Written by Monte Anderson, CPA, MAc

What Happened?

In June 2018, the Supreme Court of the United States issued its landmark ruling in South Dakota v. Wayfair, Inc., where it held that states can impose sales tax on purchases made from an out-of-state seller, even when the seller has no physical presence in the taxing state. This ruling does not replace prior sales tax law; instead, it adds to the existing list of physical presence and other activities that create sales tax collection, remittance, and filing requirements.

Under the South Dakota sales tax law, a remote seller will collect and remit sales tax if the remote seller, in the previous or current calendar year:

- Had sales of taxable goods and services delivered into South Dakota exceeding $100,000; or

- Sold taxable goods and services for delivery into South Dakota in 200 or more separate transactions.

How does this impact my business?

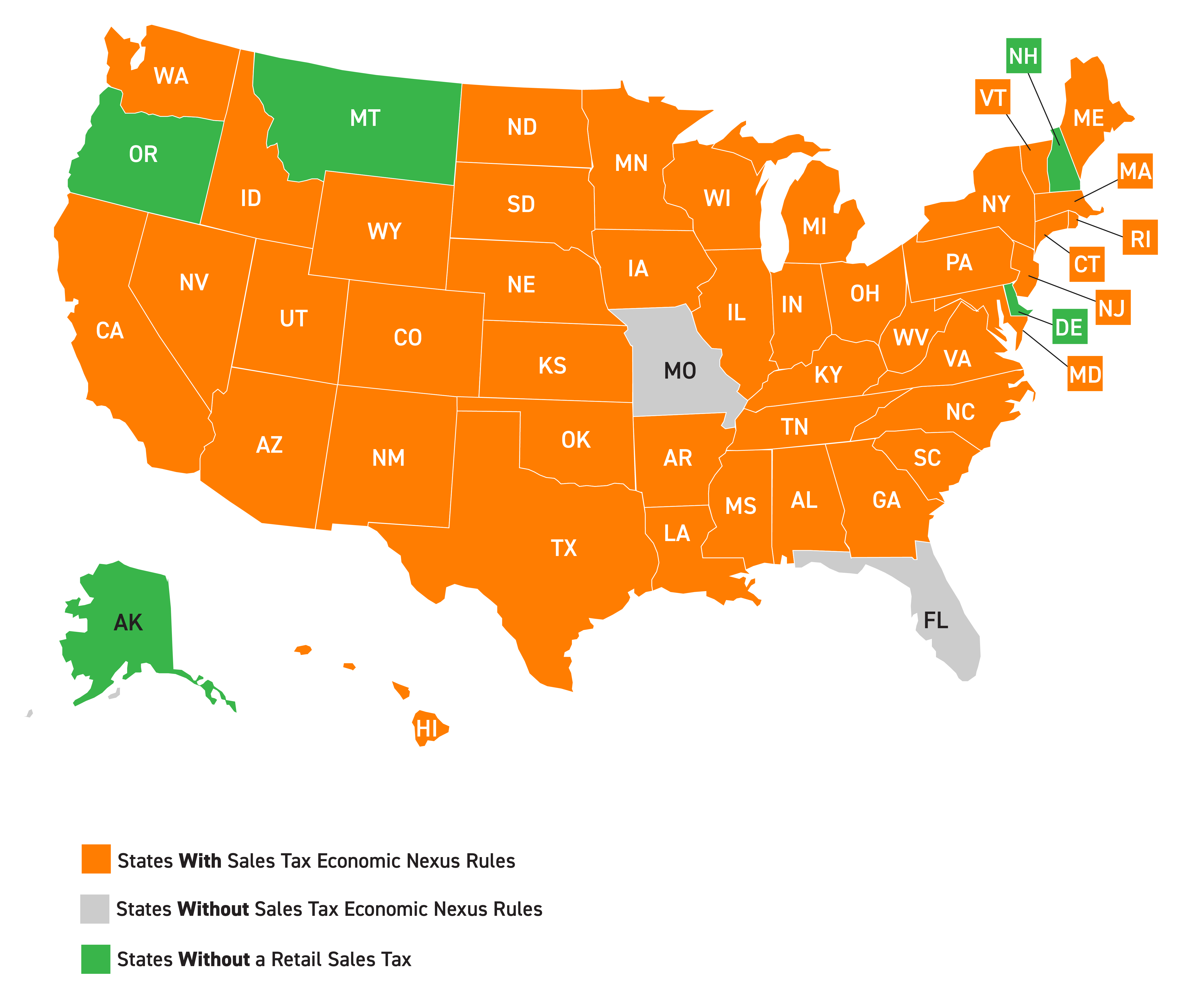

Post-Wayfair, a majority of states have enacted sales tax laws similar to South Dakota; the remaining are expected to follow. As a result, many businesses are now required to file sales tax returns and collect and remit sales tax in states where their only activity is sales to customers who reside in those states.

In addition, businesses with zero taxable sales, such as manufacturers, wholesalers, and other non-retail businesses, may still be required to register and file zero tax returns to be fully compliant under a state’s sales tax law. Under an audit, sellers are generally liable for uncollected sales tax from customers who did not pay sales tax at invoice or supply a properly completed sales tax exemption certificate. As a result, all businesses should be reviewing their sales tax exemption certificate management processes.

What should I do?

Out-of-state sales tax compliance requirements have significantly increased for businesses. Trout, Ebersole & Groff, LLP is recommending, as soon as possible, that all clients evaluate the impact of these new state sales tax laws on their out-of-state sales activities.

What if I do nothing?

There is no statute of limitations for unfiled returns, and any unpaid sales tax liabilities will compound indefinitely against non-compliant businesses. Upon inquiry, states will generally issue a maximum sales tax assessment with full penalty and interest. In these situations, businesses are directly liable for a tax that could have been collected from their customers. In addition, non-filing of zero taxable sales could result in penalty assessments.

Where can I find help?

Our State & Local Tax team at Trout CPA continues to monitor developments and guidance from the various state revenue departments, as they continue to decipher the Wayfair decision. If you would like to discuss how the Wayfair decision impacts your business or if you have concerns with any of your company’s other state and local taxes, please contact us at 717-569-2900.

Below is a more in-depth explanation of this landmark case.

Today, small and medium-sized businesses are regularly interacting with out-of-state customers, suppliers, and partners through the aid of modern technology. Sales transactions are often completed through internet, telephone, and mail order channels, where goods are shipped directly to customers by third-party shippers. This type of transaction, where sellers and customers are geographically divided, is referred to as remote selling.

Traditional Physical Presence Nexus

Sales tax nexus describes the level of connection between a taxing jurisdiction and a business that is necessary for a state to impose its sales tax. Before June 2018, a longstanding U.S. Constitutional interpretation had determined that remote selling activities (i.e. making sales without physical presence in a state) would not establish sales tax nexus. Consequently, taxpayers lacking physical presence outside of their home state had no obligation to register, collect, and remit a state’s sales tax.

Traditional sales tax nexus resulted when company sales representatives, employees, or agents (including company-owned vehicle delivery drivers) traveled into a state at the company’s direction, thereby establishing physical presence for the company. This so-called physical presence rule was intended to protect businesses from the undue burdens of out-of-state sales tax compliance.

South Dakota’s Economic Nexus Law and Adoption by Other States

On June 21, 2018, the Supreme Court of the United States ruled in South Dakota v. Wayfair, Inc. that economic contacts alone can establish substantial nexus for sales tax purposes. This economic nexus is determined simply when a company’s total revenues, or number of transactions, in a state exceed a specified threshold.

Under the South Dakota economic nexus law, a remote seller shall collect and remit sales tax if the seller, in the previous or current calendar year:

- Had gross revenue from the sale of taxable goods and services delivered into South Dakota exceeding $100,000; or

- Sold taxable goods and services for delivery into South Dakota in 200 or more separate transactions.

Sales tax economic nexus is not established for a remote seller that does not exceed the above revenue or number of separate transactions threshold.

Because Wayfair is a case that was decided by the Supreme Court of the United States, all states are free to adopt their own economic nexus laws. Since June 2018, the majority of states have already enacted economic nexus laws for sales tax and the remaining states that impose a sales tax are expected to follow.

Similar to South Dakota, many of the new state economic nexus laws have opted to use a threshold of gross revenue exceeding $100,000 or 200 or more separate transactions in the state.

Impact on Small Businesses with Out-of-State Sales

Through remote selling, even small companies may have considerable out-of-state sales without ever having company employees or agents physically present in those states. As a result, many small businesses may now be required to collect and remit sales and use taxes and file related returns in states where they merely have sales to out-of-state customers.

As we continue to follow developments and guidance from the various state revenue departments, we are finding that sales tax economic nexus compliance may have further implications for manufacturers, wholesalers, and other nonretailer businesses.

Manufacturers, wholesalers, and nonretailers often sell goods and services to customers in tax-free exchanges. Instead of charging the necessary sales tax at invoice, these sellers obtain a sales tax exemption certificate. A sales tax exemption certificate is required for all sales of taxable goods and services where sales tax is not charged at invoice. Upon an audit, sellers are generally liable for uncollected sales tax from customers who did not pay tax or supply a properly completed sales tax exemption certificate.

Increased Concerns and Compliance Challenges

Enacted state economic nexus provisions vary by state. Many states have opted to include resale exempt sales in their economic nexus threshold definitions, while others include only taxable sales. As a result, manufacturers, wholesalers, and nonretailers with zero taxable sales and substantial resale exempt sales in a state may still be required to register and file zero tax returns to be fully compliant under a state’s economic nexus law.

Currently, marketplace and direct-to-consumer sales may be a normal part of nonretailer business activities. Many nonretailers have at least some level of direct retail sales to customers, as a way to develop more business. Post-Wayfair, all retail sales to customers in other states are potentially taxable sales. Correspondingly, even a small amount of retail sales can create a recurring tax collection and reporting requirement in a state that determines its economic nexus threshold based on gross sales.

Sales tax exemption certificate processing requirements also vary by state. For manufacturers and wholesalers, whether you have received an exemption certificate in proper form may not always be a simple determination. Sellers that drop ship goods on behalf of their customers should take extra care to obtain proper exemption documentation for these sales. A number of states will hold a seller that drop ships goods responsible for the collection of sales tax, if the seller accepts a resale exemption certificate from an unregistered customer.

Post-Wayfair, all nonretailers should be reviewing their exemption certificate management processes to identify, understand, and correct all noted deficiencies. Nonretailers should also be evaluating the extent of their out-of-state retail sales to customers and the potential tax implications of those sales.

Potential Consequences for Noncompliance with Economic Nexus

There is no statute of limitations for unfiled returns, and unpaid sales tax liabilities will compound indefinitely against non-compliant businesses with sales tax nexus. Upon inquiry, state departments of revenue will generally issue a maximum tax assessment against a noncompliant business, with full penalty and interest. Upon assessment, these non-compliant sellers are directly liable for a tax that could have easily been collected from customers and remitted to the inquiring state. As economic nexus continues to expand its reach, businesses should be aware that their out-of-state sales activities may be increasingly subject to inquiry and audit by the various state revenue departments.

Economic Nexus Planning and Compliance Review

Potential out-of-state sales tax compliance obligations have significantly increased for many small businesses, as a result of the Wayfair decision. We are therefore recommending that all clients with out-of-state sales make an initial determination on the impact of state economic nexus laws respective to their out-of-state sales activities. This should be completed as soon as possible.

Businesses with out-of-state sales can begin to evaluate their economic nexus profile by:

-

Identifying the states where gross revenue exceeds $100,000, or separate transaction count exceeds 200, for the most recent annual reporting period.

-

Determining if economic nexus has been established by reviewing the economic nexus laws of each identified state and comparing the state law to the identified revenue and transaction information for that particular state.

-

Deciding how and when to comply in states where economic nexus for sales tax has been established.

The Illustration above was last updated on November 11, 2019.

While $100,000 or 200 transactions are generally the lowest economic nexus threshold that will trigger a state collection and reporting obligation, some individual state thresholds may be higher. Also, keep in mind that a seller of lower-value goods may exceed 200 transactions with gross revenues that are significantly less than $100,000.

To familiarize yourself with a specific state’s sales tax economic nexus law, see Avalara’s Remote Seller Nexus Threshold Chart. This reference provides a state-by-state map and an up-to-date summary reference chart on remote seller nexus.

Nonuniformity of state reporting rules, sales tax law complexities, and unique business transaction profiles may require consulting with a qualified CPA firm for help with this assessment. Additionally, the economic nexus ruling in Wayfair does not replace prior sales tax law; it adds to the existing list of physical presence and other activities that have traditionally created sales tax nexus. TEG is available to assist you and answer questions as you navigate the complications of an economic nexus assessment for sales tax.

The State and Local Tax (SALT) team at Trout CPA continues to monitor developments and guidance from the various state revenue departments, as they continue to decipher the South Dakota v. Wayfair decision. If you would like to discuss how economic nexus impacts your business or if you would like assistance with your company’s state and local tax concerns, please complete the form below.