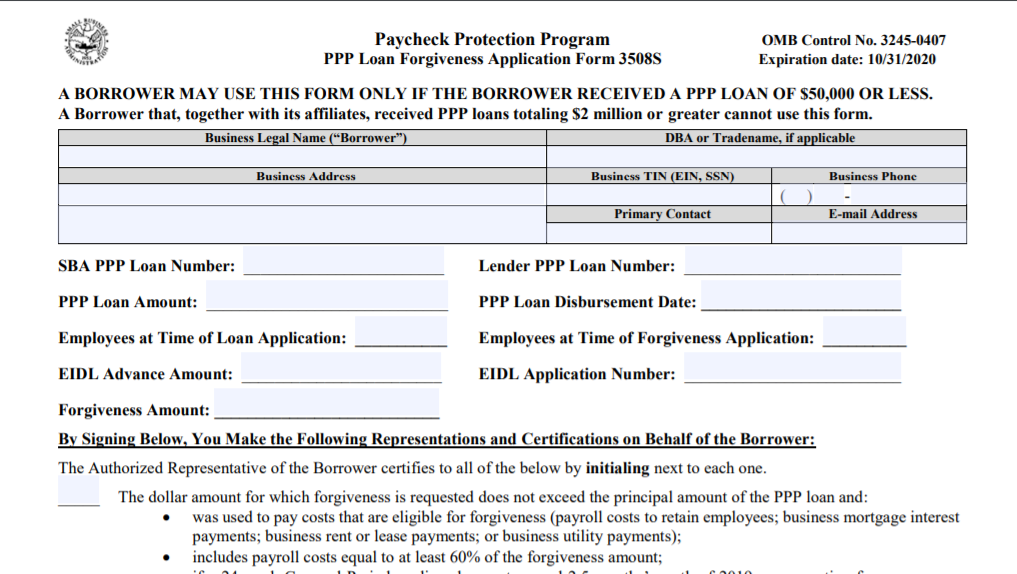

On Thursday, October 8, 2020, the U.S. Small Business Administration (SBA) and the Treasury Department have released a simpler loan forgiveness application for Paycheck Protection Program (PPP) loans of $50,000 or less.

Secretary Steven T. Mnuchin said, “Today’s action streamlines the forgiveness process for PPP borrowers with loans of $50,000 or less and thousands of PPP lenders who worked around the clock to process loans quickly.”

The new form allows borrowers to apply for forgiveness without calculating reductions for changes in full-time equivalent (FTE) employees and without calculating the rate of pay reductions greater than 25%.

- View the simpler PPP Loan Forgiveness Application (Form 3508S)

- View the instructions for completing PPP Loan Forgiveness Application Form 3508S

- View the Interim Final Rule

For assistance with completing a PPP Loan Forgiveness Application, call 717-569-2900 or click the button below.