Written By: Monte Anderson, CPA

INTRODUCTION

A construction contract is a written or oral agreement for the construction, reconstruction, remodeling,

renovation or repair of real estate, whereby a contractor permanently attaches or affixes tangible personal

property to real estate. Typically, a construction contractor will pay sales or use tax on the purchase price of all

building materials, supplies, equipment, and components that are furnished and installed in the performance of a

construction contract.

Pennsylvania Act 45 of 1998 introduced some significant changes to the sales tax law impacting contractors, by

including a Building Machinery and Equipment (BME) exemption. The BME exemption for contractors only applies

if the construction contract is with a tax-exempt government agency or purely public charity. Additionally, only

certain items that meet Act 45’s strict definition of building, machinery, and equipment may be exempt from

Pennsylvania sales tax at the time of purchase.

BME EXEMPTION

For a contractor to even consider the BME exemption, the other party to the construction contract must be an entity exempt from Pennsylvania sales tax. This may include the following:

-

Purely Public Charities (exemption number begins with 75)

-

School Districts (exemption number begins with 76)

-

Government Agencies or Instrumentalities

-

Municipalities or other Political Subdivisions (exemption number begins with 76)

-

The Federal Government or the Commonwealth of Pennsylvania

The contractor must then directly purchase BME, as defined in Act 45, to be furnished and installed on an exempt entity contract. An item will meet the BME definition for exemption from sales tax if it passes the two-part test

described below:

-

The item is either generation equipment, distribution equipment, conditioning equipment, storage

equipment, or termination equipment, AND

-

The item is used in one of the ten following categories:

-

Air Conditioning - Limited to heating, cooling, purification, humidification, dehumidification, and

ventilation

-

Electrical - Does not include wire, conduit, receptacle, and junction boxes

-

Plumbing - Does not include pipes, fittings, pipe supports, and hangers

-

Communications - Limited to voice, video, data, and sound

-

Alarms - Limited to fire, security, and detection

-

Control Systems - Limited to energy management, traffic, and parking lot and building access

-

Medical Systems - Limited to diagnosis and treatment, medical gas, nurse call, and doctor paging

-

Laboratory System

-

Cathodic Protection System

-

Furniture, Cabinetry, and Kitchen Equipment

-

-

A tax-exempt government agency or purely public charity may also use its own general sales tax exemption certificate to directly acquire items that meet Act 45's BME definition. These purchases are similarly exempt from sales tax and qualify as BME when they are used in in the construction, reconstruction, remodeling, renovation or repair of purchaser's real estate; a formal construction contract is not required.

-

The PA Department of Revenue has created a comprehensive 54-page Taxability of Contractors’ Purchases for Exempt Entities List detailing various construction materials and whether they are considered taxable or non-taxable under the ACT 45 BME definition. While the list includes a statutory code citation for each item, it is offered by the Department as interpretive guidance only. We recommend that contractors use the taxability list as a primary resource for determining when items will be exempt under the BME carve-out. Items not specifically included on the list must be subjectively evaluated using the broader two-part test, as previously described.

APPLYING

-

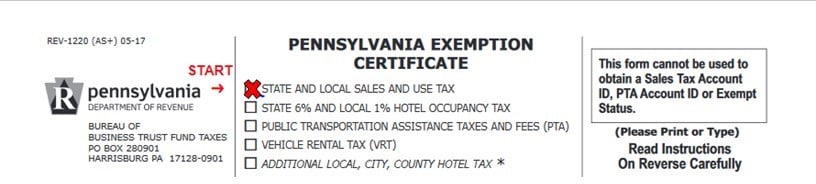

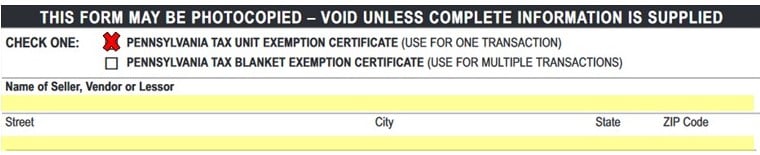

On the top of the certificate, check the State and Local Sales & Use Tax box.

-

Check the Pennsylvania Tax Unit Exemption Certificate box.

-

Complete the yellow highlighted areas with your business information.

-

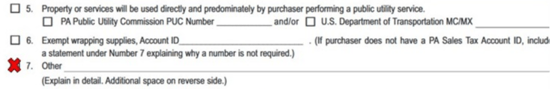

In the next section, check box number 7 and write, “Under Act 45, this property or service qualifies as exempt building machinery and equipment that will be transferred pursuant to a construction contract to [name of tax-exempt entity] holding Sales Exemption Number [insert their tax-exempt number].”

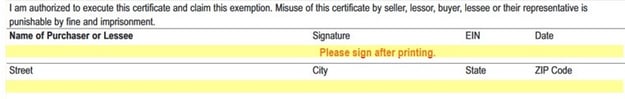

- Complete the yellow highlighted areas.

-

Make a copy of this certificate for your records, and then give it to the vendor/supplier for that transaction.

APPLYING THE EXEMPTION TO PREVIOUSLY TAXED QUALIFIED BME PURCHASES

Ideally, all exemptions should be addressed at the time of purchase, however, a timely petition for a refund where a contractor mistakenly pays tax that should have been exempt may be effective, as indicated by PA DOR in non-authoritative guidance. Petitions must be filed within 3 years of payment of tax and include specifics of the purchase/exemption and proof that tax was paid.

For more information or assistance with the PA Building Machinery and Equipment exemption, please complete the form below.