Written by Randall Weaver, CPA, Partner

Have you ever had those discussions about how the wealthy seem to pay less taxes? If you have, you are not alone. The fact is, anybody can benefit from our tax system if they know the basic rules of the game. Thankfully, you do not have to dig deep to find one tax “secret” that real estate investors use to pay little or no taxes on their rental real estate income.

It’s called Cost Segregation.

What is Cost Segregation?

Cost Segregation is a tax strategy that allows real estate owners to utilize accelerated depreciation deductions to increase cash flow and reduce the federal and state income taxes they pay on their rental income.

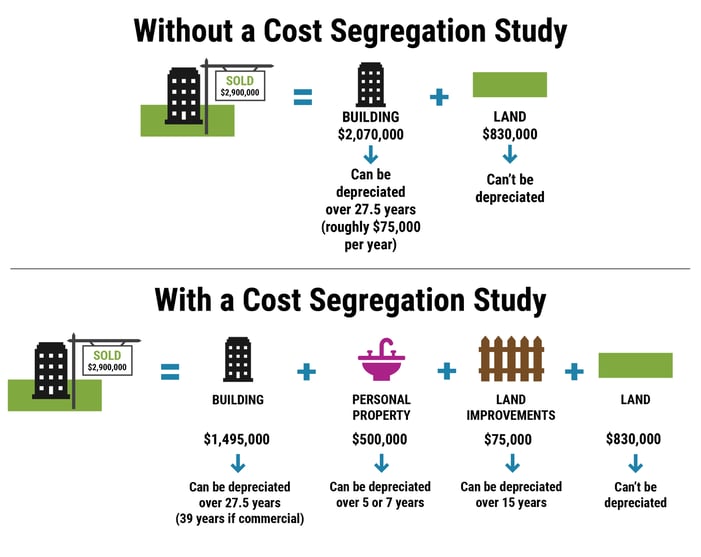

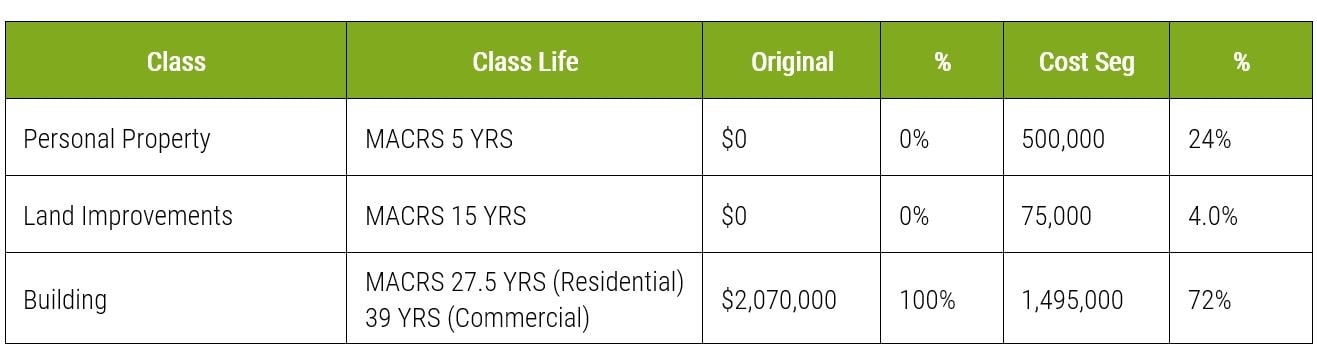

Without a Cost Segregation Study, real estate is broken into two categories, Land and Building. Land is not depreciated, while the building is depreciated over 27.5 years (if residential) and 39 years (if commercial). While the depreciation is beneficial, the yearly tax deduction is relatively minor. A cost segregation study, performed by qualified engineers and/or certified public accountants (CPAs), follows the Internal Revenue Code and the Unit of Property rules to further segment the building into Personal Property and Land Improvements categories.

Is Cost Segregation worth it?

It depends on your unique situation, which is why it is essential to involve your tax advisor in the process. If a cost segregation study does make sense for your specific situation, it will save you income taxes and increase your cash flow. Thanks to the 2017 Tax Cuts and Jobs Act, used property is now eligible for 100% bonus depreciation. Bonus depreciation can be taken on any assets whose tax lives are 20 years or less. This means the assets in the Personal Property and Land Improvements categories can be written off in the FIRST year. Bonus depreciation will be phasing out in a few years. The bonus depreciation rate will be 80% in 2023, 60% in 2024, 40% in 2025, 20% in 2026, and 0% in 2027 and later years. However, even without bonus depreciation, there is still a benefit in doing cost segregation due to depreciating the building components over 5, 7, and 15 years verse having the building depreciated over 27.5 or 39 years.

Example of Cost Segregation

Let’s assume you purchase a multifamily residential property. Ignoring the land portion of the purchase price, the purchase price of the building is determined to be $2,070,000. Without the cost segregation study, this property would be depreciated over 27.5 years or roughly $75,000 per year.

However, if a cost segregation study is performed, $500,000 is considered Personal Property, and $75,000 is considered Land Improvements. Due to the current law concerning bonus depreciation, that means $575,000 can be written off in year one! The remaining $1,495,000 is depreciated over 27.5 years and is an additional $54,000 in year one depreciation, bringing the year one depreciation total to $629,000.

Assuming a tax rate for the taxpayer of 35%, the cost segregation study will provide a federal income tax savings of $220,150 (629,000 X .35). Even if the full $629,000 cannot be utilized in year one, the unutilized benefit/loss can roll forward into the following tax year and shield the taxpayer from future rental profits. The cash savings alone will provide the taxpayer with the ability to put 20% down on another sizable project. Please note that the below example has a slightly higher allocation to short year property than typical. Generally, 20% - 25% is allocated to Personal Property and Land Improvements.

Summary

You don’t have to be part of the 1% to take advantage of tax planning like cost segregation studies. All it takes is a CPA who understands your situation and can help guide you through the process.