Written By: Doug Deihm, CPA

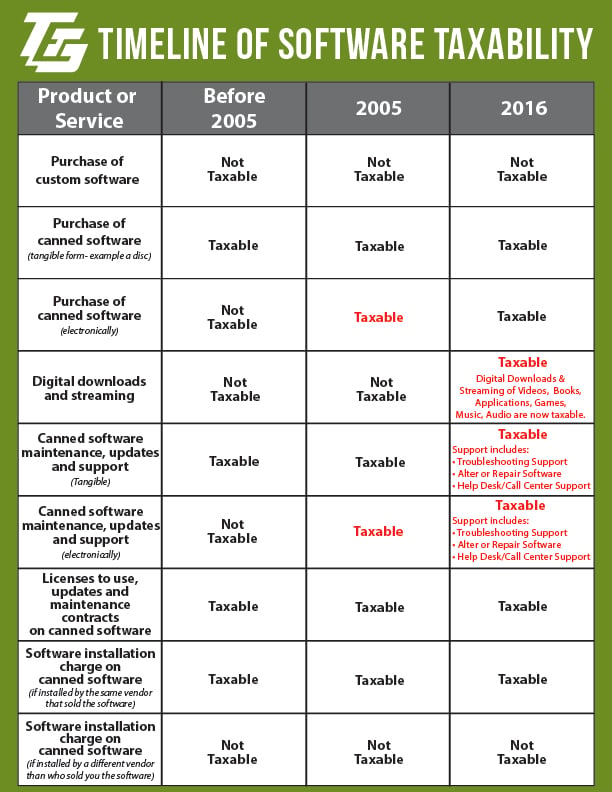

For many years, the rules concerning canned software were relatively straightforward and easy to understand, but in recent years have been increasingly confusing. Before going too in-depth, let’s talk basics.

Canned Software vs. Customized Software

Canned software, is a prewritten program you can purchase at a store and is taxable, unlike custom software which is a customized computer program designed for the individual customer.

Tangible Canned Software vs. Electronic Canned Software

Tangible Canned Software is when the customer receives a physical copy of the program, such as on a disc. In comparison, Electronic Canned Software is delivered electronically.

Before 2005: Canned Software was Taxable only if delivered in a tangible form, not electronically.

Prior to 2005, the PA rules for software taxability were simplistic. When you purchase canned software in a tangible form, you paid tax, unlike custom software and electronically delivered canned software where you did not.

The software’s licenses to use, update and maintain contracts were taxable. Help desk, training, and customer support on canned software were not taxable, and installation of the software was not taxed unless done by the same vendor who sold the software. This is true of all tangible personal property.

2005: Electronic & Physical Forms of Software are Taxable.

Upon the 2005 ruling in the Graham Packaging vs. Commonwealth Case, the ruling declared that canned software is taxable no matter how it is delivered, making electronically delivered canned software taxable. Later rulings made it clear that canned software is taxable where it is used, and the fact that it was hosted on a cloud did not matter.

2016: Digital Downloads and Streaming of Videos, Books, Applications, Games, Music, and Audio are now Taxable.

The confusion began when Act 84 of 2016 updated the statutory definition of “tangible personal property” to expressly include certain specified items such as videos, books, applications, games, music, audio, canned software, and other specified items; whether deliver in tangible form or delivered electronically. For example, such services subscriptions provided by Amazon, Netflix, and Sirius Satellite Radio which allow digital downloads and streaming, are now taxable.

The concern from many came because the Act 84 of 2016 also specifically included in the definition of tangible personal property the “maintenance, updates and support” of the newly defined electronic or digital personal property.

The Pennsylvania Department of Revenue considers “support” to be any and all support services to canned computer software. This includes:

- Troubleshooting: identifying the source of problems affecting the usability of the property (software)

- Altering or repairing the property to a useable state

- Training on the software

- Help Desk/Call Center Support: Customers receive troubleshooting on a software issue or give online remote access to the support to help resolve the issue

2017- Training is no Longer Considered Tangible Personal Property.

In April 2017, PA changed its position; where it formerly said that sales and use tax could be imposed when a vendor provides training on how to use the software. The new guidance says that training is not included in the PA Department of Revenue’s definition of taxable support for digital tangible personal property.

In summary, the Pennsylvania Department of Revenue considers both tangible and electronic canned software, such as QuickBooks, Microsoft Office, and Adobe Creative Suite, as taxable tangible personal property and thus is taxable. Taxable tangible personal property also includes streaming & digital downloads. For example, if you have Netflix, your subscription is taxed.

So, why the change? The government is essentially looking to update the laws to keep up with our now digital society because PA relies on Pennsylvania sales and use taxes for revenue to be used on government and public services. Although the April 2017 guidance elaborated more on the once-grey law, we expect to hear more updates on canned software taxability and other tax laws, which now are having to be adapted to reflect our digital culture.