Written by Travis Oot, CPA

Managing cash flow effectively is essential for any business, but for funeral homes, where services are often provided before full payment is received, strong cash management can make the difference between sustainability and financial stress. This article outlines practical strategies funeral homes can implement to improve cash flow, minimize risks, and position themselves for long-term success.

Key Takeaways

Accelerate collections: Address delayed payments by offering early payment discounts, automating invoices, and following up with families 30 days after service.

Use smart pricing and technology: Slightly adjust pricing to offset discounts and integrate funeral home management software to streamline billing and reminders.

Reduce unnecessary spending: Review compensation structures, minimize excess inventory, and separate personal expenses from business costs to maximize tax efficiency.

Optimize real estate and depreciation: Use cost segregation and Section 179 to accelerate deductions on facilities, equipment, and vehicles—freeing up cash while reducing tax liabilities.

Strengthen vendor and budget controls: Negotiate favorable payment terms, track expenses in real-time, and build budgets with modern accounting tools.

Plan for ownership transitions: Improve your valuation by maintaining strong cash flow, working with advisors early, and properly allocating value using IRS Form 8594.

Ask the right questions: Is your cash working for you? Are you managing proactively? Do you have the right tools and advisors to support your goals?

Understanding Cash Flow in the Funeral Industry

Cash flow refers to the movement of money into and out of a business. For funeral homes, significant expenses such as rent, employee wages, inventory (caskets, urns), and loan repayments must be carefully balanced against revenue streams. Unlike many retail businesses, funeral homes frequently deal with accounts receivable (A/R), making timely collections vital for liquidity.

Why Accounts Receivable Can Hurt Cash Flow

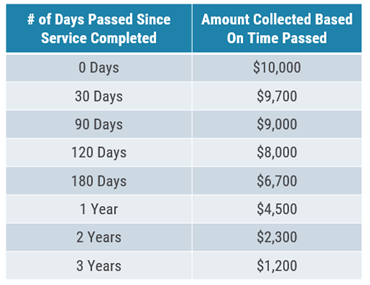

When services are rendered before payment is received, cash flow is delayed. For instance, consider a $10,000 funeral service. If the A/R isn’t collected promptly, that revenue becomes tied up and unavailable for business needs. Collecting delays can accumulate quickly, as shown in a real-world example where outstanding receivables dropped from $450,000 to $200,000 over three months, releasing $250,000 in cash inflows.

When services are rendered before payment is received, cash flow is delayed. For instance, consider a $10,000 funeral service. If the A/R isn’t collected promptly, that revenue becomes tied up and unavailable for business needs. Collecting delays can accumulate quickly, as shown in a real-world example where outstanding receivables dropped from $450,000 to $200,000 over three months, releasing $250,000 in cash inflows.

Strategies to Improve A/R Collection:

- Offer an early payment discount for payments within 30 days.

- Apply monthly interest on overdue balances.

- Avoid payment plans unless they’re automated.

- Request upfront payment for merchandise and cash advances.

- Use a collection agency if unpaid after 30 days.

Improving Cash Inflows

Prompt collection isn’t the only way to boost cash inflow. Funeral homes can improve liquidity through proactive financial policies:

- Follow-up Calls: Contact families after 30 days to ensure they received invoices and answer any questions.

- Price Strategy Adjustments: Slightly raise prices to accommodate early payment discounts without affecting margins.

- Technology Integration: Use funeral home management software to automate billing and reminders.

Managing and Minimizing Cash Outflows

Reducing unnecessary expenses is just as important as increasing inflows. Here are several high-impact areas:

- Employee Compensation. Review wages, benefits, and executive perks. Distinguish clearly between personal and business expenses and take deductions where possible.

- Personal Tax Strategy. Plan your personal tax payments around business cash flow. Consult with advisors on optimal cash distributions for covering tax liabilities.

- Inventory Management. Minimize on-hand inventory by offering discounts on slow-moving items and utilizing virtual product displays.

- Real Estate Optimization. Consider cost segregation studies to accelerate depreciation and reduce tax liability. Evaluate your real estate structure—owning through a separate legal entity and charging fair market rent can yield tax benefits.

- Vendor Relations. Understand payment terms, build good communication with vendors, and take advantage of early payment discounts. Choose vendors not only by price but also by flexibility in payment terms.

- Budgeting and Technology. Use modern accounting software to create realistic budgets, manage payables, and monitor spending in real time.

Depreciation Strategies

Capital expenditures on hearses, cremators, and facility improvements can strain cash resources. However, strategic depreciation planning can offset these costs:

- Use Section 179 and Bonus Depreciation to write off large purchases.

- Leverage cost segregation to accelerate deductions on buildings and leasehold improvements.

- Work with your accountant to properly categorize repairs versus capital improvements (e.g., HVAC, painting, flooring).

Preparing for Business Transition

Preparing for a sale or transition? Strong cash flow makes your business more attractive to buyers and ensures a smoother transaction.

Considerations:

- Work with advisors early in the process.

- Decide between a stock sale vs. asset sale.

- Use IRS Form 8594 to allocate the purchase price appropriately.

- Account for:

- Real estate value

- Goodwill and intangible assets

- Consulting agreements

- Non-compete clauses

Frequently Asked Questions

What’s the #1 cash flow challenge for funeral homes?

Delayed payment collection from clients after services are rendered, which ties up vital cash reserves.

How can we collect payments faster without being pushy?

Offer early-payment discounts, use clear payment terms, and automate follow-ups using software.

Can depreciation really improve my cash flow?

Yes. Strategic use of depreciation deductions reduces taxable income, increasing retained cash.

Should I lease or buy funeral equipment?

It depends on your cash reserves and tax strategy. Leasing reduces upfront costs but may be more expensive in the long term. Discuss with your accountant.

Critical Questions to Evaluate Your Cash Management

Ask yourself the following to assess and refine your strategy:

- Are you managing cash proactively or reactively?

- Is excess cash sitting idle instead of being invested?

- Can you support long-term goals with current cash flow?

- Are you leveraging all your bank’s cash management tools?

- Do you have a trusted advisor to guide you?

Conclusion

Effective cash management isn’t just about tightening the purse strings—it’s about building a financially resilient business that can adapt, grow, and thrive in any environment. For funeral homes, this means being proactive with receivables, strategic with expenses, and intentional about long-term planning. Implementing the right financial strategies today can lead to greater stability and more opportunities tomorrow. To ensure your cash flow strategy aligns with your business goals, reach out to the professionals at Trout CPA—we understand the funeral industry. We are here to help you navigate its unique financial complexities with confidence.