The IRS Office of Chief Counsel publicly released a memorandum[1] on October 15, 2021 highlighting the information that taxpayers need to provide when filing a refund claim involving the research credit under Internal Revenue Code Section 41 in order to meet the “specificity requirement” under Treas. Reg. § 301-6402-2(b)(1).

As a result of the memorandum, effective January 10, 2022, claims for refund based on the research credit must meet the IRS’ minimum validity standards or face a significant risk of rejection. Further, given the IRS’ current resource constraints and resulting lag time in initiating research credit claim reviews, the IRS may deem a claim for refund as invalid only after the statute of limitations for perfecting such a claim has expired.

Why this new guidance?

According to a related IRS release (IR-2021-203 dated October 15, 2021), the legal advice “is the result of ongoing efforts to manage research credit issues and resources in the most effective and efficient manner.” The release highlights that claims for the research credit comprise a substantial number of examined cases and consume significant resources for both the IRS and taxpayers.

Additionally, the Chief Counsel memorandum states, “requiring that certain specific facts be included with a claim allows the Service to screen for the likelihood of the taxpayer’s right to the refund being sought. This information helps the Service avoid paying refunds to taxpayers who have no factual support for their claim and helps the Service effectively allocate its limited resources to determining which procedurally compliant claims to examine.”

Requirements

The Chief Counsel memorandum provides that for a research credit claim for refund to be considered a valid claim and satisfy the specificity requirement, the taxpayer must, at a minimum, at the time the refund claim is filed with the IRS:

- Identify all the business components to which the research credit claim relates for that year.

- For each business component, identify all research activities performed and the names of the individuals who performed each research activity, as well as the information each individual sought to discover.

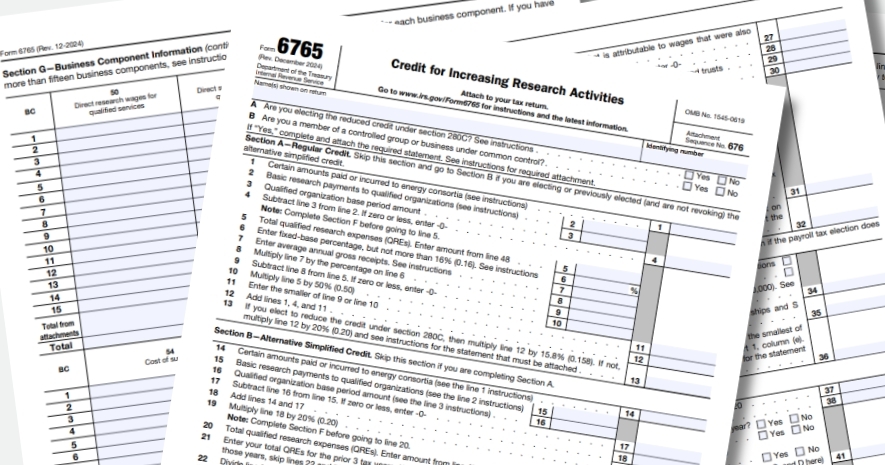

- Provide the total qualified employee wage expenses, total qualified supply expenses, and total qualified contract research expenses for the claim year (this may be done using Form 6765, Credit for Increasing Research Activities).

The memorandum also instructs taxpayers to identify “in detail each ground upon which a credit or refund is claimed and facts sufficient to apprise the Commissioner of the exact basis thereof.”

Significantly, the identification of the legal grounds and factual basis for a taxpayer’s credit claim is not considered conclusive proof that the taxpayer is entitled to the research credit. Although formal documentation is not required to be submitted, according to the memorandum, if a taxpayer does provide documents (including a credit study) with the claim, the taxpayer must specifically identify where in the documents the facts responsive to each of criteria listed above can be found. According to the memorandum, “[a] mere volume of documents will not suffice to meet a taxpayer’s obligation.”

The memorandum recommends that the Service reject as deficient any claim for refund relating to the research credit that does not include the information described above or that is not signed under penalty of perjury. According to the memorandum, these measures should eliminate the possibility that a court will find that the Service has waived the specificity requirement under Treas. Reg. § 301.6402–2(b)(1).

The IRS will provide a grace period (until January 10, 2022) before requiring the inclusion of this information with timely filed Section 41 research credit claims for refund. Upon the expiration of the grace period, there will be a one-year transition period during which taxpayers will have 30 days to perfect a research credit claim for refund prior to the IRS' final determination on the claim.

However, the memorandum indicates that a rejection of a refund claim may preclude a taxpayer from amending or perfecting its claim if it did not satisfy procedural requirements and the statute of limitations to file a new refund claim expires prior to perfection of the claim.

Further details will be forthcoming; however, taxpayers may begin providing this information immediately.

Insights

The Chief Counsel memorandum has already generated significant controversy within the U.S. taxpayer community and will likely be challenged at the administrative level. However, Chief Counsel’s guidance here cannot be disregarded until such time it is modified or withdrawn.

Tax professionals should be aware that strict adherence to IRS minimum standards for research credit claims is critical to ensure claims are properly processed and not rejected without the potential for future resolution. More than ever, thorough documentation of a taxpayer’s research activities is necessary to support research credit claims for refund and avoid costly future litigation.

Please contact your tax advisors to determine how this new guidance impacts pending research credit claims that: (i) have not yet been filed with the IRS; or (ii) have already been filed but that the IRS has not yet accepted or examined.