INTRODUCTION

Financial due diligence is the in-depth study of a company’s financials and cash flow, which includes its core operating variables affecting its earnings. Financial due diligence goes beyond the balance sheet and includes the story of a company’s sales and earnings (e.g., top customers and vendors, products, and normalized adjustments).

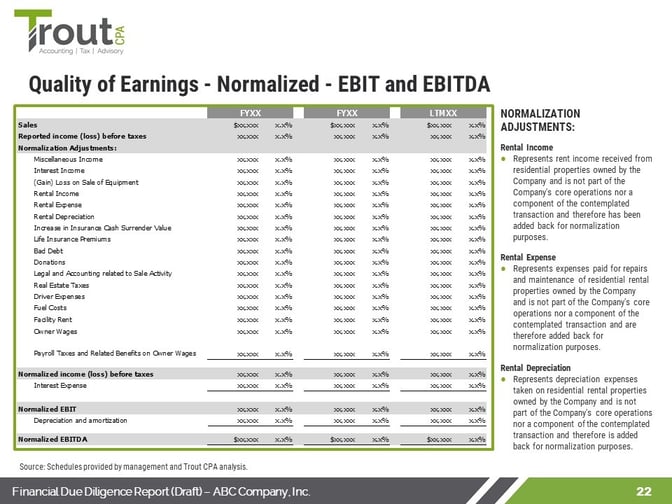

A Quality of Earnings (QoE) Report is typically included with financial due diligence and focuses on working capital and normalized EBITDA (earnings before interest, taxes, depreciation, and amortization).

Although many sellers choose to have a financial audit of their company, it typically does not include all the information that a buyer is interested in knowing before making an acquisition decision. Unlike a financial audit, which provides reasonable assurance about whether the financial statements are free of material misstatement and performed with generally accepted auditing standards (GAAS), financial due diligence does not include an opinion but rather a deep analysis of underlying factors driving operations and the reported numbers.

WHAT IS INCLUDED?

A financial due diligence report will vary depending on the seller’s industry and what information the client is requesting. A full report will typically include:

- Executive Summary

- Company Overview

- Employee Matters

- Product Analysis

- Seasonality

- Customer Analysis

- Vendor Analysis

- Quality of Earnings (QoE)

- Normalized EBIT & EBITDA

- Working Capital Analysis

- Aging of A/R and A/P

- Fixed Assets & Capital Expenditures

- Inventory Analysis

- Proof of Cash

Throughout the report, we provide illustrations and analysis to support our findings.

FINANCIAL DUE DILIGENCE BENEFITS

When it comes to a business transaction, no one likes surprises. Both a buyer and a seller want to be prepared which is why financial due diligence is essential.

Seller Benefits

Financial due diligence prepares the seller by allowing them to identify and resolve potential issues with their transaction advisor to increase the company’s value before negotiations begin. It also improves marketability, increases credibility with the buyer, and helps to decrease the transaction timeline.

Buyer Benefits

Financial due diligence allows a buyer to verify the accuracy of the information provided by the seller. Since the report shows the story beyond the numbers, a buyer is able to make a more informed decision by identifying the risks, liabilities, and opportunities. In addition, a buyer can use the information they discovered in the Due Diligence and Quality of Earnings Report as leverage when negotiating the sale price.

CONCLUSION

In the end, financial due diligence allows the seller to be more prepared to sell their company and gives the buyer more confidence in their transaction decision. At Trout CPA, we assist sellers or buyers throughout the transaction process. To learn more about financial due diligence and quality of earnings (QoE) reporting, contact our Transaction Advisory Team at 717-569-2900 or click the button below to start a conversation with us.