8/2/2021 Update

Exempt EAP Salary Increase Repealed

In June, we alerted you that the minimum salary threshold for exempt executive, administrative, and professional (EAP) employees in Pennsylvania would increase to $780 per week on October 3. That rule has recently been repealed by the state legislature. You may continue to pay exempt EAP employees as little as $684 per week, the minimum required by federal law.

The Pennsylvania Minimum Wage Act establishes a fixed Minimum Wage and Overtime Rate for employees in Pennsylvania. Pennsylvania's Overtime Rule has increased the salary threshold executive, administrative, or professional need to make in order to be exempt from overtime. The increases will be phased in with the next salary threshold increase on October 3, 2021.

What should employers do now to prepare?

- Review job descriptions and ensure that all employees that they have classified as exempt remain properly classified

- Identify your employees whom you pay less than $780 per week and currently classify as exempt from overtime

- Decide if you will give them a raise so they will continue to be exempt or reclassify them as non-exempt. Non-exempt employees will qualify for overtime when they work more than 40 hours in a workweek.

What are the overtime salary threshold phases?

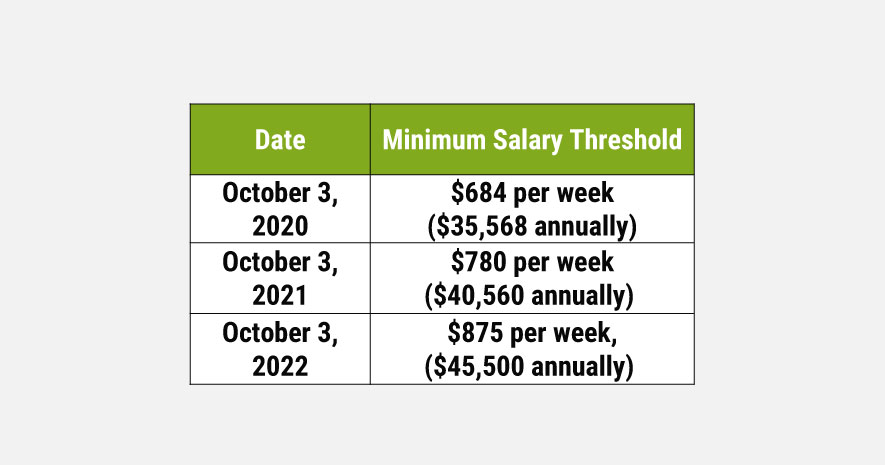

Current (Started October 3, 2020): $684 per week ($35,568 annually)

October 3, 2021: $780 per week ($40,560 annually)

October 3, 2022: $875 per week, ($45,500 annually)

The salary threshold will increase every three years, starting October 3, 2023,