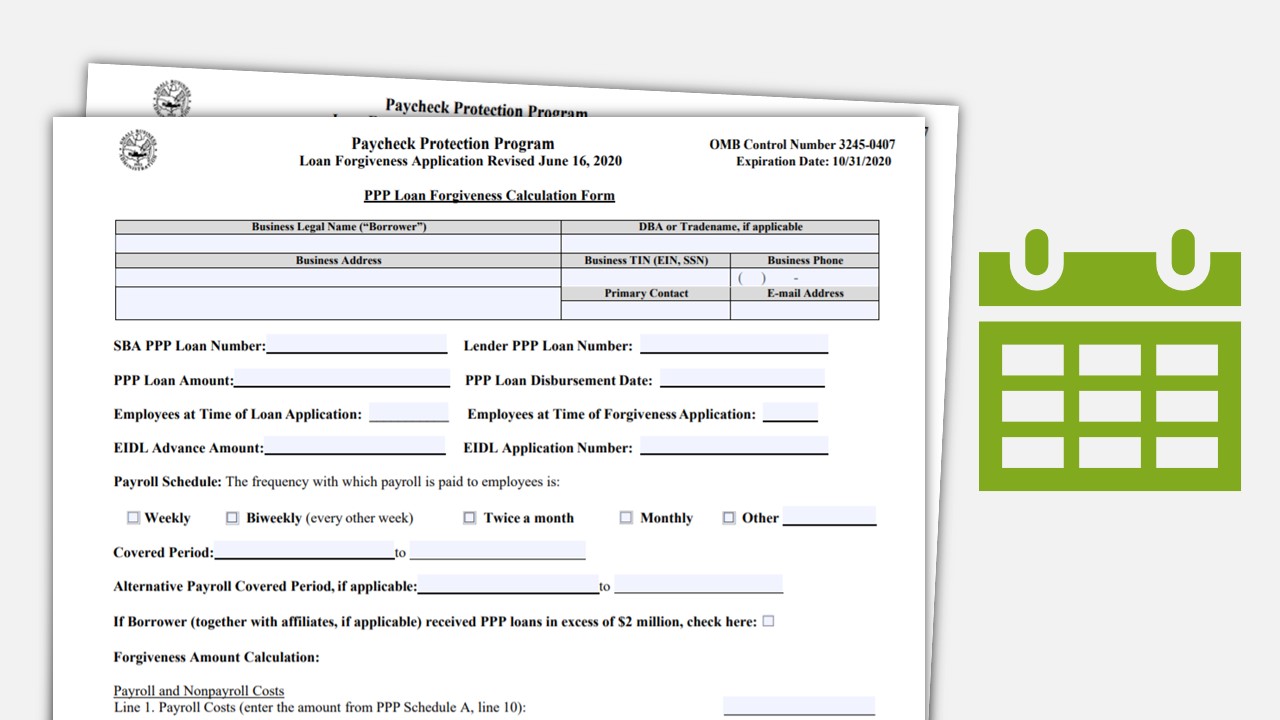

Banks are starting to accept Paycheck Protection Program (PPP) loan forgiveness applications, and some businesses are jumping at the opportunity to have the loans officially forgiven. The timing of your application and forgiveness could affect the timing of the tax effects and when you show the income in your financial statements. Please consider the following before submitting your application:

Tax:

As a reminder, the IRS is taking the position that expenses paid by the PPP funds forgiven will not be tax deductible. It is currently unclear whether the IRS will determine if PPP loans will be income in the year the PPP loan was granted or the year it was forgiven.

Financial Reporting:

Generally accepted accounting principles (GAAP) allows for two approaches which are essentially to record the proceeds as a form of ‘other income’ either at: 1) point of legal forgiveness by the bank or 2) upon spending of the loan proceeds for eligible costs. If you report under a method that is not GAAP this same approach may or may not apply. Read Accounting for PPP Loans for more information on this topic.

Timeline Considerations:

Applicants have 10 months from the end of their covered period (8-24 weeks) to apply.

- Certain banks are requesting applications and possibly taking a phase approach to this to ensure reasonable processing on their end.

- If you prefer to wait beyond the application window that the bank is providing, we recommend getting written communication from the bank allowing this extension.

- Interest that accumulates during this time will be forgiven IF the loan is forgiven.

Other Things to Consider:

- The Small Business Administration (SBA) has a five-year statute of limitations to scrutinize PPP fund usage and PPP loan forgiveness. Any business decision made in the next five years should take this into consideration. A future SBA review of your loan could have an impact. For instance, loans greater than $2 million may be examined for the necessity of the loan. It is still possible for all other loans to be scrutinized in other aspects.

- Congress could take further action which could impact the PPP program either by again changing the details surrounding forgiveness or possibly (hopefully) allowing the expenses used for the PPP loan forgiveness to be tax deductible.

- The pending election could indirectly have an impact. For example, the tax rate structure could change in the future years or Congress’ approach or actions could alter.

- Businesses with multiple owners should consider the implications to the owner group including the impact to current and upcoming ownership transitions.

There are many other technical aspects that will be in question until the further guidance is provided. We strongly encourage you to work with your accounting professional, bank, and other advisors before applying for PPP loan forgiveness.