COVID-19 has shaken nearly every aspect of the retail industry. Retailers have been grappling with never-before-seen store closures, supply chain disruptions and personnel changes. Even as the country slowly opens back up for business, we know retailers will continue to feel the pandemic’s impacts for several sales quarters to come. Going forward, charting a digitally-enabled, customer-centric path to recovery will be crucial for long-term success.

The retail industry is no stranger to disruption, and COVID-19 has largely accelerated existing trends that were already unsettling to traditional retailers. The rise of e-commerce and decline in foot traffic, tightening purse strings due to recession concerns and need for digital transformation were just a few of the contributing factors to the bifurcation of retail Thrivers and Survivors pre-pandemic.

TRAFFIC TURNS, SALES SPLIT

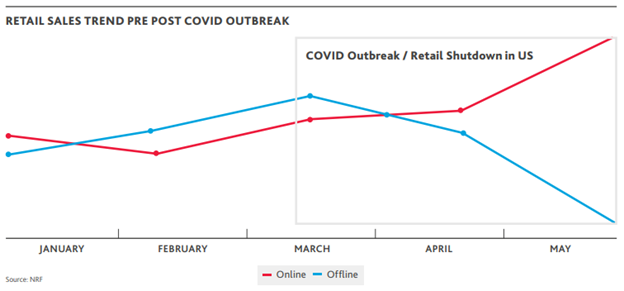

Total retail sales are estimated to decrease by 10.5% in 2020, including a 14% drop for brick-and-mortar, according to eMarketer. Heightened consumer spending on essential products is not enough to offset dampened spending on luxury items, apparel and other non-essential goods.

However, there’s reason to be hopeful: Less than half (47%) of retailers expect a decline in revenue caused by the pandemic, according to Statista. While that number may seem surprisingly low on first glance, it reflects the success that e-commerce and digitally mature companies are experiencing. In fact, Statista expects e-commerce sales to grow by 18% in 2020, signaling the vitality of strong e-commerce capabilities for retailers’ futures.

Resilient retailers have reason to be cautiously optimistic, but they won’t be able to ride out the recession without immediate cost-saving strategies, successful omnichannel tactics and refined plans for pivoting back to offense after COVID-19 demanded retailers deploy their strongest defensive moves to date.

EVERY DOLLAR AND DECISION COUNTS

Effective operation in the new normal while delivering exceptional customer experience (CX) will revolve around retailers’ organizational fitness and agility. This means implementing processes to ensure a strong focus on controlling costs and expenditures across the business. As retailers begin the path to recovery, every dollar and decision matters.

In action, this could take a variety of forms. For example, big-box retailers and those who rely on brick-and-mortar will likely have to assess the profitability of their store networks and strategically reopen certain locations to account for pent-up inventory. This could lead to the introduction of new labor models such as adjusting employee hours to account for reduced foot traffic and the restructuring of management responsibilities and schedules. While ideally retailers would be able to support their entire workforce, optimizing labor to achieve desired service levels will help businesses stabilize. Adjusting management responsibilities also empowers more local control. Local employees and managers are often best equipped to address on-site conditions based on state and local regulations and consumer behavior.

Additionally, retail occupancy cost reduction offers immediate paybacks. Rent expenses are the key driver of operating costs for most retailers, followed by salaries and fit-out costs. If you haven’t already, now is the time to have discussion with vendors and landlords regarding lease terms and negotiations and conduct construction audits to validate compliance to contract terms and budget.

Where possible, retailers should seek to consolidate suppliers to optimize inventory and working capital. They can also perform vendor spend analyses to ensure they’re capturing economies of scale across SG&A, including HVAC maintenance, janitorial and security contracts. If there’s no flexibility on the vendor side, consider consolidating your physical footprint and associated occupancy costs, or work in shared-service centers and centers of excellence. Completing scenario analyses, factoring in multiple assumptions across the portfolio, will be critical in decision making. The need for consolidation is critical, but retailers must make informed decisions about where to streamline for the greatest return with minimal disruption. This will best be accomplished through scenario planning, with prioritization of key financial and operational impacts.

Implementing a CAM Audit program, that goes beyond a peripheral review, will realize savings by challenging landlord passthrough expenses. Greater insight into CAM expenses may provide leverage for lease renegotiations.

Eventually, retailers will have to look beyond the new normal and seize opportunities to transform themselves for long-term profitability and growth. But these immediate cost reduction strategies may create savings to fund new initiatives in digital and omnichannel expansion.

MEET CONSUMERS WHERE THEY ARE… INCLUDING AT THE CURB

Changes in consumer buying patterns and guidelines around social distancing and sanitation have introduced a slew of new demands that must be met as they resume operations. While the variables are new and plenty, the means to achieving success remain the same: understand and cater to the customer.

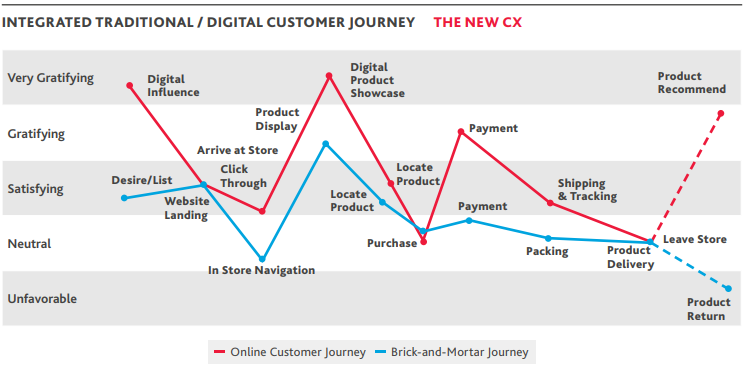

Several retailers have acquired a new audience since e-commerce became the only viable channel during the pandemic. It will be critical to retain these customers and capitalize on new relationships through effective omnichannel strategies. The new standard of omnichannel means knowing who your customer is and what they want—and personalizing their experience whether they walk through your door or enter your site. Even before COVID-19 hit, improving CX was 71% of retailers’ top business objectives, according to BDO’s 2020 Retail Digital Transformation Survey.

It comes as no surprise that both digitally native brands and traditional brands with strong omnichannel capabilities have had an easier time responding to the pandemic. Retailers with a solid digital presence have implemented new strategies to boost customer engagement, leading to better overall satisfaction and more sales conversions. Since March, retail has seen a 91% increase in consumer digital presence, including increases in e-commerce, social media behavior and online streaming, according to eMarketer.

Omnichannel excellence starts with retailers improving their merchandise assortment and optimizing the customer experience, particularly online and via mobile. Customer-facing digital initiatives, such as apps, emails, social media posts and influencers are all part of the digital customer journey, and connection is critical for frictionless CX. Consumers that were even slightly forgiving of a retailer’s digital shortcomings during the pandemic will likely lose that patience quickly when circumstances shift. Each of these potential touchpoints help capture the essential customer analytics data that should drive a successful omnichannel strategy.

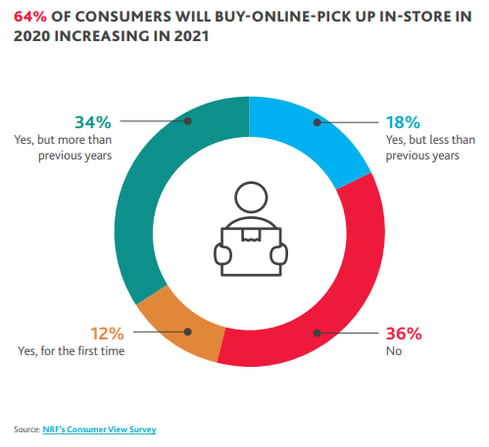

Consumers demand options, whether it’s through merchandise selection, payment methods or fulfillment choices. In light of the pandemic, buy-online-pickup-in-store (or curb), or BOPIS, has accounted for up to 50% of total online revenue in the latest three months for many of the nation’s largest retailers.

BOPIS works by integrating digital and brick-and-mortar assets in conjunction with a single, unified supply chain to give consumers the ability to physically pick up what they ordered online without friction. And although the journey begins online, retailers can’t neglect their physical presence to ensure a fluid BOPIS experience. Stores may have to undergo transformation to ensure their in-store or curbside experience is part of their new CX strategy. This may include increasing investments in sanitation and maintenance, and redesigning parking lots and center layouts to facilitate pickup capacity. Retailers have indicated that their biggest reason for implementing BOPIS was to remain relevant against Amazon who can come close to on-demand access to products. But where retailers can capitalize on BOPIS in a way Amazon cannot is through potential impulse purchases consumers can make in-person. In fact, one-in-four consumers who use BOPIS are upsold in store, according to Nielsen. If consumers are going to venture out, they’re going to want to know their desired product is in store, but offering other services including demonstrating benefits of products or a showroom might also prove effective for reviving foot traffic.

BOPIS fosters a symbiotic relationship for retailers and consumers. Consumers avoid expensive delivery methods and shipping costs, and retailers can potentially drive in-store sales, all while increasing the number of consumer touchpoints. Looking ahead, BOPIS should continue to be on retailers’ radars as this offering is expected to expand to 90% of retailers by 2022, according to Nielsen. Convenience is not a short-term phenomenon but rather a consistent long-term trend.

Demand for the back-to-school and holiday seasons is up in the air but will be key indicators of the industry’s overall health and outlook. However, retailers will need to prepare for the path from recession to recovery resembling a “W” shape, where the economy temporarily rebounds but then dips into a second downturn— potentially due to a further increase in cases. Success will require the ability to control cost, prioritize CX and create adaptable, long-term crisis management protocols as retailers work to shift from a defensive to offensive posture even in an uncertain time.