Written by Tax Managers Dan Chodan, CPA & Michael Carr, CPA

On August 28, 2020, the Treasury Department released guidance on President Trump’s Memorandum - Deferring Payroll Tax Obligations (the “program”). The Treasury Department’s guidance allows employees to defer having their portion of social security taxes withheld if their employer opts-in to the program. While seemingly beneficial to employees, many employers are questioning whether they should opt-in.

What is the payroll tax deferral?

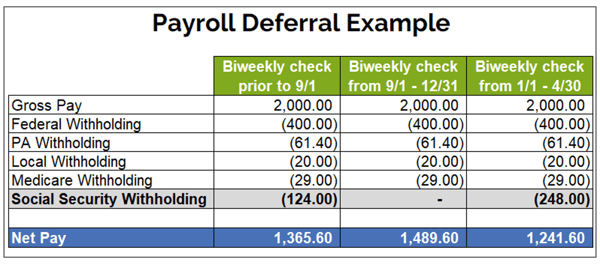

The program postpones the withholding and payment of the employee portion of social security tax for pay dates between September 1, 2020 and December 31, 2020 (the “deferment period”) for employees earning social security wages of less than $2,000 per week, as determined from week to week.

Starting on January 1, 2021, normal employee social security tax withholding and payment restarts. Unless forgiven, the repayment of the deferred social security tax will also begin on January 1, 2021 and continue until April 30, 2021 (the “repayment period”). The result can look like double withholding in 2021 as shown in the example below:

Could this payroll tax deferral be forgiven?

This program is only a deferral unless Congress acts to forgive any deferred amounts.

Who decides to defer tax - employers or employees?

The guidance does not require employers to implement the program, and statements by Treasury Secretary Mnuchin have indicated the program will be voluntary for employers. The guidance does not indicate an employee could force their employer to participate. Instead, the guidance seems to indicate the employer has the discretion of whether to implement deferment across all employees.

Who bears the risk of paying the deferred taxes?

Ultimately, the employer bears the responsibility to repay the deferred taxes, though employers are supposed to withhold tax from the same employees who received deferral. There are administrative issues, additional tax filings required, and increased income tax burden on an employee if an employer pays an employee’s deferred taxes.

It is important to note: If the deferred taxes are not repaid by April 30, 2021, penalties and interest will begin to accrue on May 1, 2021 and will be paid by the employer.

Complications that could cause an employer to bear the burden of repaying the deferred taxes include:

- An employee is terminated or quits during the deferment or repayment period.

- An employee is on unpaid leave during the deferment or repayment period.

- An employee’s wages are reduced during the deferment or repayment period.

Can an employer continue withholding but not remit the tax?

No.

What should an employer do?

Given the current limited guidance, there is no clear answer. Before opting into the program, an employer should consider consulting with their accountant, lawyer, and payroll provider. The program presents a financial risk to the employer and should not be opted into without discussing and understanding all the potential liabilities to the employer.

For questions or assistance, complete the form below.