The Bipartisan Budget Reconciliation Act of 2015 (BBA) significantly changed how most partnerships are audited by the IRS, how partnerships file amended returns, and how partners claim benefits from reductions in partnership taxable income identified after the original partnership return is filed.

All partnerships are subject to the BBA effective for tax years beginning after December 31, 2017. However, a partnership can elect out of the BBA regime if it satisfies the following conditions:

- The partnership has no more than 100 partners during the tax year; and

- None of the partners are a partnership, trust, disregarded entity such as a single-member limited liability company or grantor trust, foreign entity that would not be treated as a C corporation were it a domestic entity, estate of an individual other than a deceased partner, or nominee that holds the partnership interest on behalf of another person.

The election out of the BBA rules is effective only for the taxable year for which it is made, so a partnership wishing to elect out of the regime must make a valid election each year.

Given the requirements for electing out, most partnerships will likely be subject to the BBA rules (these partnerships are referred to as BBA partnerships). Consequently, it is critical that partnerships understand the impact of these rules when amending a tax return to allow its partners to claim a refund.

Amending Partnership Returns Under the BBA

Under the BBA rules, when a BBA partnership amends a previously filed tax return (by filing an Administrative Adjustment Request or AAR), it will determine whether the partnership adjustments result in an “imputed underpayment” (IU). An IU is generally computed by multiplying the AAR’s net adjustment by the highest tax rate for the tax year. When the AAR filing results in an IU, the BBA partnership can either pay the resulting tax liability or “push out” the adjustments to the affected partners. When the AAR filing results in a decrease in taxable income, e.g., the AAR claims increased deductions relating to bonus depreciation, the BBA partnership is required to push out the adjustments.

Under the existing rules, each partner that receives a push out adjustment is required to recalculate its tax liability for each affected tax year. If the adjustment results in increased tax liability, the partner reports the additional tax with its tax return filed for the current year (i.e., the year in which the BBA partnership filed the AAR). If the adjustment results in a decreased tax liability, the partner reports the amount of the decrease on its current year return as a tax credit.

Importantly, a tax credit may only reduce the partner’s current year tax liability to zero. Consequently, under the existing rules, any tax credit in excess of the partner’s current year tax liability is permanently lost. Consider the following example:

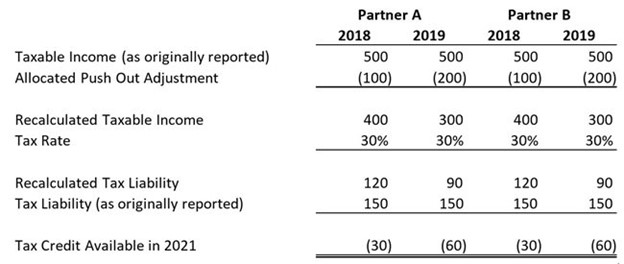

AB Partnership, a BBA Partnership, files AARs during 2021 relating to its 2018 and 2019 federal income tax returns, which result in net decreases in taxable income of $200 and $400, respectively. Because the filings result in net decreases in taxable income, AB Partnership is required to push out the adjustments to its partners. Partners A and B share all items of income and expense equally. Therefore, AB Partnership reports to Partners A and B adjustments that reduce each partner’s taxable income by $100 for the 2018 tax year and $200 for the 2019 tax year.

The following table illustrates the calculation of the tax credit that will be available to Partners A and B.

As noted above, because AB Partnership filed the AAR in 2021, Partners A and B must use the credit against their respective 2021 tax liabilities. Further, under the current rules, Partners A and B may only claim the credit to the extent of their otherwise calculated 2021 tax liability.

Assume that, before the AAR adjustment, Partner A generated a significant loss during 2021 and therefore has no tax liability, while Partner B has a tax liability of $100. Under the existing rules, Partner A will not be able to claim a credit for 2021 and the entire $90 credit will be permanently lost. Partner B, on the other hand, will be able to fully utilize its available tax credit resulting in a net 2021 tax liability balance of $10.

Green Book Proposals

As noted in the Green Book, the inability for certain partners to receive the full benefit of a reduction in tax as a result of partnership adjustments can lead to situations where a partner may ultimately have a greater tax liability under these rules than had the rules not been applied. To alleviate this potentially detrimental consequence, the Green Book outlines a proposal to amend these rules to address tax decreases greater than a partner’s income tax liability.

Specifically, the proposal would modify the statute to provide that the amount of the net negative change in tax that exceeds the income tax liability of a partner in the reporting year is considered an overpayment and may be refunded. If enacted, this change would allow Partner A in the above example to obtain a full refund for the entire $90 tax reduction. Thus, both Partner A and Partner B would realize the full benefit of the AAR adjustments.

Partnerships should monitor the status of the Green Book proposals on the ability of partners to claim refunds resulting from adjustments reported on AARs. Under the existing rules, a partnership that is aware that some or all of its partners may lose the benefit from an AAR tax credit can choose to file the AAR in a different year if it results in a better outcome for the partners. A partnership may file an AAR to change items on its return within three years after the later of the date on which the partnership return for that year is filed or the last day for filing the partnership return for that year (excluding extensions).