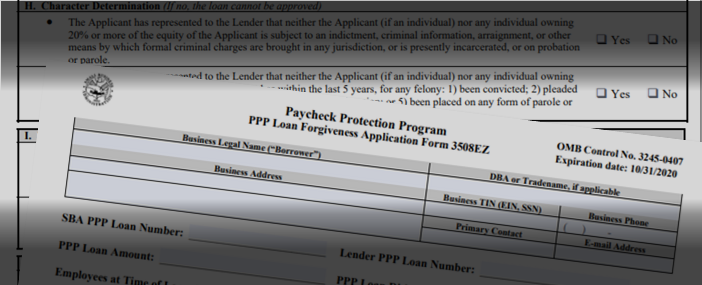

Today, the SBA and Treasury Department announced that the Paycheck Protection Program (PPP) will re-open the week of January 11th for new borrowers and certain existing PPP borrowers.

This round of the PPP continues to prioritize millions of Americans employed by small businesses by authorizing up to $284 billion toward job retention and certain other expenses through March 31, 2021, and by allowing certain existing PPP borrowers to apply for a Second Draw PPP Loan.

Recently the SBA commented they do not expect the money for the PPP loans to run out; however, this is still uncertain. There could be situations where it might make sense to delay applying for new PPP loans to optimize between the PPP and ERC programs. Of course, this could be a risk if the money for the new PPP loans runs out and the IRS has not yet issued more guidance on the ERC program.

We encourage you to speak with your accounting professional at Trout CPA to discuss your specific situation.

Eligibility for a Second Draw PPP Loan:

-

Certain existing PPP borrowers can request to modify their First Draw PPP Loan amount; and

-

Certain existing PPP borrowers are now eligible to apply for a Second Draw PPP Loan.

-

Previously received a First Draw PPP Loan and will or has used the full amount only for authorized uses;

-

Has no more than 300 employees; and

-

Can demonstrate at least a 25% reduction in gross receipts between comparable quarters in 2019 and 2020.

Employee Retention Credit (ERC)

-

As a reminder, this program has been significantly expanded and qualifications are easier to meet.

-

Now businesses can potentially utilize both PPP and ERC.

-

If your business now qualifies for the 2020 ERC, you can implement the 2020 ERC on your 4th quarter 2020 payroll filings.