It is essential for retail, manufacturing, and distribution companies to adopt a method for accounting for inventory because the cost per unit of products purchased may vary. When it comes to accounting for inventory for financial reporting purposes and determining federal tax liability, Last-In, First-Out (LIFO), First In, First Out (FIFO), and Average Cost are the three methods used.

Since the pandemic, companies have experienced higher inventory costs due to supply chain problems and product shortages. As a result of the inflation, companies should assess switching their inventory costing method to LIFO. LIFO can be beneficial since the most recent higher-priced items will be considered sold and removed, leaving the lower-cost items as your ending inventory. This means a higher Cost of Goods Sold, which reduces your business’s taxable income.

A common misconception is that your inventory costing method must match your physical flow of inventory. This is not the case. Your cost flow assumption does not need to match the physical flow of inventory. For example, if you sell eggs, you can still choose the LIFO method even though you will be selling your older eggs first.

When considering LIFO, a company must decide if the tax savings outweigh the cost to implement the new method. Businesses should have a LIFO estimate performed by a tax advisor to see if their company would benefit from switching their inventory costing method. It is also important to mention that you must use this method for a minimum of five years.

How does a company switch to LIFO?

If your business chooses to adopt LIFO as its inventory costing method, you must file Form 970, Application to Use LIFO Inventory Method.

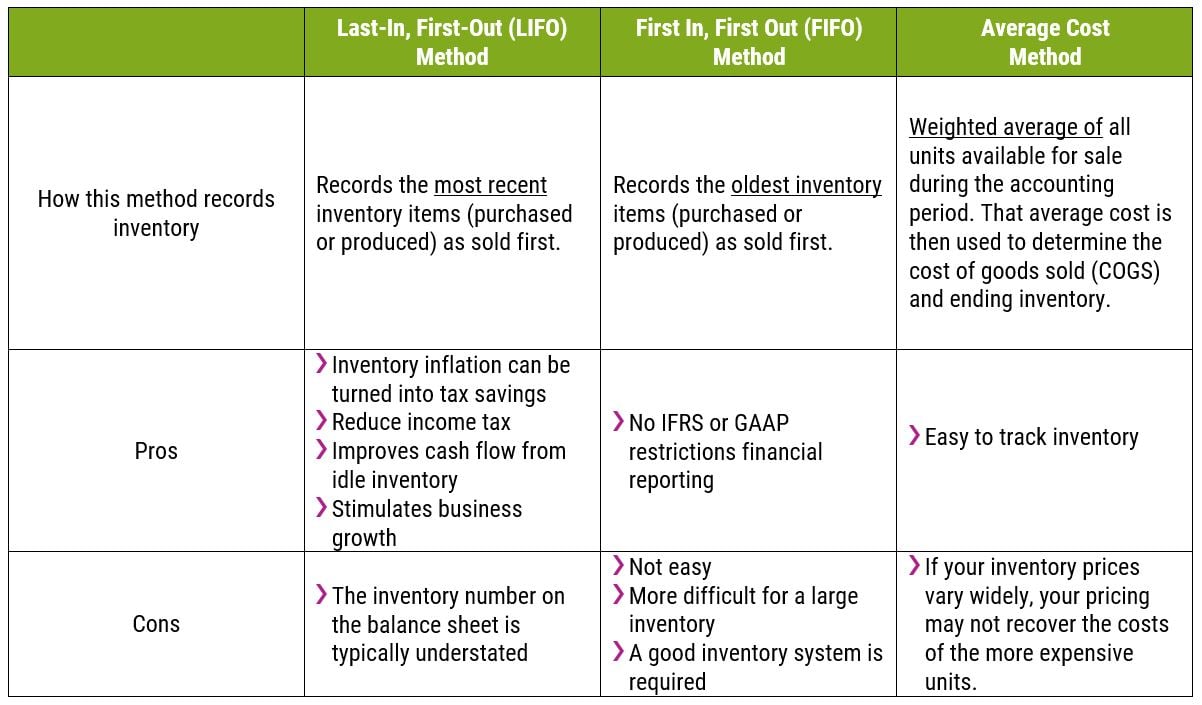

Comparing the three different inventory costing methods

The chart below compares the three different methods to account for inventory.

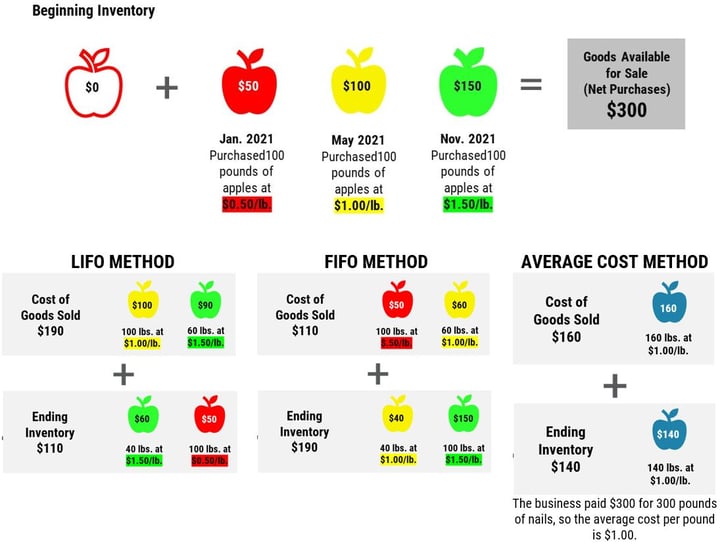

Inventory Costing Methods Illustration

For questions or assistance with selecting the best inventory costing method for your business, please complete the form below.