Written by Dustin Peck, CPA

In the dynamic world of real estate investment, strategic decisions can significantly impact your financial success. One such strategy that seasoned investors often leverage is the 1031 exchange. Understanding the basics of this powerful tool can open new avenues for growth and optimization in your investment portfolio.

What is a 1031 Exchange?

A 1031 exchange, named after Section 1031 of the Internal Revenue Code, allows real estate investors to defer capital gains taxes on the sale of one property by reinvesting the proceeds into another property. This exchange provides investors with a unique opportunity to preserve and reinvest their capital, fostering continued growth.

Key Benefits of 1031 Exchange for Real Estate Investors

- Tax Deferral: The primary advantage of a 1031 exchange is the ability to defer capital gains taxes. By reinvesting the proceeds into a like-kind property, you can delay paying taxes until a later date.

- Portfolio Diversification: Investors can use 1031 exchanges to strategically diversify their real estate holdings without triggering a taxable event. This flexibility allows you to adapt your portfolio to changing market conditions.

- Increased Buying Power: With tax deferral, you have more capital available for the acquisition of higher-value properties. This increased buying power can enhance your overall investment strategy.

Terms to Know

- Replacement property: The property that is being purchased in the 1031 exchange.

- Relinquished property: The property being sold in the 1031 exchange.

- Exchanged Basis or Carryover Basis: The taxpayer’s adjusted tax basis in the relinquished property that is carried over into the replacement property.

- Excess Basis: The additional cost basis in the replacement property beyond the exchanged basis.

Eligibility Criteria

To qualify for a 1031 exchange, investors must adhere to certain criteria:

- Use of Property: Must be held for use in a trade or business or for investment. It cannot be held for personal use.

- Like-Kind Property: The replacement property must be of like-kind to the property being sold. Fortunately, the definition of like-kind is quite broad in the context of real estate.

- Identification Period: Investors have 45 days from the sale of the relinquished property to identify potential replacement properties.

- Closing Period: The replacement property must be acquired within 180 days of the sale of the relinquished property.

- Qualified Intermediary: To facilitate the exchange, investors must use a Qualified Intermediary (QI). The QI helps ensure compliance with IRS regulations and manages the funds during the exchange process.

1031 Examples

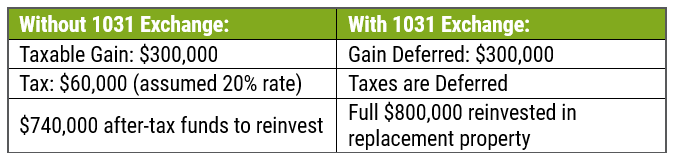

Basic Scenario

Sarah, a real estate investor, owns a commercial property (relinquished property) that she purchased for $500,000 several years ago. The property has appreciated, and its current market value is $800,000. Sarah is considering selling this property and using the proceeds to acquire a different commercial property (replacement property).

Scenario with Depreciation

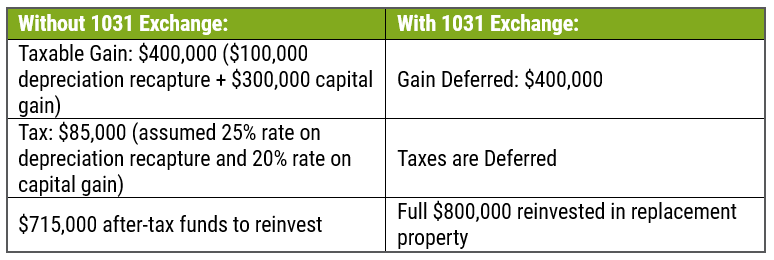

The relinquished property in the above example did not include any depreciation. If Sarah had been renting out the property or using it in her business, then she would have been depreciating the property. Depreciation is a non-cash expense that can be used to reduce taxable income. However, depreciation also reduces the tax basis of the property.

In the scenario given above, let’s assume all the same facts, except that the property had $100,000 of depreciation, leaving it with an adjusted tax basis of $400,000.

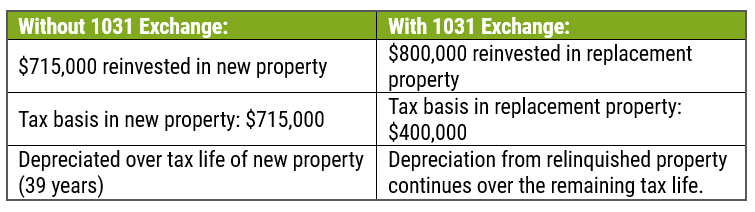

Basis Reduction from Deferred Gain

A key element to understand in a 1031 exchange is that the deferred taxable gain reduces the tax basis in the replacement property. In the example above, let’s say Sarah used the remaining proceeds from the sold property to purchase a new property for exactly the same amount.

Note: If Sarah purchased a replacement property at $900,000, she would have $100,000 excess basis in addition to the $400,000 carryover basis. The excess basis would be depreciable based on the tax life of the replacement property instead of based on the relinquished property.

What is Boot?

Another term you may hear in the context of 1031 exchange is “boot”. “Boot” refers to the portion of a 1031 exchange transaction that does not qualify for tax deferral and is treated as a taxable gain in the year of the exchange. In most 1031 exchanges, the goal is to avoid causing boot. Common causes of boot can include cash proceeds received or a net reduction in mortgage debt from the relinquished property to the replacement property. The rules and calculations surrounding boot can get complex. Be sure to consult with a tax professional and work with your qualified intermediary to determine if a planned 1031 exchange will cause boot.

Long-term Strategy

A real estate investor considering a 1031 exchange needs to keep in mind that the taxable gain is only deferred, not eliminated. The investor can continue to defer the gain into new properties by using a 1031 exchange each time they replace the property. However, if the investor ever wants to cash out by selling the property without a 1031 exchange, they will have to pay the tax on the gain at that time. If the gain has been deferred for many years into multiple properties, the tax basis could be very low due to depreciation while the value has increased over time. The amount of the gain and the resulting tax could be very substantial.

An investor who plans to eventually cash out needs to weigh the current benefits vs. the future costs and risks of the deferral. The benefits are saving cash now on taxes and being able to reinvest the savings into new properties, creating compounding returns over time. The costs and risks include a potentially large tax bill at sale and the unknown of what tax rates will be in effect at the time of the future sale.

One way that the taxable gain can potentially be avoided permanently is if the investor is interested in passing the property to their children or other beneficiaries at their death instead of cashing out in their lifetime. When appreciated assets of an individual are passed to their estate, their beneficiaries receive a “step-up” in the tax basis of the assets to their value at the time of death. In this way, the deferral of the gain is made permanent.

Tips for Success

- Plan Ahead: Strategic planning is key, both in the initial decision to use a 1031 exchange and in the execution of the exchange. Be sure to identify potential replacement properties early in the process to meet the 45-day identification window.

- Professional Guidance: Consult with tax advisors and legal experts to navigate the complexities of the 1031 exchange process.

- Due Diligence: Thoroughly research and evaluate potential replacement properties to make informed investment decisions.

In conclusion, a 1031 exchange can be a valuable tool for real estate investors seeking to optimize their portfolios and defer capital gains taxes. By understanding the basics and working with knowledgeable professionals, you can unlock the full potential of this strategy and take your real estate investments to new heights.

About the Author

Dustin Peck. CPA joined Trout CPA in 2018 after graduating from Messiah College (summa cum laude) with a Bachelor of Science degree in Accounting with a minor in Economics. Dustin serves on the firm’s Construction & Real Estate and Consumer Services Industry Groups. He also serves on the firm’s Multistate Taxation Practice Group.

As a Supervisor, Dustin handles all aspects of tax preparation, planning, and advisory for businesses and individuals.

Dustin enjoys spending time with his family and friends in his free time and participating in outdoor activities such as hiking, biking, and hunting. He lives in Lancaster County with his wife.