As of January 22, 2019 these instructions no longer apply.

|

UPDATE: On June 7, 2018, Pennsylvania issued additional guidance regarding the requirement to withhold tax from Recipients of non-employee compensation, business income and lease payments. Taxpayers must provide REV-1832 to all Recipients of non-employee compensation, business income and lease payments. Withholding will then be determined by the information filled out on this form. If the form is not returned, incomplete or not signed by the Recipient, you should withhold PA tax from any payment made to the Recipient. Failure to withhold tax could cause the taxpayer to be liable for the PA withholding. This form must be maintained by the Taxpayer for a minimum of 5 years. Failure to do so could cause the Taxpayer and/or the Recipient to be liable for any possible withholding PA determines should have been done. |

Is your business a Pennsylvania (PA) Entity that issues 1099s to service providers or landlords who reside outside of PA? If so, PA now requires your business to withhold 3.07% PA tax from payments to certain types of service providers and landlords when the payments are related to PA-sourced income.

Affected types of service providers include individuals and disregarded entities that have a non-resident member who receive annual payments from your business of $5,000 or more. Affected types of landlords include individuals, estates and trusts who receive annual payments from your business of $5,000 or more.

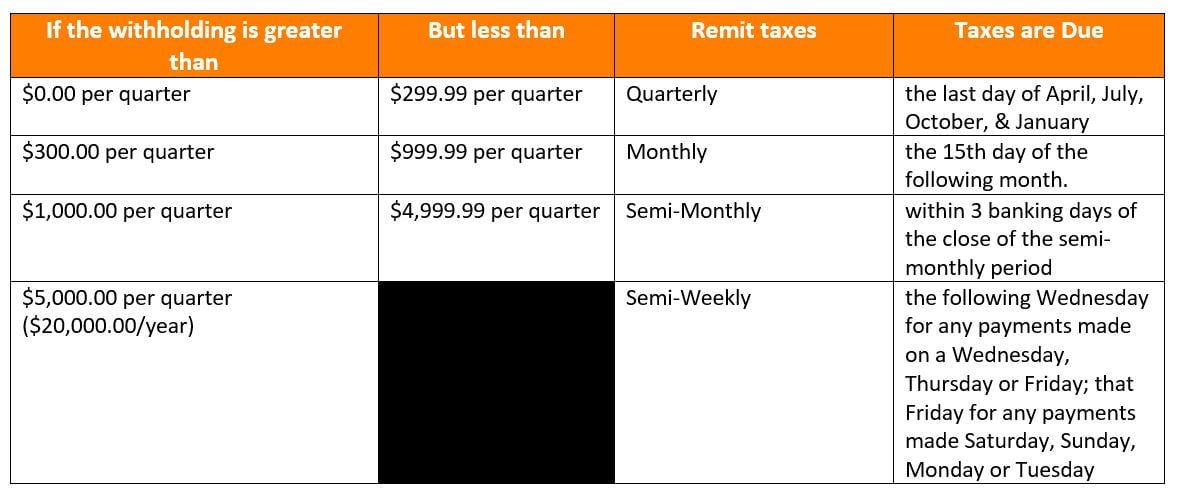

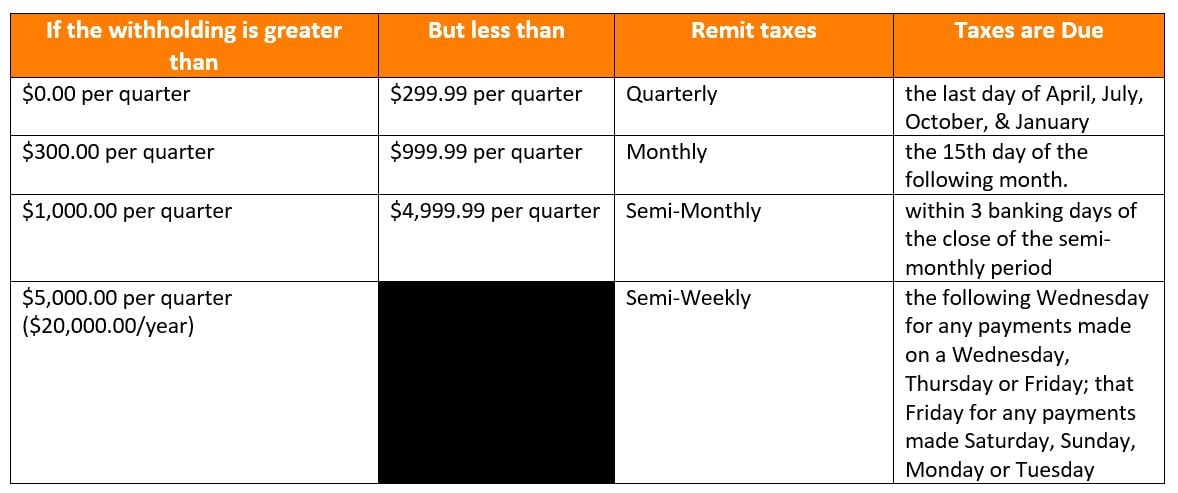

Starting July 1, 2018, your business must remit these withheld taxes to PA on a periodic basis which is determined by the amount of withholding, as indicated below.

All payments of $1,000 or more must be paid via Electronic Funds Transfer. Tax filings and reconciliations are also required on a quarterly and annual basis, separate from employee income tax withholding. An Annual Withholding Statement, along with copies of the individual 1099s, must be filed with PA through e-TIDES by January 31 of the following tax year.

If your business is affected by this change, it is recommended applying for a second PA Withholding Tax Account. This will avoid co-mingling of 1099 withholding and employee withholding, which may cause you to have to remit withholding more often than you would otherwise have to.

In addition, many payroll services have indicated they will no longer be able to provide filing, payment, or reconciliation of PA employee withholding accounts on a quarterly or annual basis unless a second PA Withholding Tax Account is established.

If your business needs to set up a second PA Withholding Tax Account, instructions are below. Although it is possible to complete these instructions online, the fastest way to get a second PA Withholding Tax Account is to fax the relevant pages to PA.

Instructions for Applying for a Second PA Withholding Tax Account:

1. Print pages 4, 5, and 6 of the Form PA-100.

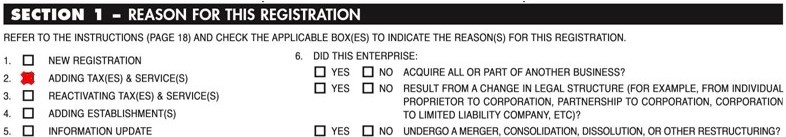

2. In Section 1, check box #2 ADDING TAX(ES) & SERVICE(S).

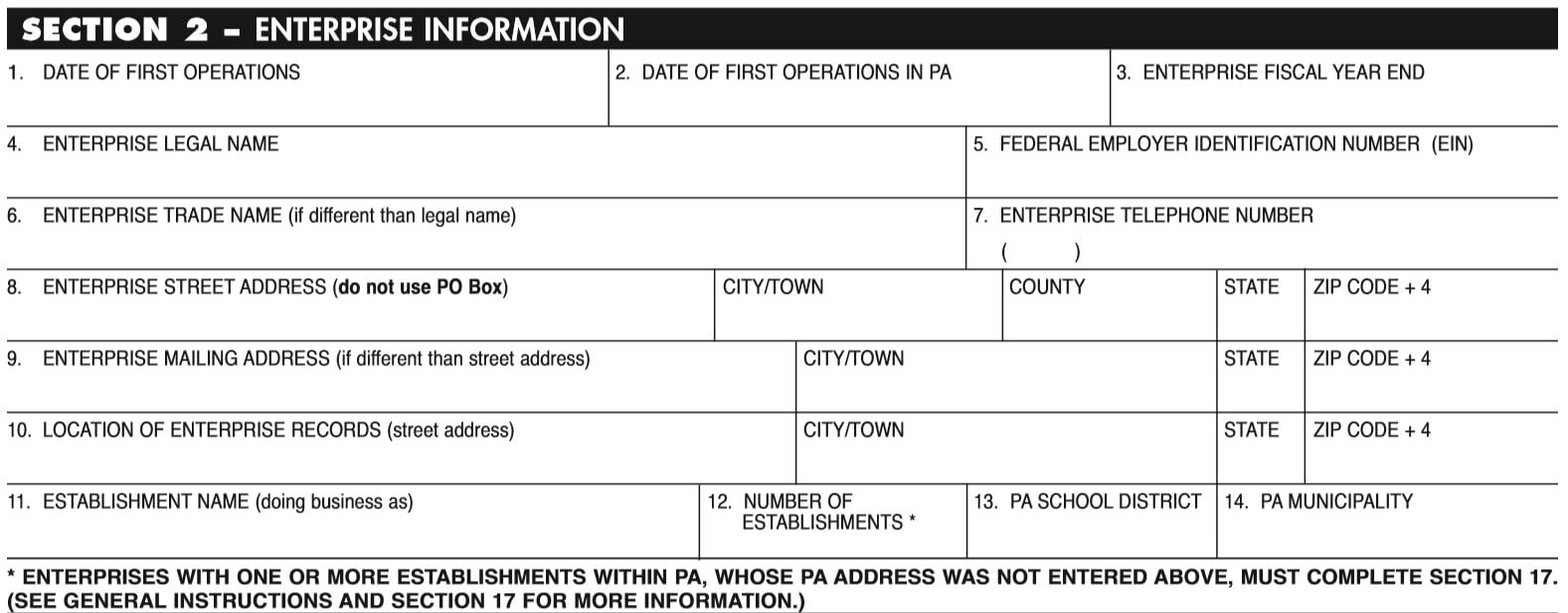

3. Complete Section 2.

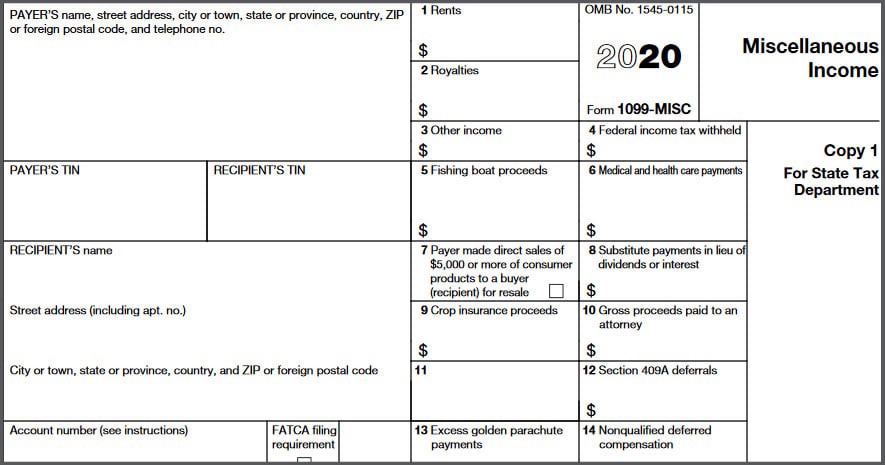

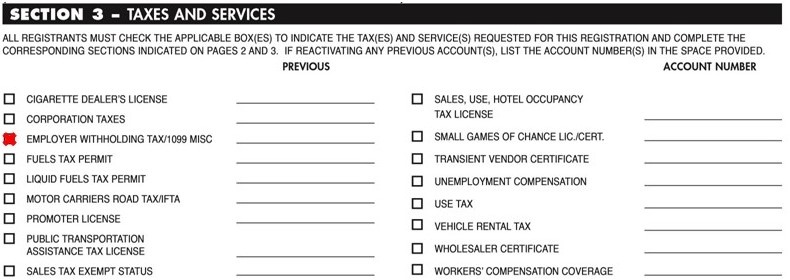

4. In Section 3, check the EMPLOYER WITHHOLDING TAX/1099 MISC. You do not need to write anything in the “PREVIOUS” column.

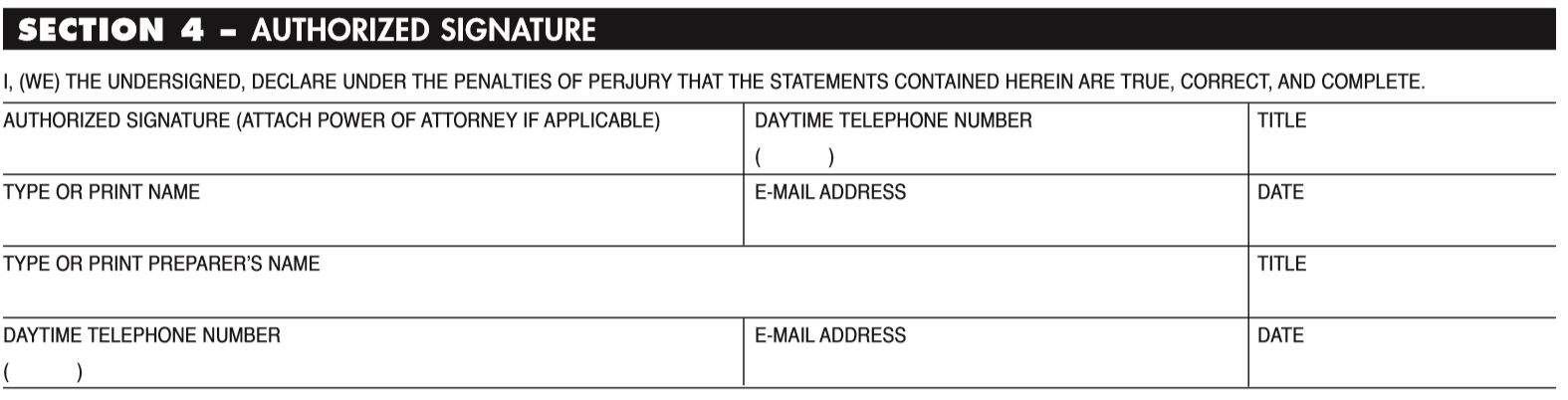

5. Complete Section 4.

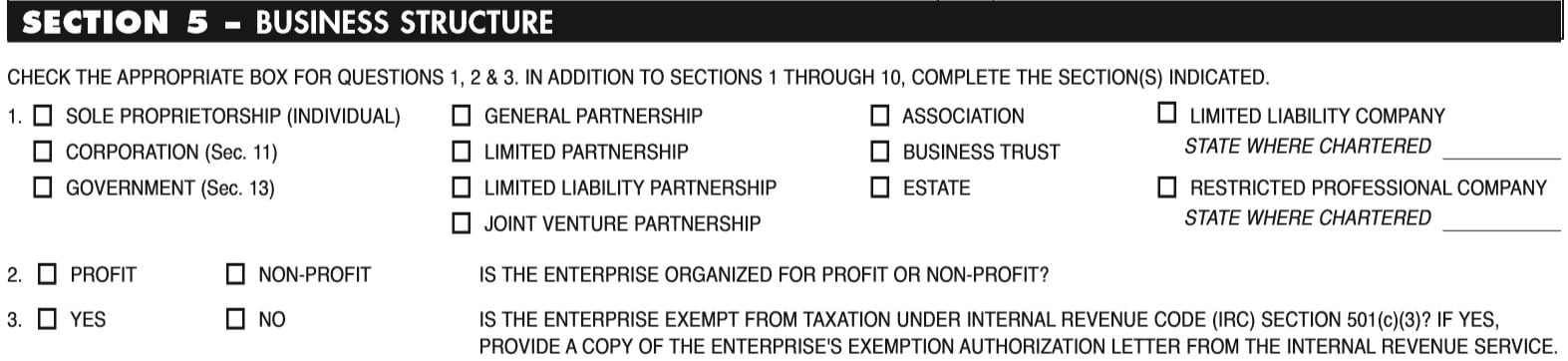

6. Complete Section 5.

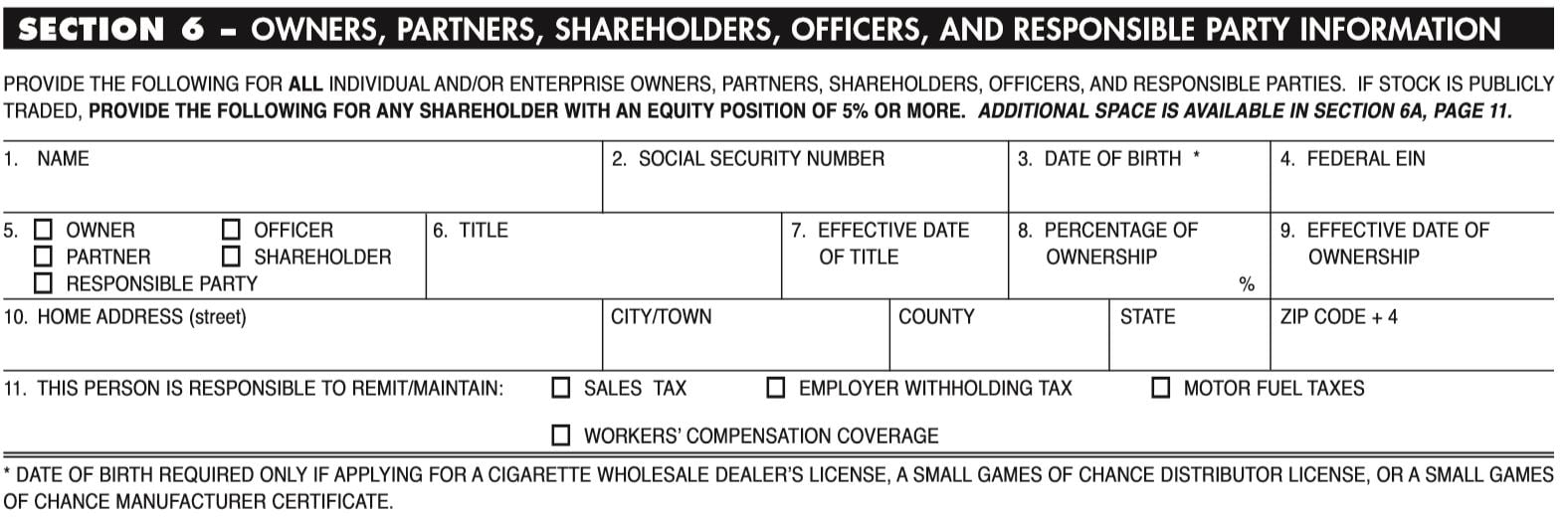

7. Complete Section 6.

8. Skip Sections 7 and 8.

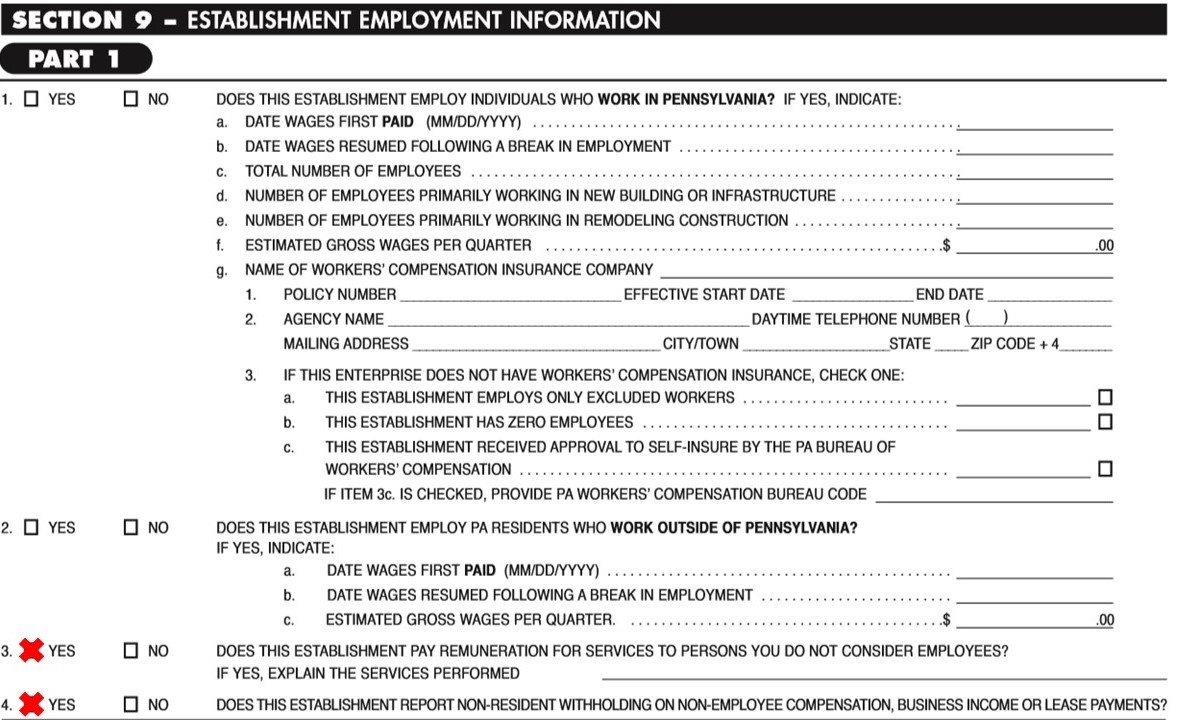

9. In Section 9 – Part 1, check the “YES” box for questions 3 and 4. Leave the rest of this section blank as indicated below. This will trigger the creation of the new PA Withholding Tax Account.

10. Skip Section 9 – Part 2 and Section 10.

11. Fax the completed form to the PA Registration Division at 717-787-3708.

12. For your records, print a confirmation transmittal fax record sheet.

13. Within a few weeks you should receive a confirmation letter indicating your second PA Withholding Tax Account has been successfully created. Provide a copy of this letter to your accounting professional for their records.

If you need assistance with completing form PA-100, contact our Client Accounting Service Team.

If you have questions on who your business should be issuing 1099s to, contact our Tax Department.

If you have questions on what constitutes PA sourced income, contact our SALT Department.

All can be reached via the Contact Us button below or by calling in to 717-569-2900 and requesting assistance.

Additional resource: PA Department of Revenue – New 1099-Misc Withholding Tax Requirements