By W. Michael Wolfe, CPA/ABV, CVA, Valuation Services Partner at Trout CPA

Pandemic Impact on M&A

We can now appreciate the normalcy that existed at the end of 2019. There was plenty of M&A activity, lots of “dry powder” with private equity firms, low interest rates, and a great time to sell or buy a business. Then came the COVID-19 pandemic in early 2020 and the ensuing chaos in business – shutdowns, government assistance, labor problems, and most recently, the supply chain disruption. Now that 2020 and 2021 are behind us, businesses can see how the pandemic has or will be affecting their operations. Some companies went out of business, while some only saw a decline in revenue and profitability in 2020. Most held on to the hope that things would return to pre-pandemic levels. In the midst of this uncertainty, companies continued to want to engage in M&A. Sellers wanted to sell and buyers wanted to buy. But now, it was riskier for buyers and sellers because no one could anticipate where things were headed, and that uncertainty created anxiety with both buyers and sellers.

The good news for some is that the pandemic didn’t impact their businesses at all. In other cases, the pandemic enhanced their businesses, and we have seen some companies experiencing the best year they have ever had in 2020 and 2021. In some cases, it was due to the pandemic and in other cases, it was normal growth. But for most businesses, there is now more uncertainty about the future resulting from the pandemic. This increase in uncertainty translates into greater risk, which ultimately translates into lower valuations.

Managing Pandemic Risk and Future Expectations

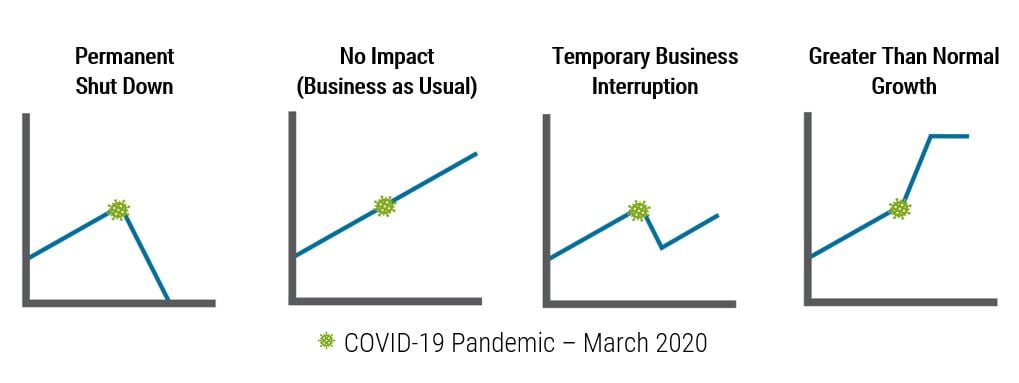

Let’s go back to the basics - what is it that buyers are purchasing? From a financial standpoint, buyers are buying (and sellers are selling) a “future economic benefit” such as EBITDA or Net Cash Flows. Before the pandemic, both buyers and sellers could usually rely on historical results to predict the future under the premise that history repeats itself. A typical LOI offer would be based on trailing twelve months normalized EBITDA times a selected multiple. In the current environment, however, buyers must ask themselves, is this really what the future economic benefit will be? To answer this, more intense financial due diligence and an assessment of quality of earnings is necessary. Buyers not only have to understand what the business was all about before the pandemic but, in the current environment, how the pandemic has affected the business and what it means for the future. In many cases, historical results may not be as meaningful as expected future results. The following graphs point to different ways the pandemic may have affected various businesses.

Value Expectations

For those companies impacted by the pandemic, future variations in profitability, EBITDA, and cash flows call for a change in valuation methodology. The traditional income approach of capitalization of historical cash flows or multiples of historical EBITDA may no longer be appropriate. A methodology based on revised future expected results may now be more appropriate. The value associated with these expected future results can be captured by using a discounted cash flow valuation methodology. It starts with a well-thought-out year-by-year forecasted income statement taking into consideration swings in revenue and profits until the company stabilizes post-pandemic. Future expected profits are then converted to cash flows and present valued to today’s dollars using an applicable risk rate for the risk of receiving those future cash flows. Risk rates for those companies impacted by the pandemic would be expected to be higher than those not impacted. And, of course, greater risk reduces the overall value of the business.

Earnouts Making a Comeback

If the future expected results are so uncertain, an earnout may be the best strategy to bridge what the seller wants to receive versus what the buyer is willing to pay. This has never worked so well as it does in the current uncertain environment. Buyers can base the LOI offer on pre-pandemic results and anything achieved above that can be paid as an earnout. As in a pre-pandemic environment, where a seller’s forecast is more optimistic than what the buyer is willing to believe, the difference in price can be structured as an earnout. The beauty of the earnout is the seller gets paid if their forecast is met, but if it isn’t, the buyer is not obligated to pay more. Buyers still may be willing to pay a higher price if there is little risk associated with future expected results, such a committed contracts.

Pandemic Impact on EBITDA Multiples

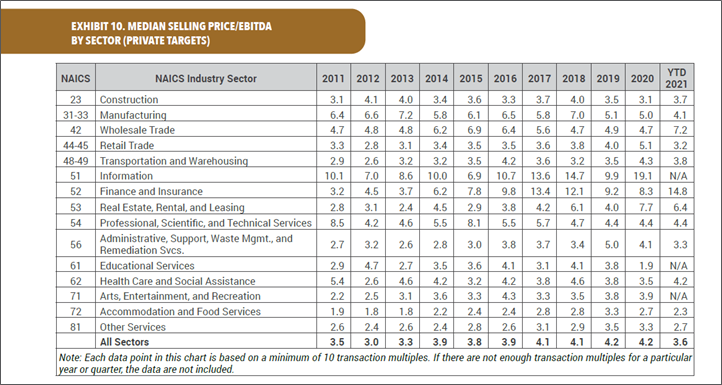

The chart that follows is from the DealStats Quarterly Value Index and illustrates the trends of lower middle-market EBITDA multiples by sector for the 11-year period 2011 to 4Q 2021. By the end of 2021, the median multiple of all sectors hit its lowest level since 2014. The Wholesale Trade sector increase in 2021 was driven by beverage distributor transactions resulting from greater alcohol consumption during economic lockdowns. The Accommodations and Food Services sector saw declining multiples in 2020 and 2021 with lockdowns contributing to this downward trend. Prior to the lockdowns, this sector was at a 10-year high in 2019. The pandemic has had an impact on what buyers are willing to pay and pricing clearly reflects how buyers perceive the risk of receiving the illusive “future economic benefit” for their investment. Not only must buyers consider the normal pre-pandemic business risks, but they are now faced with assessing risks and disruptions caused by the pandemic as well.

The chart above is from Business Valuation Resources, LLC (BVR)’s DealStats Quarterly Value Index 4Q.

For questions or assistance, please complete the form below to speak with W. Michael Wolfe, CPA/ABV, CVA, Valuation Services Partner.