Written by Evgenia V. Sheaffer, CPA, Senior Manager at Trout CPA

What is an installment sale?

Business owners considering selling their business as a stock or asset sale at a gain often wonder if there is a way to minimize the tax impact in the year of sale. The good news is that if you receive at least one payment after the tax year of the sale, then the gain will be recognized when you receive each payment, therefore allowing the business owner the option to defer the gain. This method of reporting gain is called the installment method.

Note: Funds held in escrow are only considered a payment once they are released to you.

What assets are eligible for installment sale treatment?

- S corporation stock

- Goodwill

- Tangible property

- Real property

The installment method is not available for the following

- Gains associated with inventory, depreciation, amortization recapture, and other ordinary income items.

- Dealers of real or personal property cannot use the installment method.

- Sales at a loss do not qualify for the installment method.

- Gains on the sale of depreciable property between related parties must be recognized in the year of sale.

How is deferred gain calculated, and how is gain recognized over time?

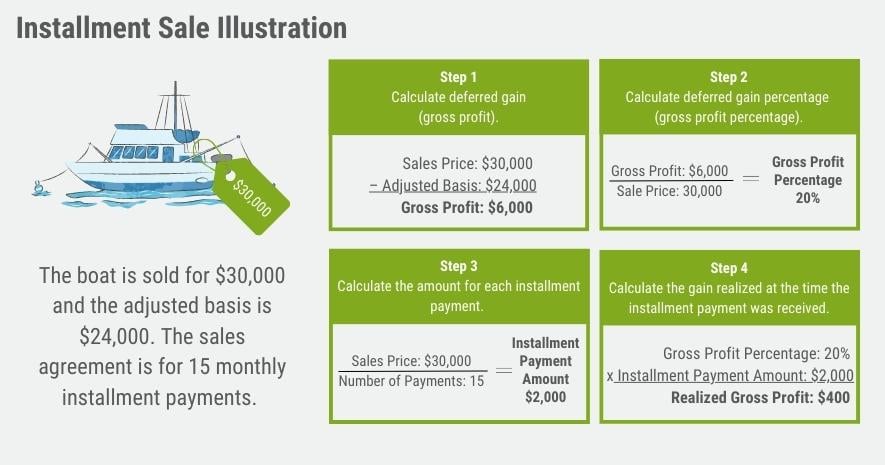

Example: The sales price for an asset sold is $30,000, and the adjusted basis of the asset is $24,000. The sales agreement is for 15 monthly installment payments.

Step 1: Calculate deferred gain (gross profit).

$30,000-$24,000=$6,000

Gross Profit = Sales Price – Adjusted Basis

Step 2: Calculate deferred gain percentage (gross profit percentage).

$6,000 / $30,000=20%

Gross Profit Percentage = Gross Profit/Sales Price

Step 3: Calculate the amount for each installment payment.

$30,000 / 15=$2,000

Installment Payment Amount = Sales Price/Number of Payments (without consideration for interest for example simplicity)

Step 4: Calculate the gain realized at the time the installment payment was received.

20% x $2,000=$400

Realized Gross Profit = Gross Profit Percentage x Installment Payment Amount

Installment sale considerations

- Future capital gain rate changes.

- If you elect out of the installment sale, the payment of the income tax reduces your estate for any potential estate tax.

- Loss carryovers that can offset the total gain.

- Avoiding an interest charge on deferred tax (if your outstanding installment receivable balance exceeds $5,000,000).

- Gain reinvesting in a qualified opportunity zone fund.

- Election out of the installment sale.