Written by Doug Deihm, CPA

Are you confused by Sales & Use Tax? You're not alone. Many Pennsylvania Veterinarians are unsure about what services and products they should be collecting taxes for, so we've created this blog, Ultimate Sales Tax Guide for Veterinarians, to help you make sense of this confusing and complex area.

Taxable vs. Nontaxable Common Veterinary Products & Services

|

Product/Service |

Example |

Taxable |

Nontaxable |

|

Boarding or Sitting |

|

|

X |

|

Walking |

|

|

X |

|

Medicines & Medical Supplies (used for medical treatment or preventive medical care) |

flea collars, flea powder, etc. |

|

X |

|

Grooming & Cleaning of Productive Farm Animals* |

|

|

X |

|

Grooming & Cleaning of Non-Productive Farm Animals |

washing the animal, cleaning the eyes and ears, and clipping or trimming the nails and coat |

X Unless the cleaning service is for the purpose of or incidental to medical treatment |

|

|

Grooming Equipment Non-Productive Farm Animals |

Clippers or clipping machines |

X |

|

|

Grooming Equipment Productive Farm Animals |

dehorners,de-beakers, and hoof trimmers as well as cleaning solutions and compounds |

|

X |

|

Harnesses Used to Control Productive Farm Animals |

|

|

X |

|

Pet Supplies |

collars, leashes, food bowls, dog beds, bird cage |

X |

|

|

Pet Shampoo |

|

X |

|

|

Pet Food |

food supplements & prescription food |

X |

|

|

Pet Vitamins |

|

X |

|

|

Pet Sales, Adoptions & Rentals |

|

X |

|

|

Sale of Productive Animals |

|

|

X |

|

Pet Caskets & Urns |

|

X |

|

|

Pet Cremation & Burial Services |

|

|

X |

|

Farrier Services for Pet Horses |

|

X |

|

|

Microchip Implanted into a Pet |

|

X |

|

|

Veterinary Services |

pet neutering |

|

X |

|

Dog Training Service Fee |

|

|

X |

|

Breeding Services for Productive Animals |

|

X |

|

|

Office Equipment |

|

X |

|

|

Diagnostic Medical Equipment |

|

X |

|

*A productive farm animal is sold for its meat, milk, or eggs, and therefore grooming and cleaning is not taxable because it is interpreted as necessary to preserve the animal’s health.

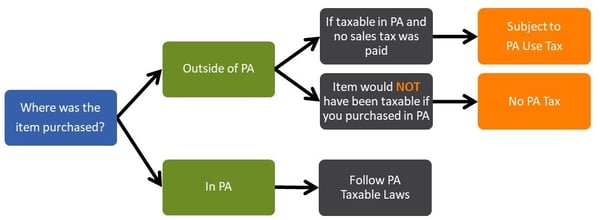

Anything that is taxable if purchased in Pennsylvania, is subject to “use” tax if purchased out-of-state and sales tax was not paid. Please check all out-of-state purchases for use tax due.

A business can avoid paying sales tax on products they purchase exclusively to resell by using a resale exemption certificate. For example, if you are buying dog collars and are planning to sell them in your veterinary practice, you do not need to pay sales tax when you purchase the collars because you will be collecting sales tax when your customer purchases the collar from your office.

For a veterinary practice to use the resale exemption, you must complete the REV-1220- Form - Pennsylvania Exemption Certificate.