The Multistate Tax Commission (MTC) has reconsidered its interpretation of Public Law (P.L.) 86-272—the federal statute that prevents a state from levying a net income-based tax on an out-of-state business in certain circumstances. On August 4, 2021, the MTC’s member states formally adopted updates to its P.L. 86-272 model statement, which include a view through the lens of an e-commerce economy and raise questions about whether the law, for practical purposes, will be rendered obsolete.

Originally enacted in 1959 by the federal government to address a state’s ability to tax interstate commerce, P.L. 86-272 protects an out-of-state company from a state’s net income tax if its only activity in the state is the solicitation of orders of tangible personal property that are approved and shipped from outside the state. In 1986, the MTC issued its Statement of Information Concerning Practices of Multistate Tax Commission and Signatory States Under Public Law 86-272, with a view to clarifying the law. This model statement, last updated in 2001, has been adopted by both member and non-member states.

Revisions to Model Statement

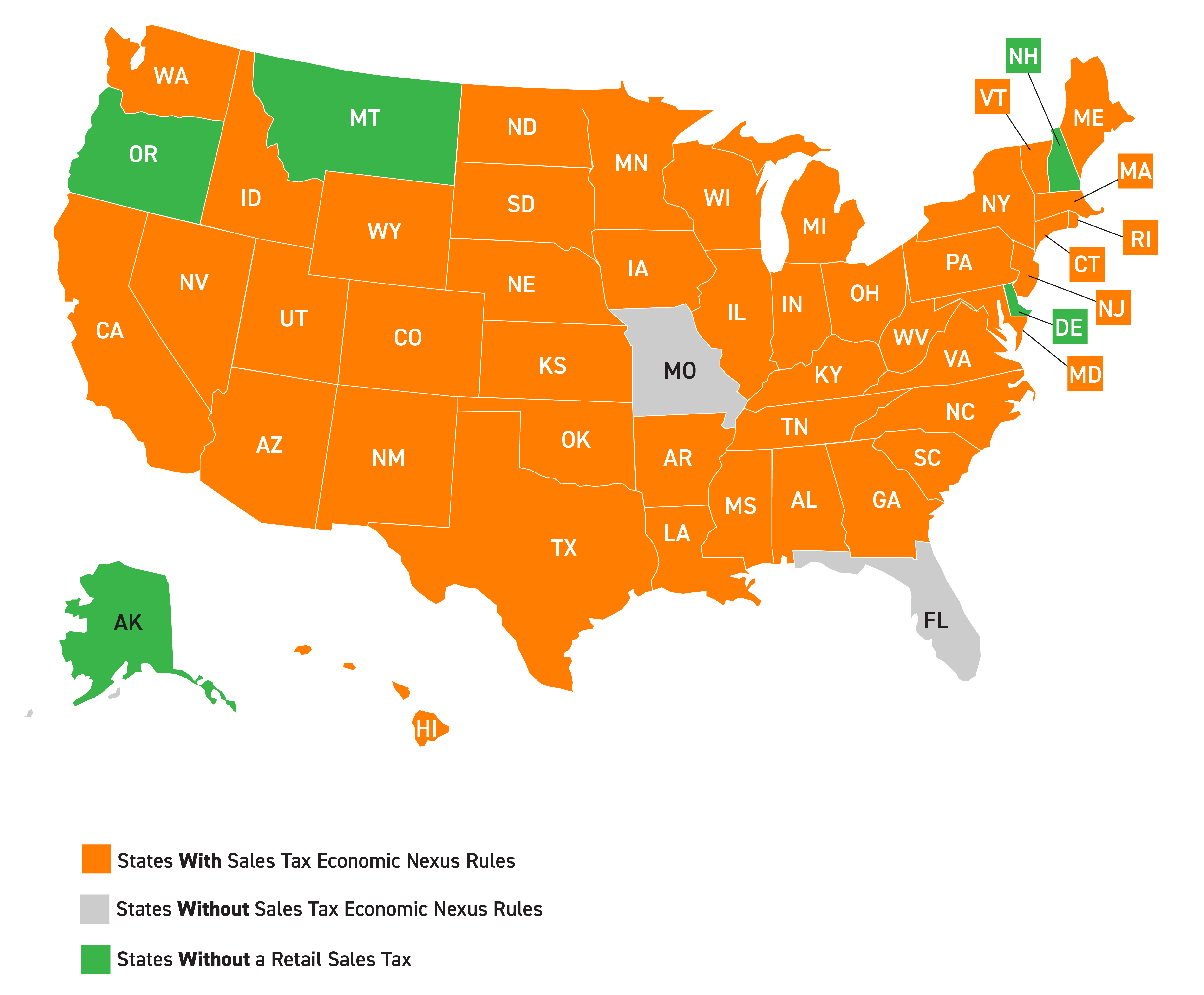

In light of the service and e-commerce dominated economy today, PL 86-272 may be an increasingly narrow protection. It’s clear that the Wayfair decision has influenced the MTC’s updates, even though Wayfair addressed substantial nexus, not protected activities for out-of-state companies. The MTC model statement’s new revisions will be influential on states applying the law’s protections to activities involving the internet. States will still need to formally adopt the model statement revisions.

The most significant updates to the model statement relate to e-commerce and interactions with in-state customers via the internet. The MTC views most interactions with customers over the internet as activities beyond solicitation of orders for sales of tangible personal property. For example, the MTC’s updates indicate that the following activities by an out-of-state business are not protected by PL 86-272:

- Placing cookies on in-state customers’ computers (except for certain purposes entirely ancillary to the solicitation of orders for tangible personal property);

- Providing post-sale assistance to in-state customers via chat or email;

- Remotely fixing or upgrading products previously purchased by its in-state customers by transmitting code or other electronic instructions to those products via the internet; and

- Selling extended warranty plans via the business’ website to in-state customers.

As noted, a state will have to formally adopt the revised statement, which will take time. In the meantime, state courts will continue to weigh in on the application of P.L. 86-272. It is important to remember that the MTC’s model statement and updates are only the organization’s interpretation of the application of the law. The law itself has not changed.

What should companies do now

Companies should monitor states’ adoption of the MTC’s updated statement on P.L. 86-272. In anticipation of states’ adoption, companies can begin now to review their activities performed in each state and across state lines, the extent to which their e-commerce and other digital activities create nexus with a state and whether their activities are considered protected by P.L. 86-272.