2022 projects to be another robust year of deals for insurance brokers. In 2021, insurance broker M&A activity remained at record levels following the initial pandemic-related disruption to financial markets in 2020. Driven in part by vast sums of private equity capital, a low-interest-rate environment, a fragmented industry, and a preponderance of sellers, insurance broker M&A volume rose by nearly 30% in 2021 compared to 2020.

Changing dynamics across the industry also fueled inorganic growth. The continuing shift to digitalization in both customer experience and internal operations has accelerated the need to acquire talent and technology. Further, expanding product and service offerings, in light of changing work and consumer patterns, has become essential for companies to position themselves well in the market. These factors combine to make for motivated buyers and sellers during the year ahead.

2021 U.S. INSURANCE BROKER M&A RECAP

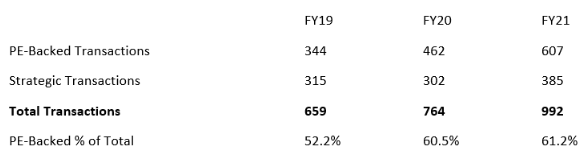

The U.S. insurance brokerage sector saw 992 transactions in 2021 according to S&P Capital IQ, a significant increase from 764 transactions in 2020. After a three-year low of transactions in Q220 following the outbreak of COVID-19, M&A in the sector bounced back in the second half of 2020 and continued its momentum during 2021. As a whole, the insurance sector has shown notable resilience throughout the pandemic.

Private equity-backed transactions were once again a driving force totaling 462 in 2020 and 607 in 2021. That volume represented 61% of total transactions in each year, an increase from 52% of total transactions in 2019.

Source: Per S&P Capital IQ Transaction Statistics for all M&A transaction types in the U.S.

While 2021 saw over 75 different private equity-backed buyers, the top 10 accounted for over 70% of transactions. Serial acquirers — including PCF Insurance Services, High Street Insurance Partners, Acrisure and Hub International — continued to dominate the buyer market in 2021.

2022 INSURANCE TRENDS

As we look to the coming year, the conditions that converged to create a robust deal environment in the second half of 2021 have largely remained into 2022. The following factors will likely impact M&A this year:

1. Consolidation fueled by private equity capital: The buying power of private equity capital, together with a fragmented market, remains the driving factor in M&A activity in the insurance broker sector in 2022. According to a Preqin report, private equity firms had more than $1.3 trillion of “dry powder” at their disposal as of September 2021, and the actual figure may be even higher. The largest acquirers in the industry will continue to be private equity-backed companies looking to consolidate smaller, regional brokers to drive top-line revenue growth and scale across operating platforms.

2. Seller demographics: An aging demographic of insurance broker owners and accelerated retirement plans for business owners will continue to drive significant opportunities for buyers in 2022. As discussed in the latest issue of “Horizons: BDO’s Global View of Mid-Market Deal Activity” a survey of 150 North American business owners found that 66% planned to sell or retire sooner due to the COVID-19 pandemic, with reasons ranging from monetizing recent successful years to a fear of new increases on capital gains tax, as well as a lack of desire to undertake the next phase of growth. If high valuations persist in the sector in 2022, more and more family-owned brokers may be convinced to sell to private equity consolidators.

3. Maturity of insurtech: There was already a push toward digitalization in the insurance industry prior to COVID-19, and the pandemic further accelerated that trend. The pandemic led to wider technology adoption and highlighted the importance of customer experience. Insurers are under increasing pressure to address rising customer expectations through improved technology offerings. In addition, insurers are using predictive analytics, telematics, automation and AI to better manage the claims and underwriting processes.

Although historically viewed as disruptors, insurtechs can help strengthen brokers and administrators through partnerships or acquisitions. Previously, insurtechs were the domain of venture capital and start-up capital, but they have since matured into profitable companies, which makes them more attractive acquisition targets.

Acquiring an insurtech company can be a way to buy new technologies that’s often more expedient than building capabilities in-house. The demand for insurtechs reflects larger trends, as M&A in the tech sector set new records in 2021, and tech companies will likely remain in demand for the foreseeable future.

4. Extreme weather events: 2021 saw an especially damaging Atlantic hurricane season. In particular, Hurricane Ida caused devastation throughout Louisiana and more than a dozen states, with insured losses estimated between $31 billion and $44 billion. In total, natural catastrophes during 2021 caused an estimated $120 billion in insured losses, the second most costly calendar year behind 2017, which saw three Category 4 hurricanes (Harvey, Irma and Maria) make landfall in the U.S. As damaging weather events — including extreme temperatures, high winds and flooding, as well as large-scale disasters — occur more often and in more places, brokers can stay ahead of changing product needs and pricing. In particular, brokers can assess their written premium by industry and geography and take steps to mitigate risks from any overexposure in climate- impacted areas.

5. Impacts of COVID-19 on life, health and liability insurance:

COVID-19 had caused more than 75 million infections and 900,000 deaths in the U.S. as of early 2022. As a result, health insurance usage has shifted, and demand for life insurance has risen significantly. In March 2021, life insurance policy applications were 18.5% higher than in March 2020.

To address increased demand, some providers have offered further incentives like eliminating the requirement for a pre-policy medical exam. In addition to changing health and life insurance needs, COVID-19 has disrupted the work environment as companies look to manage risk from remote working, including cyber risk. Successful insurance companies have reacted quicker than competitors and developed new products and service offerings to meet the changing environment.

6. Macroeconomic policy: At the end of 2021, the U.S. inflation rate hit 6.8%, culminating in the Federal Reserve tapering bond purchases and indicating multiple interest rate hikes in 2022 and beyond. Enterprise and asset valuations may decline, which could cool or dampen the historically high M&A activity witnessed over the past several years. However, there is still significant private equity capital for deal activity, which could help maintain a high level of insurance broker transactions throughout 2022.

Looking forward, the key factors that shaped 2021 have laid the foundation for another year of high M&A activity. Although macroeconomic events in 2022 could dampen activity somewhat and impact valuations, prevailing market conditions remain favorable for deals. With more than six in 10 insurance broker transactions driven by private equity-backed buyers in 2021, substantial dry powder will continue to support robust insurance broker M&A through 2022.

Written by Jonathan Roberts Principal. Copyright © 2022 BDO USA, LLP. All rights reserved. www.bdo.com