Written by Andrew Rice, CPA, CVA, Managing Director of Trout CPA’s Transaction Advisory Services

When structuring an M&A transaction, deciding between an asset or stock sale can be an obstacle between buyers and sellers. Finding a transaction structure that works for both parties is critical to the success of the deal. Two solutions have become prevalent in the deal community, though one offers significantly more flexibility.

One such solution is section 338(h)(10) election, which allows the transaction to be treated as a stock sale for legal purposes and an asset sale for tax purposes. The Internal Revenue Code has a fairly narrow set of criteria that governs when and if this election can be utilized. Another possible solution is section 368(a)(1)(F) reorganization (commonly referred to as an “F-reorg”). F-reorg provides more flexibility for both the buyer and the seller while avoiding the limitations imposed by the 338(h)(10) election.

Buyer and Seller Vantage

Generally speaking, sellers are typically better off in a pure stock transaction, while a pure asset transaction is more beneficial for buyers. Why? A stock sale enables sellers to receive preferential capital gains treatment rather than be subject to higher ordinary income tax rates. (Note: when a seller is considering the tax impact between an asset and stock sale, there is considerably less of a gap when the selling company is an asset-light business, where the majority of the purchase price is comprised of goodwill). On the contrary, an asset sale enables buyers to achieve a step-up in tax basis, providing future depreciation to offset taxable income.

338(h)(10) Election Structure Highlights

For starters, this structure only works when the selling company is an S Corporation, and the buyer is also a Corporation (S-Corp or C-Corp). Further, the buyer must be acquiring at least 80% of the target company’s stock. Both previously mentioned guardrails can prove to be problematic. Most private equity buyers use LLC entities as the acquiring entity, which is not allowable in a 338(h)(10) transaction. Additionally, when the seller is rolling equity (when some of the transaction’s proceeds are re-invested back into the company), they cannot achieve a tax deferral on the rollover portion. It feels like this is worth repeating: the rollover equity is taxed upfront in 338(h)(10) transactions. Lastly, the entire structure of a 338(h)(10) election hinges on the S Corporation status being valid and staying valid. If the S Corporation status was inadvertently or unknowingly compromised, the post-transaction entity immediately flips to a C Corporation. Clearly, the path to a successful 338(h)(10) transaction is narrow and potentially risky.

F-Reorganization Structure Highlights

An F-reorganization has become a common solution to avoid the limitations inherent in the 338(h)(10) election. An F-reorganization is defined as “a mere change in identity, form or place of organization of one corporation, however, affected.” Like the 338(h)(10) election, an F-reorganization allows buyers to step-up their tax basis in the target company’s assets and avoid the complexities surrounding the change of control and contract assignability issues. However, unlike a 338(h)(10) election, the F-reorganization does not require that target to maintain its S Corporation status, and it provides for tax-deferred treatment on rollover equity. (The last point is critical to sellers).

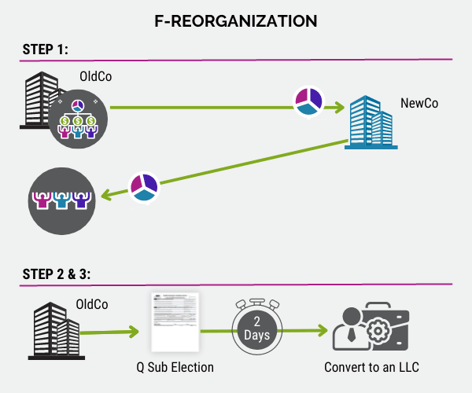

The owners of the S Corporation will need to engage in certain pre-transaction restructuring. If you’ve ever seen a slide deck illustrating the moving pieces involved, it can make your head spin. At the end of the day, however, it is primarily a two-step process, with one additional step for passthrough entity buyers (LLCs and partnerships):

- Shareholders of the S Corporation target (OldCo) form a new corporation (NewCo) and contribute the shares of OldCo to NewCo, in exchange for all of NewCo’s shares;

- OldCo elects to be a qualified Subchapter S subsidiary (Q-sub), enabling a deemed tax-free liquidation of OldCo into NewCo while extending the S Corporation status to NewECo;

- Convert OldCo from a corporation to an LLC no sooner than one day after steps 1 and 2. As a wholly-owned LLC (similar to a Q-sub), OldCo remains a disregarded entity for federal income tax purposes. This step simply converts one disregarded entity (Q-sub) to another disregarded entity (SMLLC), which has no federal income tax consequence.

In conclusion, consider whether a 338(h)(10) or F-reorganization is appropriate when contemplating transaction structures. In our experience, the flexibility offered by an F-reorganization makes it the superior structure for the vast majority of situations where both options are considered. Working with informed tax and legal advisors is critical when structuring your next transaction.

For questions or assistance with selecting and structuring an M&A transaction, please contact Andrew Rice, CPA, CVA at 717-358-9129 or anrice@troutcpa.com.

(10)-Election-Header-1.jpg)