Overview

RECENT EVENTS

In early 2020, the coronavirus pandemic spread globally, resulting in vast economic impacts, including supply chain disruptions, changes to working environments, increased market volatility and changing consumer spending habits. As a result of these challenges, companies may be facing a negative impact on their financial condition and results. Even with restrictions beginning to lift in 2021, some companies may continue to face these disruptions throughout the next few years. As such, companies should consider the ongoing impacts of the pandemic when assessing asset impairments.

In this blog post, we focus on the application of the impairment guidance for goodwill, with a focus on private companies.

APPLICATION ORDER – WHERE DO I BEGIN?

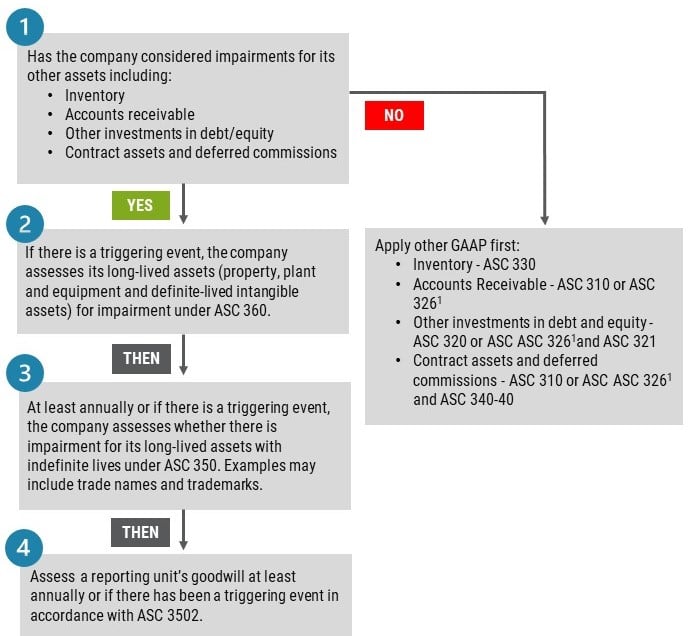

The accounting literature provides for a specific order in which assets which are held for use are assessed for impairment, as illustrated in the following flowchart:

CONSIDERATION OF OTHER ASSETS FOR IMPAIRMENT

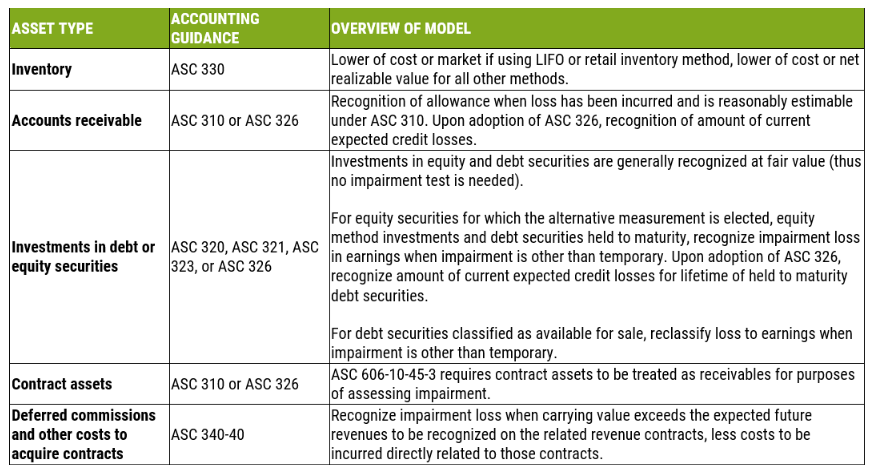

Prior to assessing whether any long-lived assets, including goodwill, are impaired, a reporting entity is required to first assess any other assets owned by the entity for impairment. The order of impairment is important because the impairment test of long-lived assets groups under ASC 360 and goodwill under ASC 350-20 depend on first establishing the proper carrying amounts of the underlying assets. Those other impairment models are summarized below.

LONG-LIVED ASSETS WITH FINITE LIVES

When we think about long-lived assets with finite lives, we typically think of:

- Buildings & factories

- Modes of transportation (e.g., vehicles & trailers)

- Patents & copyrights

- Equipment & machinery

- Office equipment and furniture

Long-lived assets associated with property, plant, and equipment are initially and subsequently accounted for according to the guidance in ASC 360-10, Property, Plant, and Equipment. In addition, intangible assets with finite lives which are amortized over their useful life are also subject to the impairment guidance in ASC 360-10, as are right-of-use assets related to leases. Per this guidance, the long-lived assets are combined with other assets in an asset grouping which represents the lowest level for which there are standalone cash flows. This asset group is then tested for recoverability when there are triggering events (situations or changes in circumstances) that indicate their carrying value is not recoverable. This recoverability assessment first compares the entity’s future undiscounted cash flows expected to be generated from the use of the asset or asset group to its carrying value. If the carrying value is more than the sum of the undiscounted future cash flows, then the Company is required to determine the fair value of the asset/asset group and recognize an impairment charge measured as the difference between the carrying value and the fair value of the asset/asset group.

INTANGIBLE ASSETS WITH INDEFINITE LIVES

For some intangible assets, there may be no factors that limit their useful life and, thus, these intangible assets are considered indefinite lived. This does not mean that these assets have an infinite life but rather, that there is no limit to the asset’s useful life for the foreseeable future. Common examples of intangible assets with indefinite lives include tradenames, trademarks, and brands. ASC 350-30 requires that these assets be tested at least annually for impairment, and more frequently if there are triggering events. Companies are allowed to perform an optional qualitative assessment to determine whether there have been any triggering events that create a situation in which it is more likely than not that the intangible asset is impaired. In this assessment, more likely than not is typically interpreted to mean a greater than 50% probability. If a company bypasses this qualitative assessment or determines that the intangible asset is more likely than not impaired, the company will then determine the fair value of the asset and compare it to the asset’s carrying value. If the carrying value is more than the fair value, the intangible asset is considered impaired, and the difference between the fair value and the carrying value is recognized as a loss on impairment.

GOODWILL

The goodwill impairment assessment is always the last impairment assessment performed after considering impairment of all other assets. This is especially important if there are asset groups that include goodwill (for example, the asset group for a corporate headquarters building will often include all of the assets and liabilities of the company, as there is no lower level at which standalone cash flows exist).

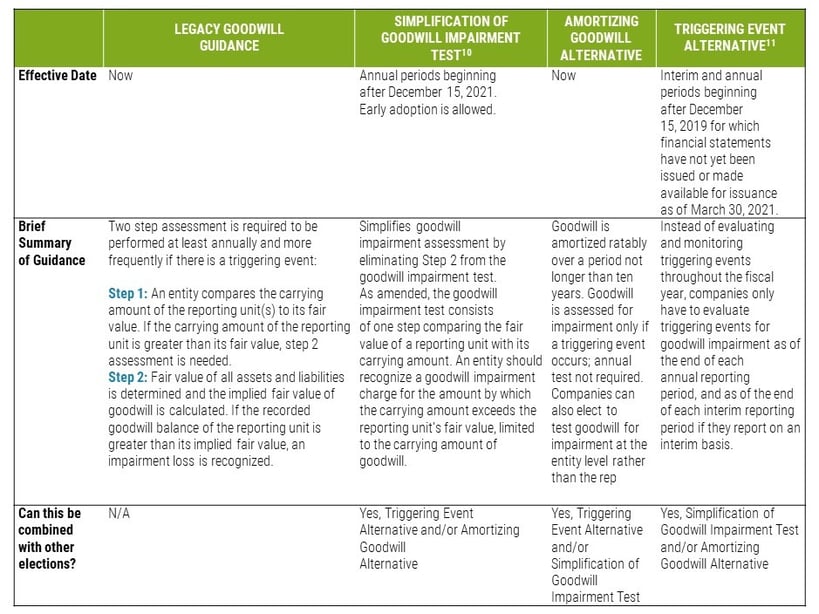

Unless a company has elected to amortize its goodwill under the private company alternative, goodwill must be assessed for impairment at least annually and more frequently if there are triggering events that create a situation where goodwill is more likely than not impaired3. A company has an option to perform the same qualitative assessment as that for intangible assets with indefinite lives. If the company elects to bypass the qualitative assessment or if the results of the qualitative assessment indicate that it is more likely than not that the reporting unit is impaired, the company compares the carrying value of the reporting unit inclusive of goodwill to its fair value. This assessment is typically referred to as the “step 1 test”. If the carrying value exceeds the fair value, then the entity must perform the second step, which is to compare the implied fair value of goodwill to its carrying value and record an impairment charge for any excess of carrying value over implied fair value.

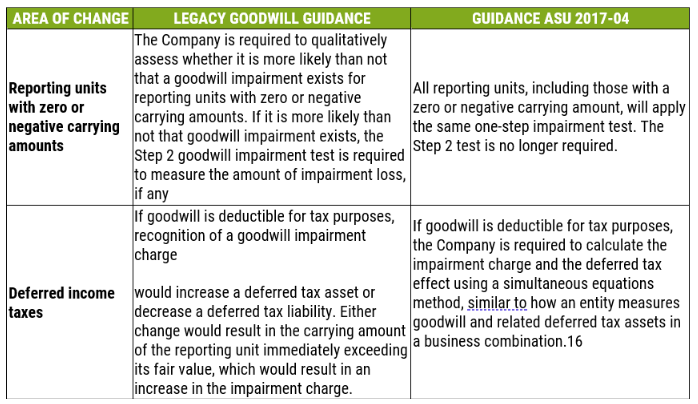

In 2017, the Financial Accounting Standards Board (FASB) simplified the goodwill impairment assessment4. Under this revised guidance, instead of performing the second step, a company will recognize a goodwill impairment charge for the amount by which the reporting unit’s carrying amount exceeds its fair value. However, any loss recognized is limited to the total amount of goodwill allocated to that reporting unit. This update to the goodwill impairment assessment is applicable in 2022 for all private companies when performing an impairment assessment. This guidance may also be early adopted.

Recently, stakeholders raised concerns with FASB about the cost and complexity associated with evaluating triggering events and potentially measuring a goodwill impairment during the reporting period, rather than aligning the evaluation date with the end of the reporting period. In particular, the issue had become exacerbated during the COVID-19 pandemic, which resulted in economic uncertainty and significant changes in facts and circumstances throughout 2020 and 2021. As such, the FASB provided an accounting alternative for private companies to evaluate triggering events for goodwill impairment only as of the end of each reporting period5. In this newsletter, we focus on the testing for impairment of goodwill by private companies.

Accounting for Goodwill

WHAT IS GOODWILL?

Goodwill is an intangible asset that is recognized when a business is purchased, and the purchase price exceeds the fair value of the identifiable assets less the liabilities assumed. Typically, goodwill represents the value inherent in an existing set of operations and includes the economic value of the costs previously incurred to start and grow the business, as well as certain intangible assets that are not separately recognized, such as an assembled workforce. Goodwill, once recorded, is presented as a noncurrent asset on the balance sheet.

UNIT OF ACCOUNT

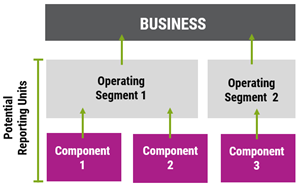

Upon initial recognition, goodwill is assigned to the reporting unit(s) of a company, and subsequent to initial recognition, goodwill is assessed for impairment at the reporting unit level6. So what is a reporting unit?

A reporting unit is a portion of a business, either an operating segment or one level below an operating segment, which is commonly called a component.

ASC 280 Segment Reporting7 provides guidance on the identification of operating segments. Although private companies are not required to provide the segment reporting disclosures in ASC 280, they are required to identify what their operating segments would be in order to determine how to allocate goodwill. The identification of operating segments is based on how management manages the business. Specifically, a portion of a company represents an operating segment if it meets all three of the following criteria:

ASC 280 Segment Reporting7 provides guidance on the identification of operating segments. Although private companies are not required to provide the segment reporting disclosures in ASC 280, they are required to identify what their operating segments would be in order to determine how to allocate goodwill. The identification of operating segments is based on how management manages the business. Specifically, a portion of a company represents an operating segment if it meets all three of the following criteria:

- It engages in business activities from which it may earn revenues and incur expenses (including intercompany revenues and expenses).

- Its operating results are regularly reviewed by the company’s chief operating decision maker (usually the CEO or equivalent position, but can be others within the organization) to make decisions about allocating resources and assessing performance.

- Discrete financial information specific to that portion of the business is available.

Often an operating segment is managed by a segment manager who reports to the chief operating decision maker and who discusses its operating results, operating plans, and financial forecasts with the chief operating decision maker. Once the operating segments have been identified, a company next assesses whether those operating segments consist of one

or more components. A component of an operating segment is a reporting unit if it represents a business for which discrete financial information is available and segment management regularly reviews its operating results. It is important to note that in order for a component to be considered a reporting unit, it must meet the definition of a business8 in ASC 805.

Assuming it is a business, then a portion of an operating segment is considered a component if the segment manager regularly reviews discrete financial information about it. This assessment is similar to the assessment of whether a portion of a business is an operating segment, but is performed one level lower in the company structure.

Once the components have been identified, components of the same operating segment are required to be aggregated into one reporting unit for purposes of allocating and testing goodwill if the components have similar economic characteristics such as:

- Types of products, services, or production processes

- Distribution method of products or services

- Types of customers

- Regulatory environment.

In addition, two or more components should be combined if they are managed as a single unit. In making that assessment, the following factors should be considered:

- The manner in which the company operates the business and the nature of those operations.

- Whether goodwill is recoverable separately, or only from two or more components in concert.

- The extent to which the components share resources.

- Whether the components support and benefit from common research and development projects.

It is essential that companies identify the reporting units and assign goodwill correctly after the purchase of a business. Once goodwill has been recorded, a private company has several options for its subsequent measurement.

PRIVATE COMPANY ACCOUNTING ELECTIVES — SUBSEQUENT MEASUREMENT OF GOODWILL

As noted in the Overview, the FASB has recently approved accounting standard updates that provide more options for private companies to consider when accounting for goodwill after initial measurement. In the table below, we compare these options9.

TRIGGERING EVENTS

Companies are required to assess goodwill for impairment whenever a triggering event occurs. A triggering event is defined as events or circumstances that may indicate that the fair value of the reporting unit or entity is less than its carrying value. Some examples of indicators that may lead a company to perform a goodwill impairment assessment include12:

- Decline in general economic conditions or restrictions on accessing capital that signify deteriorating economic conditions.

- A change in the demand for its products or services and/or a new competitor in the marketplace that makes the competitive environment more challenging.

- Increased costs for raw materials or labor that have a negative effect on earnings or cash flows.

- Decrease in actual or planned revenue compared with projected results of relevant periods.

- Litigation events or contemplation of the filing for bankruptcy.

- The sale, disposition, or impairment of a significant asset group.

- A continued decrease in share price or value.

The above indicators are not all-inclusive, and judgment is required to assess whether a company has incurred a triggering event.

EXAMPLE 1: Triggering Events

FACTS:

- As of June 30th, Travel Destination Group has experienced a recent decline in bookings and an increase in cancellations due to travel restrictions resulting from the COVID-19 pandemic.

- Likewise, there are new regulations and restrictions on travel in areas where the Company usually plans and books vacations and excursions for its customers.

- Over the past 6 months, the Company has experienced a significant decline in actual versus planned revenue.

- Travel Destination Group operates in a single segment, which also represents its only reporting unit. Before the pandemic, the Company performed a fair value analysis for purposes of valuing stock options granted to employees. Based on that analysis, the Company’s fair value was approximately 10% higher than its carrying value.

QUESTION: Does Travel Destination Group have a triggering event as of June 30th?

ANALYSIS: Travel Destination Group will have to consider the extent to which each of the adverse events and circumstances

identified could affect the comparison of its reporting unit’s fair value to its carrying amount. More weight should be placed

on the events and circumstances that are most likely to affect the reporting unit’s fair value. The Company should also

consider positive and mitigating events and circumstances that may affect its determination of whether it is more likely than not that the fair value of a reporting unit is less than its carrying amount. Potentially, if the Company has a recent fair value calculation for a reporting unit, it also should include as a factor in its consideration the difference between the prior fair value and the carrying amount in reaching its conclusion about whether to perform the first step of the goodwill impairment test.

In this fact pattern, it is likely that the Company has experienced a triggering event and should perform a goodwill impairment test. The current economic environment has resulted in a significant revenue shortfall, and there are indicators that the conditions will persist for some time. In addition, in its last assessment, the Company’s carrying value did not significantly exceed its fair value.

EVALUATING TRIGGERING EVENTS — PRIVATE COMPANY ALTERNATIVE

As previously mentioned, during 2020 and 2021, certain stakeholders of private companies raised concerns with the FASB about the cost and complexity associated with evaluating triggering events and potentially measuring a goodwill impairment during the reporting period and expressed a view that evaluating goodwill impairment on the date that a triggering event occurs may not provide users of private company financial statements with useful information as the circumstances that led to the triggering event may no longer exist at the end of the reporting period. In response to these concerns, the FASB issued ASU 2021-03 (the “Update”).

The Update provides private companies with an optional accounting policy election to assess goodwill impairment triggering events only as of the end of each reporting period, whether the reporting period is an interim or annual period. The accounting alternative applies to goodwill subsequently accounted for in accordance with ASC 350-20 and is available regardless of whether the entity also elected the accounting alternative for amortizing goodwill. To clarify, a company is neither required to elect, nor precluded from electing, either or both accounting alternatives.

Companies that elect the triggering event alternative must disclose this as a significant accounting policy and should perform the evaluation as follows:

- For a company that has elected the accounting alternative for amortizing goodwill, the triggering event evaluation shall be performed only as of each reporting date.

- For a company that has not elected the accounting alternative for amortizing goodwill:

- If the company performs its annual goodwill impairment test as of the end of the reporting period, it should not assess whether triggering events have occurred during that reporting period.

- If the company performs its annual goodwill impairment test on a date other than the end of the reporting period, its evaluation of whether a triggering event has occurred during that reporting period should be performed only as of the end of the reporting period.

Because this accounting alternative requires a triggering events assessment to be performed at the end of each interim period for which the Company reports financial information prepared in accordance with generally accepted accounting principles (“GAAP”), questions have arisen on the application of this alternative for companies with interim reporting requirements. In particular, it can be challenging in some cases to determine whether a private company provides GAAP-compliant financial information on an interim basis to external parties. The following examples illustrate whether a private company in different fact patterns would be required to assess whether triggering events have occurred at an interim date:

EXAMPLE 2: Triggering Events for Private Companies that Selected the Triggering Event Alternative

FACTS:

- Same facts as Example 1.

- Travel Destination Group is a private company and has elected the private company alternative to perform goodwill impairment triggering event evaluations only as of the end of each reporting period.

- The Company must provide GAAP-compliant financial statements to its bank semiannually on June 30 and Dec 31 of each year.

- The Company has not elected to amortize its goodwill and performs an annual impairment assessment of its goodwill as of the beginning of the fourth quarter.

QUESTION: Does the Company need to assess whether a triggering event has occurred as of June 30th?

ANALYSIS: Although interim reporting isn’t specifically defined in GAAP, we believe that providing financial statements that are compliant with GAAP is considered interim reporting, regardless of whether those financial statements are filed with a regulatory agency or not. As such, Travel Destination Group would need to perform a triggering event assessment on the interim reporting date (as of June 30th). If a triggering event has occurred as of that date, the Company will then need to perform a goodwill impairment assessment because it is more likely than not that the carrying value of the reporting unit is greater than its fair value.

EXAMPLE 3: Triggering Events for Private Companies that Selected the Triggering Event Alternative

FACTS:

- Same facts as Example 1.

- Travel Destination Group is a private company and has elected the private company alternative to perform goodwill impairment triggering event evaluations only as of the end of each reporting period.

- The Company must provide financial information to its lender on a quarterly basis. The information provided consists of EBITDA for the three-month period, calculated in accordance with GAAP, as well as an interest coverage ratio calculated as defined in the debt agreement, which excludes certain nonrecurring items, including any goodwill impairment charges.

- The Company has not elected to amortize its goodwill and performs an annual impairment assessment of its goodwill as of the beginning of the fourth quarter.

QUESTION: Does the Company need to assess whether a triggering event has occurred as of June 30th?

ANALYSIS: In this example, Travel Destination Group is not required to provide financial statements to its lender on an interim basis. However, it is required to provide two metrics, EBITDA and an interest coverage ratio. While the FASB did not provide additional guidance on what constitutes interim reporting, in paragraph BC28 in the Basis for Conclusions to the Update, they note that many private companies provide “some level of financial information more frequently than annually that indicates that it complies with the recognition and measurement principles of GAAP.” Because EBITDA in this example is calculated in compliance with GAAP, and thus any goodwill impairment charge would impact the earnings number used to calculate the metric, we believe the presentation of EBITDA on a quarterly basis represents interim financial reporting. Therefore, the Company should assess whether a triggering event has occurred as of June 30th. We note that the interest coverage ratio is not calculated in compliance with GAAP. Notably, any goodwill impairment charges would be excluded.

Therefore, if the only financial information that Travel Destination Group provided to its lender on an interim basis were the interest coverage ratio, and the Company elected the private company alternative to only assess triggering event as of the reporting date, we believe that it would not have to assess whether a triggering event has occurred as of June 30th, as it would not be considered to provide interim reporting. Instead, the Company would only assess whether a triggering event has occurred as of the end of its annual reporting period, if different than its annual impairment testing date.

GOODWILL IMPAIRMENT ASSESSMENT

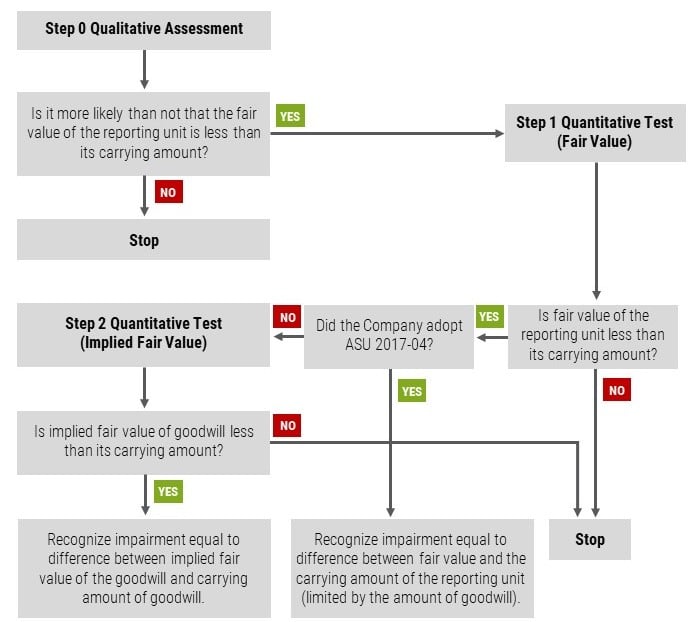

Goodwill is tested for impairment in accordance with the following flowchart. Companies may elect to bypass the Step 0 Qualitative Assessment and move directly to the Step 1 Quantitative Test.

STEP 0 QUALITATIVE TEST

When testing goodwill for impairment, companies are permitted to first qualitatively assess whether a quantitative goodwill impairment test is required for some or all of its reporting units, usually referred to as a “Step 0” test. The quantitative impairment test is required if the Company concludes that it is more likely than not that a reporting unit’s fair value is less than its carrying amount or if the Company elects to skip the Step 0 assessment for a particular reporting unit. The Step 0 assessment should consider all relevant events or circumstances that affect the fair value of the reporting unit13. During the assessment, it is important to consider any adverse events and circumstances affecting the reporting unit, as well as those that are positive or provide a mitigating effect. The assessment should include gaining an understanding of the relevant events and circumstances affecting the business, such as financial performance, costs, industry, and market conditions, and their relative significance. Companies should consider not only current events and circumstances but also any planned upcoming changes that would be expected to impact the current fair value of a reporting unit, such as forecasted cost increases and planned changes in strategies or customers.

The Company should also consider the difference between a reporting unit’s fair value and carrying amount (“cushion”) as determined in the most recent prior quantitative assessment. However, the Company must first determine whether the assumptions and projections used in the previous fair value measurement are still reasonable in the current period. The identification of significant differences may indicate that the projections used for the last fair value calculation are no longer appropriate and that less weight should be given to the apparent cushion from the prior valuation. However, more weight may be given to a prior cushion when actual results are consistent with or more favorable to the reporting unit’s fair value than prior projections. If the Company determines that it is more likely than not that the fair value of a reporting unit is less than its carrying amount, then the Step 1 quantitative test would be required to identify potential goodwill impairment. Conversely, if the Company concludes that a quantitative goodwill impairment test is not required, robust documentation should be prepared to support that conclusion. Generally, such documentation would include the events and circumstances taken into consideration during the qualitative assessment, at a level of precision that provides supportable evidence for the conclusion.

Observation

Given the level of effort involved in performing and documenting a Step 0 qualitative assessment, private companies should consider the likelihood of failing that test before conducting it. It may be more efficient and cost-effective to skip the Step 0 assessment and move straight to the Step 1 quantitative assessment, especially if the company has readily available multiyear forecasts that can be used to support a discounted cash flow analysis.

STEP 1 QUANTITATIVE TEST (FAIR VALUE)

The quantitative impairment test compares the fair value of the reporting unit with the reporting unit’s carrying amount, including goodwill, to determine any potential impairment. As mentioned previously, the reporting unit’s carrying amount is determined after all the reporting unit’s other assets have been adjusted for impairment, if necessary, under other applicable GAAP. Determination of Fair Value of the Reporting Unit The first step in the evaluation involves the determination of fair value of the reporting unit. ASC 820 provides three evaluation approaches:

- Market Approach

- Cost Approach14

- Income Approach

The determination of which of these valuation techniques to use requires judgment, and it is often appropriate to utilize multiple approaches in order to determine the best estimate of fair value. However, there is often a lack of observable market data for private companies15. Therefore, the income approach, specifically the discounted cash flow (“DCF”) method, is the most commonly used valuation technique. The DCF method involves:

- Estimating the future cash flows for a certain discrete projection period,

- Estimating the terminal value, and

- Discounting those amounts to present value at a rate of return that considers the relative risk of the cash flows and the time value of money.

It is important to note that ASC 820 requires the use of market participant assumptions in determining fair value. Therefore, it may be appropriate to consider whether the reporting unit’s estimated future cash flows should be adjusted to remove company-specific assumptions that would not be consistent with a market participant.

The Company’s estimate of future cash flows for the reporting unit may involve the preparation of a single set of future cash flows or multiple sets of cash flows representing various possible scenarios which are then probability weighted to derive a single value. If using a single set of future cash flows, the discount rate should be adjusted to incorporate the uncertainty in expectations about the future cash flows, which will generally result in a higher rate reflective of the inherent risk. Conversely, a probability-weighted cash flow analysis already incorporates assumptions about the uncertainly in expectations about the future cash flows, and thus the discount rate should be commensurate only with the risk inherent in the reporting unit’s underlying business. As a starting point to determining the required rate of return (i.e., discount rate), the Company should use the weighted average cost of capital (“WACC”) to determine the rate that a market participant would demand based upon industry-weighted average returns on debt and equity adjusted for the relative advantages or disadvantages of the entity. Companies should include a terminal value at the end of the discrete projection period of a discounted cash flow analysis to reflect the remaining value that the reporting unit is expected to generate beyond the projection period. The terminal value represents the present value in the last year of the projection period of all subsequent cash flows into perpetuity, and reflects a stable long-term growth rate. We generally believe that a growth rate consistent with expected inflation and gross domestic product (GDP) growth in the terminal year is appropriate for most entities, and a rate that exceeds expected inflation and GDP growth would be rare.

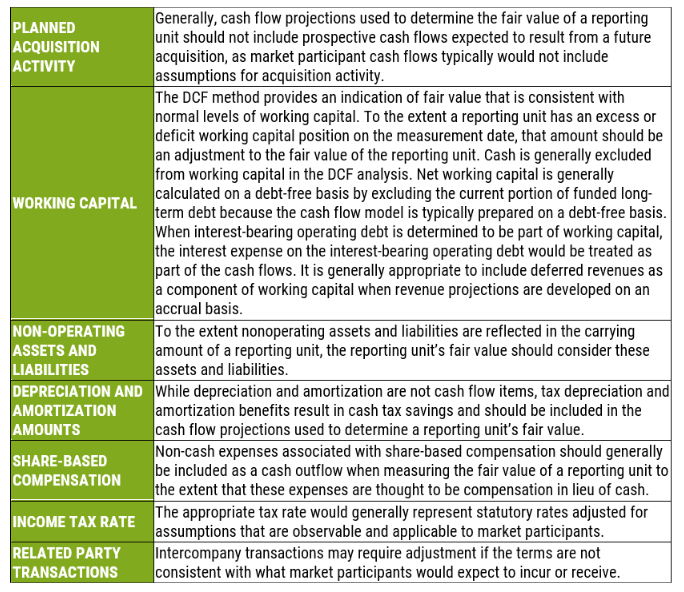

Companies may have to adjust existing cash flow projections for purposes of determining fair value of a reporting unit under ASC 350-20. The following are considerations provided in the AICPA Accounting and Valuation Guide — Testing Goodwill for Impairment that may result in adjustments to a Company’s cash flow projections:

Although the discounted cash flow method may be the most appropriate valuation technique when valuing a reporting unit, the Company should also consider the use of other methods each time the goodwill impairment test is performed. For example, the market approach may be used in certain situations as a secondary method to the income approach. We suggest consultation with valuation professionals in the determination of the appropriate model and certain inputs, such as the cost of capital or discount rate, based on the reporting unit’s specific facts and circumstances.

Determination of Potential Impairment

If the Company determines that the fair value of the reporting unit is greater than its carrying amount, the reporting unit’s goodwill is considered not impaired. If the fair value of the reporting unit is less than its carrying amount, the reporting unit’s goodwill may be impaired, and prior to the adoption of ASU 2017-04, the Step 2 test must be completed to measure the amount of goodwill impairment loss, if any.

STEP 2 QUANTITATIVE TEST (IMPLIED FAIR VALUE)

Before the adoption of ASU 2017-04

In performing Step 2 of the goodwill impairment test, the Company must determine the implied fair value of the reporting unit’s goodwill. The fair value of goodwill is measured as a residual amount as it cannot be determined directly. Therefore, the implied fair value of a reporting unit’s goodwill is derived in the same manner as the amount of goodwill that would be recognized in a business combination in accordance with ASC 805. This process involves measuring the fair value of the reporting unit’s assets and liabilities at the time of the impairment test, using the guidance in ASC 805. The difference between the fair value of the reporting unit determined in Step 1 and the sum of the fair values of all of the reporting unit’s identifiable assets and liabilities is considered the implied fair value of goodwill. Once the implied fair value of the reporting unit’s goodwill has been determined, it is compared to the carrying amount of its goodwill. If the Company determines that the fair value of the reporting unit’s goodwill is greater than its carrying amount, the reporting unit’s goodwill is considered not impaired. If the fair value of the goodwill is less than its carrying amount, the Company recognizes an impairment for the difference between implied fair value of the goodwill and the carrying amount.

After the adoption of ASU 2017-04

Upon adoption of ASU 2017-04, a Company does not perform an assessment of the implied fair value of goodwill (Step 2). Instead, the Company recognizes its impairment loss based on the Step 1 assessment. Specifically, an impairment is recognized as the difference between the carrying value of the reporting unit and the fair value of the reporting unit determined in the Step 1 assessment. There are some other significant changes to highlight resulting from the adoption of ASU 2017-04, which are summarized in the table below:

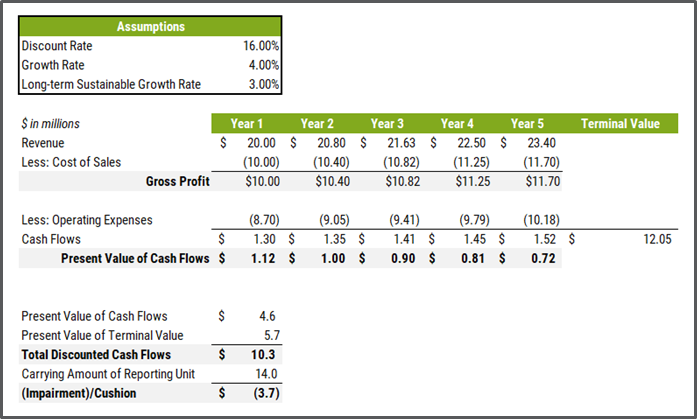

EXAMPLE 5: Goodwill impairment assessment after the adoption of ASU 2017-04

FACTS:

- Same facts as Example 1.

- The Company has adopted ASU 2017-04

- Carrying amount of reporting unit is $14.0 million, carrying amount of goodwill is $4.0 million

- The book value of the reporting unit’s other assets (excluding goodwill) has been adjusted for impairment under other applicable GAAP.

QUESTION: The Company has experienced a triggering event and should perform a goodwill impairment assessment. What is the impairment loss that should be recognized, if any?

ANALYSIS:

Step 0 Qualitative Assessment

Because the Company has already concluded that a triggering event has occurred, indicating that the fair value of goodwill may be less than its carrying value, it elected to skip the Step 0 assessment.

Step 1 Quantitative Test

The Company prepared the following discounted cash flow analysis to determine the fair value of the reporting unit. The discount rate applied of 16% reflects the uncertainty in expectations about future cash flows. The Company applied a long-term sustainable growth rate of 3% to calculate the terminal value, which is consistent with historical inflation rates.

Based on the analysis performed, the Company determined the fair value of the reporting unit to be $10.3 million, resulting in the recognition of a $3.7 million goodwill impairment charge.

EXAMPLE 6: Goodwill impairment assessment before the adoption of ASU 2017-04

FACTS:

-

Same facts as Example 5.

-

The Company has not adopted ASU 2017-04

QUESTION: The Company determined that the fair value of the reporting unit is less than the carrying value of goodwill

from its Step 1 test. What is the impairment loss that should be recognized under Step 2, if any?

ANALYSIS:

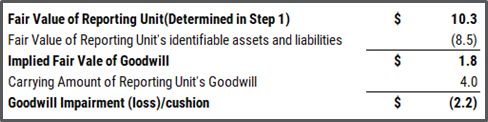

Step 2 Quantitative Test

Based on the analysis performed, the Company determined the implied fair value of goodwill to be $1.8 million, resulting in the recognition of a $2.2 million goodwill impairment charge.

Footnotes:

-

Note that ASC 326 is effective for SEC filers, excluding small reporting companies beginning in January 2020. Other entries can apply ASC 310 until their adoption date of ASC 326, which is required in January 2023.

-

ASU 2021-03 provides private companies with the option of assessing triggering events at the end of the reporting period only and the option to amortize goodwill, in which case there is no annual impairment text.

-

Private companies have the option to amortize goodwill. If a company elects to amortize goodwill, then the annual impairment assessment is not required, and goodwill is only assessed for impairment if a triggering event occurs.

-

ASU 2017-04 Intangibles — Goodwill and Other (Topic 350) No. 2017-04: Simplifying the Test for Goodwill Impairment

-

ASU 2021-03, Intangibles — Goodwill and Other (Topic 350): Accounting Alternative for Evaluating Triggering Events, provides a practical expedient for private companies. Under that option, private companies can elect to only assess whether a triggering event has occurred as of the end of the reporting period.

-

If a private company has elected to amortize goodwill, then it may also elect to test goodwill for impairment at the entity level rather than at the reporting unit level.

-

ASC 280-10-50

-

Unless it represents a nonprofit activity, in which case it would be considered a component.

-

The optional qualitative assessment in ASC 350-20-35-68 through 35-69 is allowable irrespective of which accounting treatment is elected for goodwill.

-

ASU 2017-04: Intangibles — Goodwill and Other (Topic 350): Simplifying the Test for Goodwill Impairment

-

ASU 2021-03: Intangibles — Goodwill and Other (Topic 350): Accounting Alternative for Evaluating Triggering Events

-

Selection from indicators in paragraphs 350-20-35-3c

-

ASC 350-20-35-3C provides examples of relevant events and circumstances that a Company can use to assess whether it is more likely than not that the fair value of a reporting unit is less than its carrying amount. These examples are not all-inclusive, as noted in ASC 350-20-35-3F.

-

We generally believe that it would not be appropriate to use a cost approach to value most reporting units. ASC 820-10-55-3D defines the cost approach as the amount that would be 010required currently to replace the service capacity of an asset. Because it would be difficult to evaluate the cost to replicate the value of goodwill, the cost approach would likely not provide a meaningful measure of fair value for a reporting unit.

-

In many cases, private companies may have public competitors. In that situation, it may be appropriate to consider the publicly available information about those competitors, such as stock price or EBITDA multiples or other metrics in the fair value assessment.

-

ASC 350-20-55-23A through 23D illustrates the use of the method of the simultaneous equation to account for the increase in the carrying amount from the deferred tax benefit when tax-deductible goodwill is present.