CMS has announced changes to the physician fee schedule for 2021.

On December 2, 2020, the Centers for Medicare and Medicaid Services (CMS) published its final rules for the Part B fee schedule, referred to as the Physician Fee Schedule (PFS). Substantial changes were made, with some providers benefiting more than others, and a number of specialties had a significantly negative impact.

However, President Trump’s signing of the Omnibus and COVID Relief bill on December 27, 2020, has alleviated much of the negative changes to physician reimbursement. Though our healthcare system is still grappling with the COVID-19 pandemic, it is crucial providers stay abreast of updates to payment regulations and rates.

Here’s what all Part B providers need to know about changes to the annual fee schedule updates:

Snapshot of Fee Schedule Updates

Calculation Updates

CMS uses a formula to derive the annual physician fee schedules and the “work-time” relative value units have increased significantly for select evaluation and management codes (e.g. office visits). These now reflect a global period related to office visits, including incremental calls and prescription refill times. In order for this change to be revenue neutral, a known regulatory challenge, CMS had to reduce the “conversion factor” significantly. However, with the signing of the Omnibus and Covid Relief bill, this issue has significantly been reduced while maintaining the other, positive changes made to office visit reimbursement levels.

Impact - The severity of the impact to physicians has been greatly reduced with the passage of this bill. While there are still winners (primary care/OB) and losers (hospital-based and surgical sub-specialties), the large negative impact to some provider specialties has been averted. Included is a summary the AMA has provided by specialty.

Evaluation and Management (E/M) Office Visits Coding Updates

On Nov. 1, 2019, CMS finalized revisions to the evaluation and management (E/M) office visit CPT codes 99201-99215. These revisions will go into effect on Jan. 1, 2021. They build on the goals of CMS and providers to reduce administrative burden and put “patients over paperwork” thereby improving the health system.

Impact - There are some administrative savings for physicians but also a need for new training on the new requirements and education on the new CPT codes that have been added.

Medicare Telehealth

In the 2021 Final Rule, CMS made additions to the telehealth services offered and continued the list of services available in response to the ongoing COVID-19 public health emergency (PHE).

Impact -Telemedicine is here to stay—look for a name change to “Digital Health”. We will see a plethora of new “digital” in the near future.

Quality Payment Program (QPP)

2020 has been a difficult year for virtually all providers. With that in mind, CMS has provided an extension for the “extreme and uncontrollable circumstances exception” until February 21, 2021. QPP was a result of the Medicare Access and CHIP Reauthorization Act (MACRA) of 2015, which represents CMS’s move towards a value-based reimbursement program. As a result, depending on physician performance within this program, Medicare reimbursements can be enhanced or penalized by up to 9%, although there is a two-year delay in this application (e.g. provider performance in 2021 will lead to the enhancement or penalty in 2023).

Impact -CMS is committed to move towards value and away from fee-for-service. For 2021, CMS is increasing the overall value of “cost” within the program. This program is here to stay.

Calculation Updates

Conversion Factor: The 2021 conversion factor (CF) had originally been set at $32.41, which was a decrease of 10% or $3.68 from the CY 2020 PFS CF of $36.09. This change was necessary due to the re-evaluation of the work relative value units (RVUs) for evaluation and management services. Due to the passage of the Omnibus and COVID Relief bill on December 27, 2020, the conversion factor has been readjusted to $34.89.

Work Relative Value Units (wRVU) Re-evaluation: In collaboration with guidance from the American Medical Association (AMA), CMS has updated evaluation and management (E&M) services. The “work time” for these services was updated to more accurately reflect the minimum time providers devoted to each service in order to consider non-face-to-face duties and care-coordination activities.

The following exhibit has been prepared by the American Medical Society (AMA) and reflects their estimates to the impact of the various specialties using CMS claims data:

Evaluation and Management (E/M) Office Visits Coding Updates

On Nov. 1, 2019, CMS finalized revisions to the Evaluation and Management (E/M) office visit CPT codes 99201-99215. These revisions build on the goals of CMS and the provider community to reduce administrative burden and put “patients over paperwork.” These revisions will be effective Jan. 1, 2021.

Summary of Changes

- Elimination of history and physical for code selection. Code descriptors have been revised to “state providers should perform a medically appropriate history and/or examination.”

- Physicians can choose whether their documentation is based on medical decision making (MDM) or total time. The three current MDM sub-components have not materially changed. Extensive edits have been made to the elements for code selection as well as clarifying definitions in the E/M guidelines.

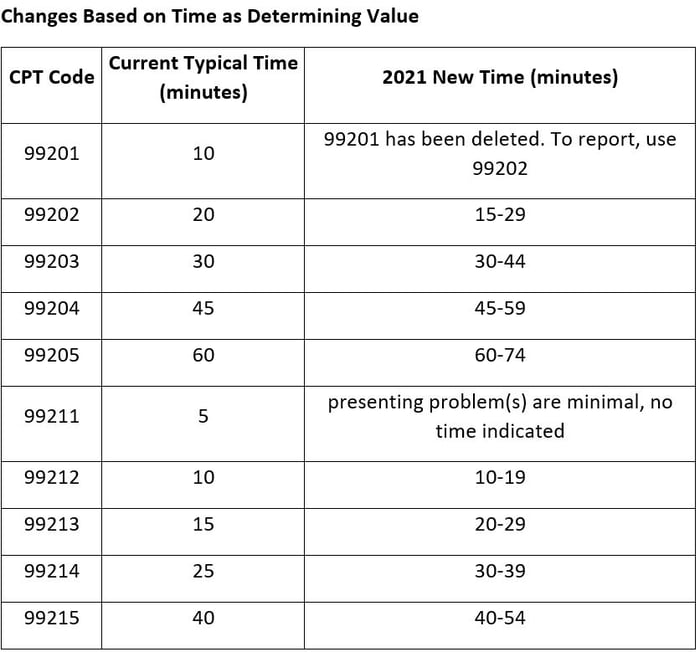

- The definition of time is now minimum time, not typical time. This now represents total physician/qualified health care professional (QHP) time on the date of service. This use of “date-of-service” time aligns with Medicare’s attempt to better recognize work involved with non-face-to-face services like care coordination. These minimum time definitions would only apply when code selection is primarily based on time and not MDM.

- Modifications to the criteria for MDM include the removal of ambiguous terms like “mild” and improved definitions of previously ambiguous concepts like “acute or chronic illness with systemic symptoms” as well as redefining data elements to focus on tasks that affect the management of the patient (e.g. independent interpretation of a test performed by another provider and/or discussion of test interpretation with an external physician/QHP).

- Elimination of CPT code 99201 based on its straightforward nature, similar to CPT code 99202.

- Creation of a shorter prolonged services code to capture time in 15-minute increments. This code would only be reported with 99205 and 99215 and be used when time would be the basis of code selection.

The AMA has published guides to use in determining the above.

Medicare Telehealth

In the 2021 Final Rule, CMS has included several Category 1 Telehealth Service additions as well as the addition of telehealth services, on an interim basis, to those services put in place during COVID-19.

CMS has categorized the request for additional services in three different categories. The explanation of each as well as the additions are as follows:

Category 1

Services approved, after a streamlined review, because they are similar to professional consultations, office visits, and office psychiatry services that are currently on the list of telehealth services. CMS has finalized the following services to be added to the Category 1 list:

- Group psychotherapy (CPT code 90853)

- Psychological and neuropsychological testing (CPT code 96121)

- Domiciliary, rest home, or custodial care services, established patient (CPT codes 99334-99335)

- Home visits, established patient (CPT codes 99347-99348)

- Cognitive assessment and care planning services (CPT code 99483)

- Prolonged services (HCPCS code G2212)

Category 2

Services that are not similar to the current list of telehealth services. The review of these requests includes an assessment of whether the service is accurately described by the corresponding code when delivered via telehealth and whether the use of a telehealth system to deliver the service produces demonstrated clinical benefit to the patient.

Category 3

These describe services added to the Medicare telehealth list during the public health emergency (PHE) for the COVID-19 pandemic that will remain on the list through the calendar year in which the PHE ends. CMS has finalized the following services to be added to the Category 3 list of services:

- Domiciliary, rest home, or custodial care services, established patient (CPT codes 99336-99337)

- Home visits, established patient (CPT codes 99349-99350)

- Emergency department visits, levels 1-5 (CPT codes 99281-99285)

- Nursing facilities discharge day management (CPT codes 99315-99316)

- Psychological and neuropsychological testing (CPT codes 96130-96133; CPT codes 96136-96139)

- Therapy services, physical and occupational therapy, all levels (CPT codes 97161-97168; CPT codes 97110, 97112, 97116, 97535, 97750, 97755, 97760, 97761, 92521‑92524, 92507)

- Hospital discharge day management (CPT codes 99238-99239)

- Inpatient neonatal and pediatric critical care, subsequent (CPT codes 99469, 99472, 99476)

- Continuing neonatal intensive care services (CPT codes 99478-99480)

- Critical care services (CPT codes 99291-99292)

- End-stage renal disease monthly capitation payment codes (CPT codes 90952, 90953, 90956, 90959, 90962)

- Subsequent observation and observation discharge day management (CPT codes 99217; CPT codes 99224-99226)

Coverage of other codes added to the covered list during the PHE not within Category 3 or that have not been permanently added to the covered list will expire at the end of the PHE.

Quality Payment Program

This has been a difficult year for all providers and practices, even though all have been impacted differently. CMS rolled out some changes to the Quality Payment Program since the COVID-19 pandemic to provide additional support for clinicians. There is an extension for the extreme and uncontrollable circumstances exception application until February 21, 2021.

CMS revised the complex patient bonus to account for challenges in treating patients during the pandemic. There is a possibility to earn up to an additional 10 bonus points toward the 2020 performance year.

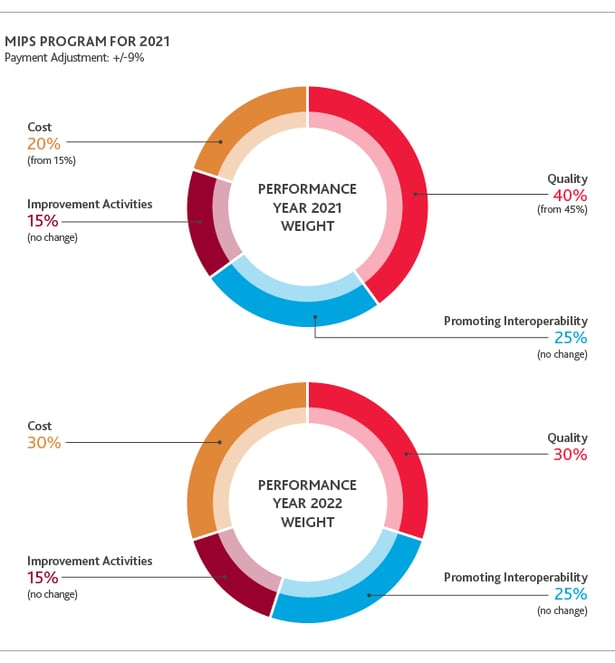

There are minimal changes to the actual MIPS scoring for the 2021 performance year. The minimum threshold will increase to 60 points in order to avoid the 9% penalty in 2023. The exceptional performance threshold remains the same at 85 points. Quality will decrease to be worth 40% and cost will increase to be worth 20%.

This application can be accessed and completed on HCQIS Access Roles and Profile (HARP) account. In addition to exceptions, there are opportunities to help improve merit-based incentive payment (MIPS) scores with new high-weighted COVID-19 clinical trial improvement activities. This may help providers receive credit towards MIPS for care provided to patients during the pandemic.

Key Takeaways

With these changes, CMS continues its focus on improving patient care outcomes, reducing costs and administrative time, expanding telehealth and moving towards value-based payments.

These changes will affect physicians and practices differently depending on their size and specialty. For example, primary care physicians, OB-GYNs and others that rely heavily on office visits will stand to benefit from the changes to the work-time relative value units. But select hospital specialties, like radiology and anesthesiology, will be negatively impacted due to the re-basing of the conversion factor.

Telehealth services have been around for years, but the pandemic has accelerated patient demand. For providers to keep up, they need to embrace telehealth, as this is just the beginning of a long-term shift in service delivery and care innovation towards more “digital health.”

The 2021 CMS Part B Fee Schedule includes significant changes with both winners and losers. Each health organization must develop a plan specific to their circumstances.